During today's Asian trading session, the USD/JPY pair broke through another psychologically significant level of 137.00, reaching an intraday local high at around 137.27. The last time USD/JPY was close to current levels was in October 1998. The quotes are growing both against the backdrop of a total strengthening of the dollar and the weak yen.

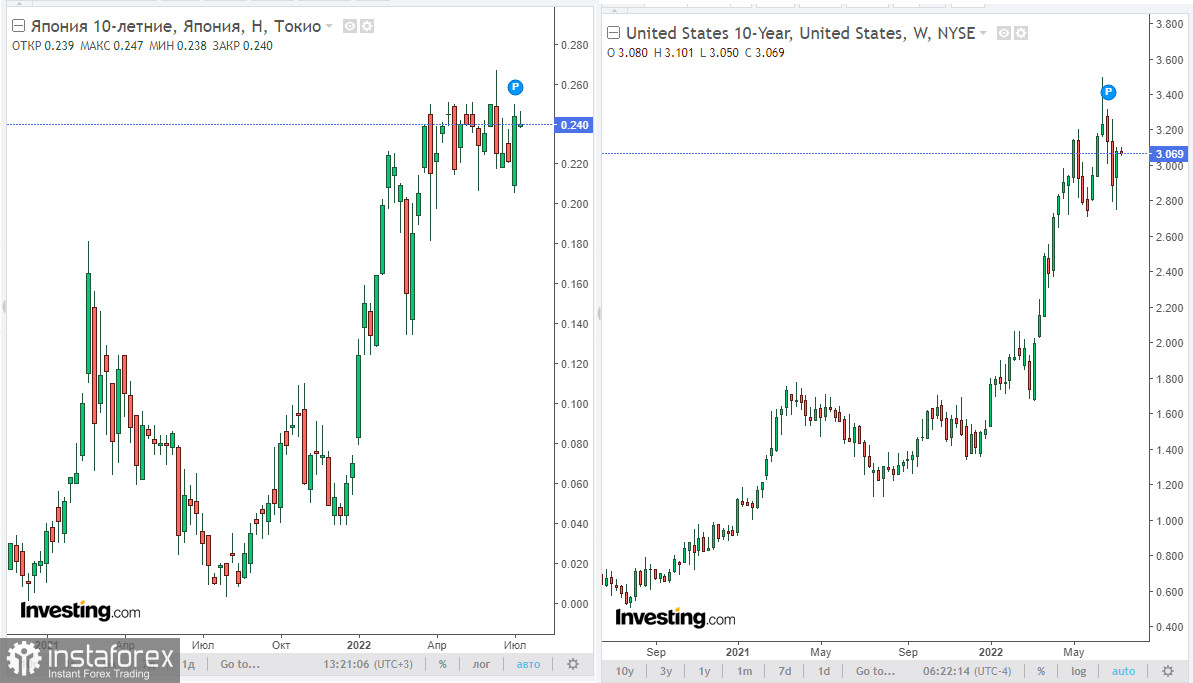

Economists also believe that the widening yield spread of US and Japanese government bonds contributes to the further growth of USD/JPY. Strategic Japanese investors are more willing to buy US government bonds, which bring more income than Japanese government bonds. Since the purchase of US assets is made in dollars, the purchase of the dollar for the yen contributes to the natural strengthening of the dollar against the yen. Markets are keeping a close eye on US Treasury yields and unless the BOJ's yield curve control (YCC) policy is changed in the near future, the USD/JPY outlook is likely to depend on the US yield outlook.

If it (yield) grows, USD/JPY will continue to grow. And the growth of the yield of American bonds is promoted, in turn, by the Fed's monetary policy, which tends to tighten further.

Last week, Fed Board member Christopher Waller announced the need for another increase in interest rates by 75 percentage points this month and by 50 percentage points in September, after which the pace of interest rate hikes can be reduced to 25 percentage points. In his opinion, inflation is a tax on economic activity, and the higher it is, the more it suppresses it.

Earlier, Federal Reserve Chairman Jerome Powell also spoke about the undesirability of high inflation in the United States. In his opinion, the fight against high inflation is the main goal of the Fed, and the risks of a recession in the national economy, in his opinion, remain low. As follows from the minutes of the June meeting of the Federal Open Market Committee (FOMC) published last Wednesday, the Fed will raise rates by 50 or 75 basis points in July. They also say that high inflation justifies "restrictive" interest rates, with the possibility of a "more restrictive stance" if inflation continues at high levels.

Last week, St. Louis Federal Reserve Bank President James Bullard also supported a more aggressive tightening of the Fed's monetary policy, noting the desirability of a key interest rate level of 3.5% this year.

At the same time, the yen remains extremely vulnerable as long as the Bank of Japan continues to take a wait-and-see attitude.

As central bank deputy governor Masayoshi Amamiya said late last month, the Bank of Japan will maintain an easing monetary policy to support the economy. The head of the Bank of Japan, Haruhiko Kuroda, as part of a discussion held in Basel on June 26, also noted that "unlike other economies, the Japanese economy has not been hit hard by the global inflationary trend, so monetary policy will continue to be stimulating."

As for the dollar, it received additional support last Friday from the publication of very positive data from the US labor market.

The US Department of Labor report pointed to an increase in the number of new jobs outside the agriculture sector by 372,000, while the unemployment rate remained at a minimum of 3.6% for the 4th month in a row.

The data speaks of the stability of the US labor market, which allows the Fed to continue the fight against rising inflation in the country. Labor market data (along with GDP and inflation data) is known to be key for the Fed in setting monetary policy parameters.

The dollar index (DXY) confidently broke through the 107.00 mark on Friday and as of this writing, DXY futures are trading near the 107.47 mark, maintaining positive dynamics and potential for further growth. The breakdown of the next "round" mark of 108.00 will be a signal to increase long positions in DXY futures with the prospect of growth towards multi-year highs of 121.29 and 129.05, reached, respectively, in June 2001 and November 1985.

Thus, the determining factors in the dynamics of USD/JPY are the continuing strengthening of the dollar and the weakening yen. And this trend will continue for the time being, at least for the next several months.

And from the news this week, investors will pay attention to US inflation data for June and the Fed's monthly economic report ("Beige Book"). Economists expect the consumer price index in June to accelerate from 8.6% to 8.8% (in annual terms), updating record highs, although the growth of the core CPI in June slowed slightly (to 5.8% from 6.0% in May, in annual terms). On Friday (at 12:30 GMT), US retail sales are due out, and they are expected to rise in June (+0.8% vs. -0.3% decline in May), which is also a positive factor for the dollar.

The other main drivers of dollar strength (global risk aversion and recession fears) are likely to continue in the near term as well.

The USD/JPY pair will most likely continue to rise. Buy positions will be possible on a pullback at least to the support levels of 136.00, 135.86, 135.19, 135.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română