The EUR/USD pair began the new week with a new reversal in favor of the US currency and a new fall toward the level of 1.0080. Today's economic calendar is empty, and there is no news to report at night for obvious reasons. Nonetheless, bear traders decided not to swing for too long and began selling the euro currency, as everyone has become accustomed to. I cannot attribute this to any specific factors. The euro currency has been falling for a long time and is powerless to compete with the American currency. Traders' "bearish" mood is likely to persist this week. However, I believe the decline in the European currency is due to the release of US payroll data on Friday. Remember that the real value exceeded traders' expectations, indicating that the report was strong. Traders decided to slightly adjust the pair on Friday, although it had fallen for four days in a row. However, we are seeing a delayed reaction to strong statistics from the United States today. The unemployment rate and average wages were also at the top of the list. However, the next significant report will have to wait until Wednesday. The June inflation report for the United States will be released on Wednesday, which is critical for the dollar. At the end of the month, if inflation rises again, the Fed will raise interest rates by 0.75 percent. Of course, this is a positive factor for the US currency, and the pair will be able to fall below the historical level of 1.0000 in the near future. As a result, I see no reason to buy the euro currency or, at the very least, count on its strong growth. The ECB is still planning to raise interest rates by a maximum of 0.5 percent over the next two meetings, which will not be enough to cause the euro currency to surge in strength. The euro could be around 0.9000 in a few months at this rate.

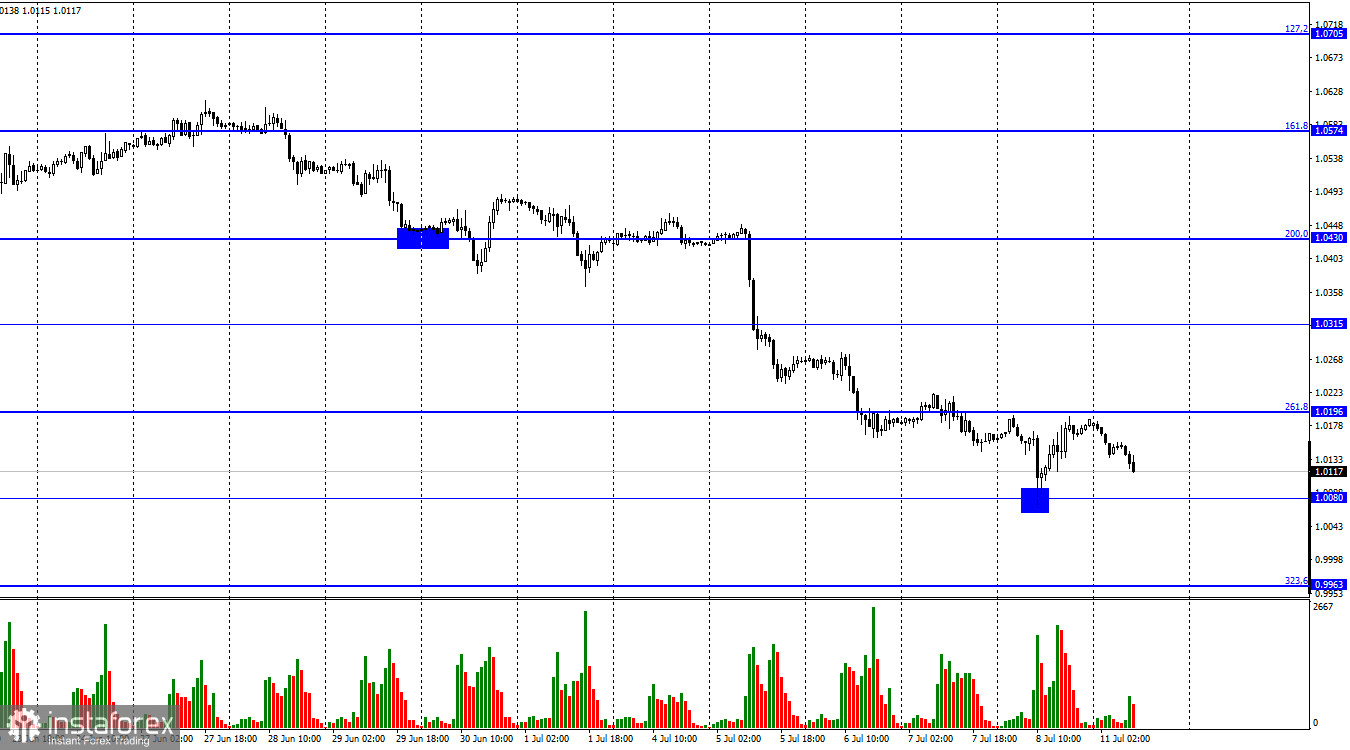

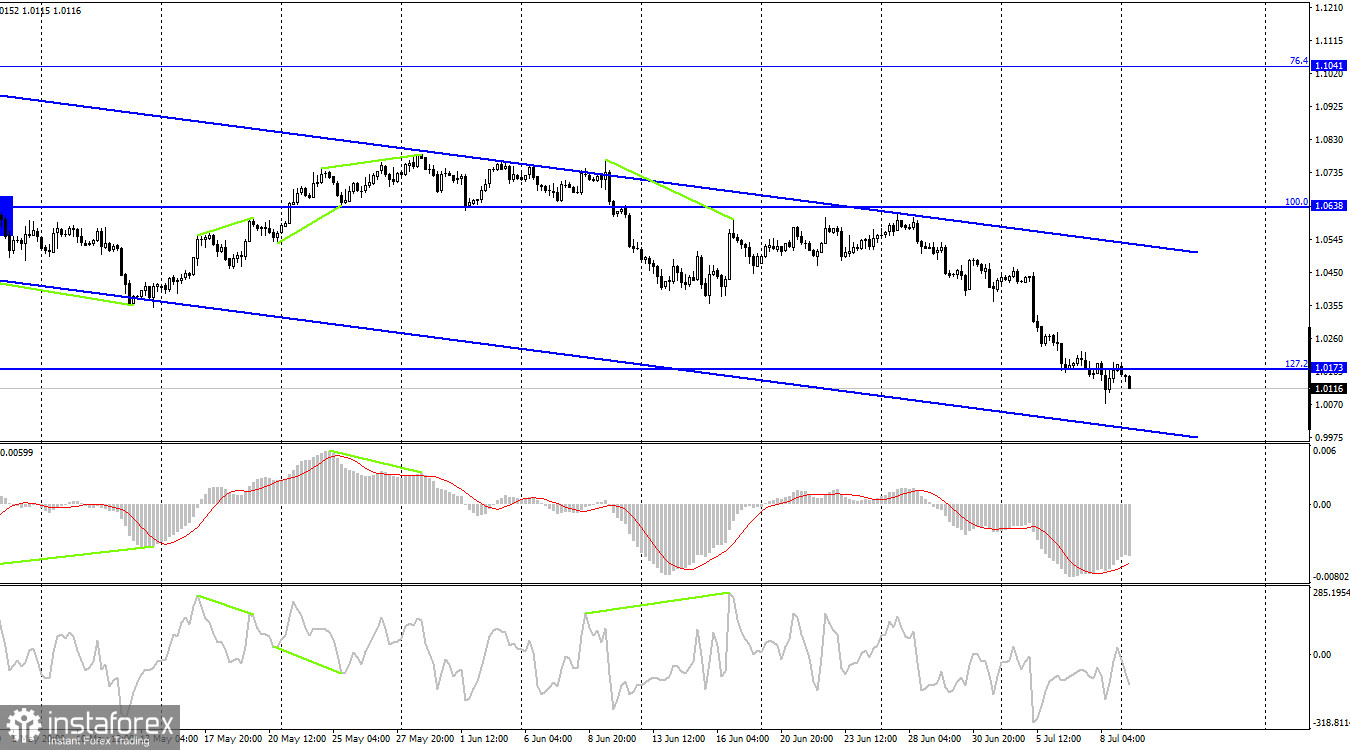

On the 4-hour chart, the pair is holding under the corrective level of 127.2% (1.0173). As a result, the price decline can be extended toward the next corrective level of 161.8% (0.9581). Today, no indicator has detected brewing divergences. The downward trend corridor continues to characterize traders' mood as "bearish."

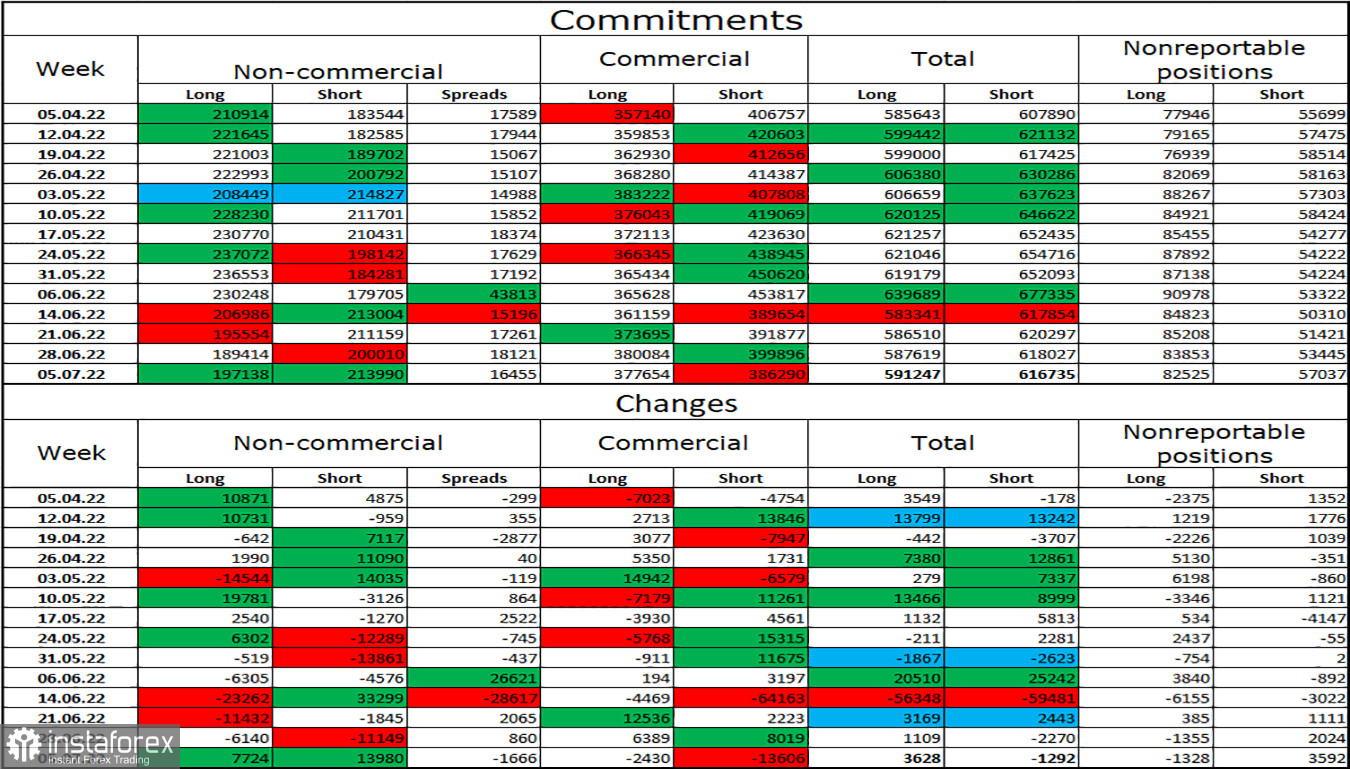

Report on Trader Commitments (COT):

Speculators opened 7,724 long contracts and 13,980 short contracts during the previous reporting week. This means that the major players' "bearish" mood has intensified and will remain "bearish." The total number of long contracts concentrated in the hands of speculators is now 197 thousand, with 214 thousand short contracts. The difference between these figures is minor, but it is not in the bulls' favor. In recent months, the euro has mostly maintained a "bullish" mood among "non-commercial" traders, which has done nothing to help the euro currency. The chances of a euro currency rise have gradually increased in recent weeks, but recent COT reports indicate that new sales of the EU currency may now follow, as speculators' mood has shifted from "bullish" to "bearish." This is the exact progression of events that we are witnessing right now.

News for the United States and the European Union:

On July 11, neither the European Union nor the United States had any interesting economic events scheduled. Today's traders' mood will be unaffected by the information background. However, the European currency has plummeted since the previous night, so Monday could also be a very interesting day.

EUR/USD forecast and trading recommendations:

When the pair were anchored below the 1.0315 level on the hourly chart, I recommended selling it with a target of 1.0196. This level has been refined. New sales were recommended at the closing price of 1.0196, with targets of 1.0080 and 0.9963, the first of which was already met. When the euro currency anchors above the corridor on a 4-hour chart, I recommend buying it with a target of 1.1041.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română