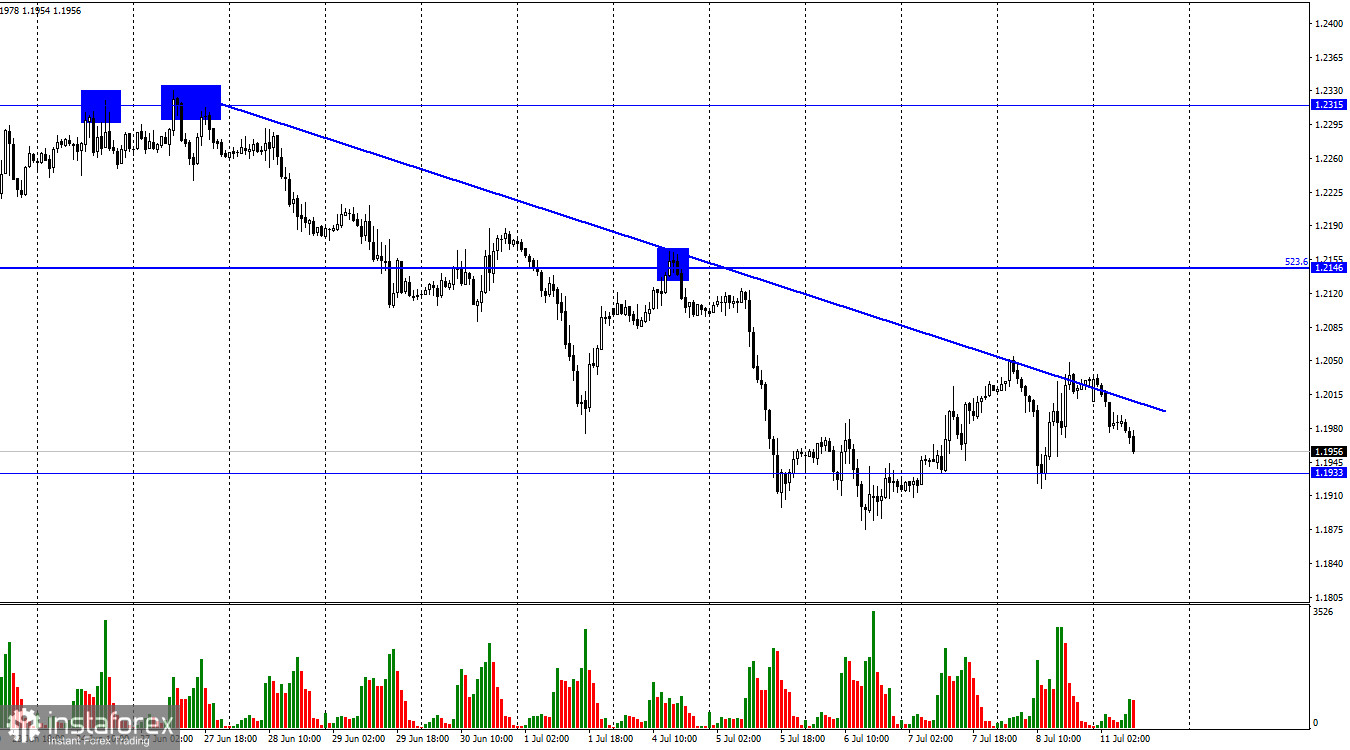

Hi, dear traders! In the 1-hour chart, GBP/USD again dropped to the downtrend channel and rebounded off it. Thus, the currency pair reversed downwards amid the strong US dollar and began a new downward cycle towards 1.1933. All in all, both the euro and the pound sterling opened a new week in the red even until some crucial events and news. From my viewpoint, theoverall sentiment remains firmly bearish. GBP/SD generated two sell signals because the price kicked twice out of the trendline. The currency pair might decline to 1.1933 in the next few hours and settle below it. In this case, the instrument could extend its decline towards 1.1684, the next Fibonacci level of 685.4%. I assume GBP could resume growth not until it settles above thetrendline.

Notably, the news of Boris Johnson's resignation has been of no importance to traders. The Britishcurrency rebounded a bit, but it is not clear whether the growth was triggered by the political crisis in the UK. Such a modest growth could have been a technical correction that happens without fundamental reasons. Wednesday this week is loaded with important events. The US is due to report on its inflation for June. The UK will release data on industrial production and gross domestic product. Let me remind you that analysts are keeping close tabs on GDP data because alot of economies around the world are on the verge of recession. At least, the recession is looming on the horizon. The feasibility of a recession in the US is the most burning issue among experts and investors. The UK is in no better position than the US. The Kingdom might face a contraction in the national economic output. High inflation raging in both countries forces the central banks to proceed with further monetary tightening. The higher interest rates are, the more realistic the recession scenario is.

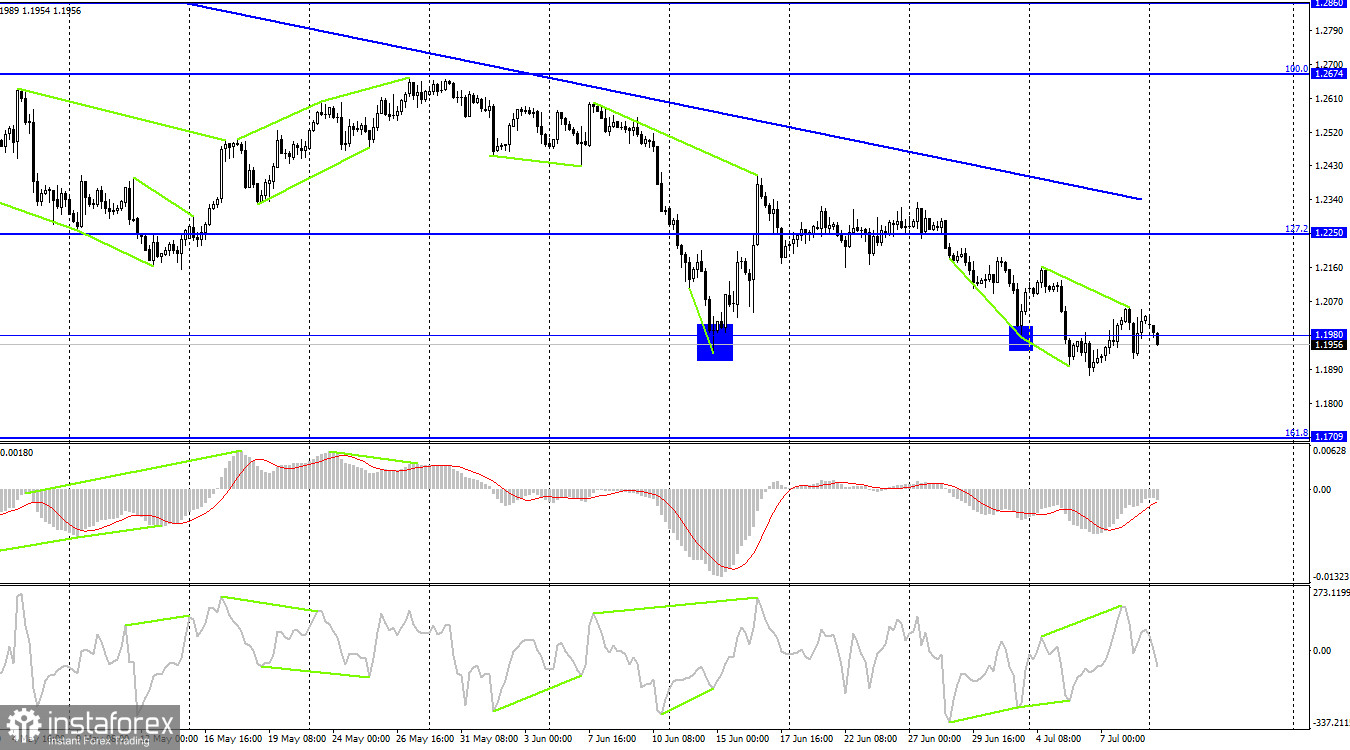

On the 4-hour chart, GBP/USD reversed downwards under the pressure of the strong US dollarand settled below 1.1980. As the next move, the currency pair could extend its fall towards 1.1709, the 161.8% Fibonacci correction. Besides, the CCI indicator formed a bearish divergence that increases the odds of a further decline in the sterling. I don't reckon on GBP growth for a while.

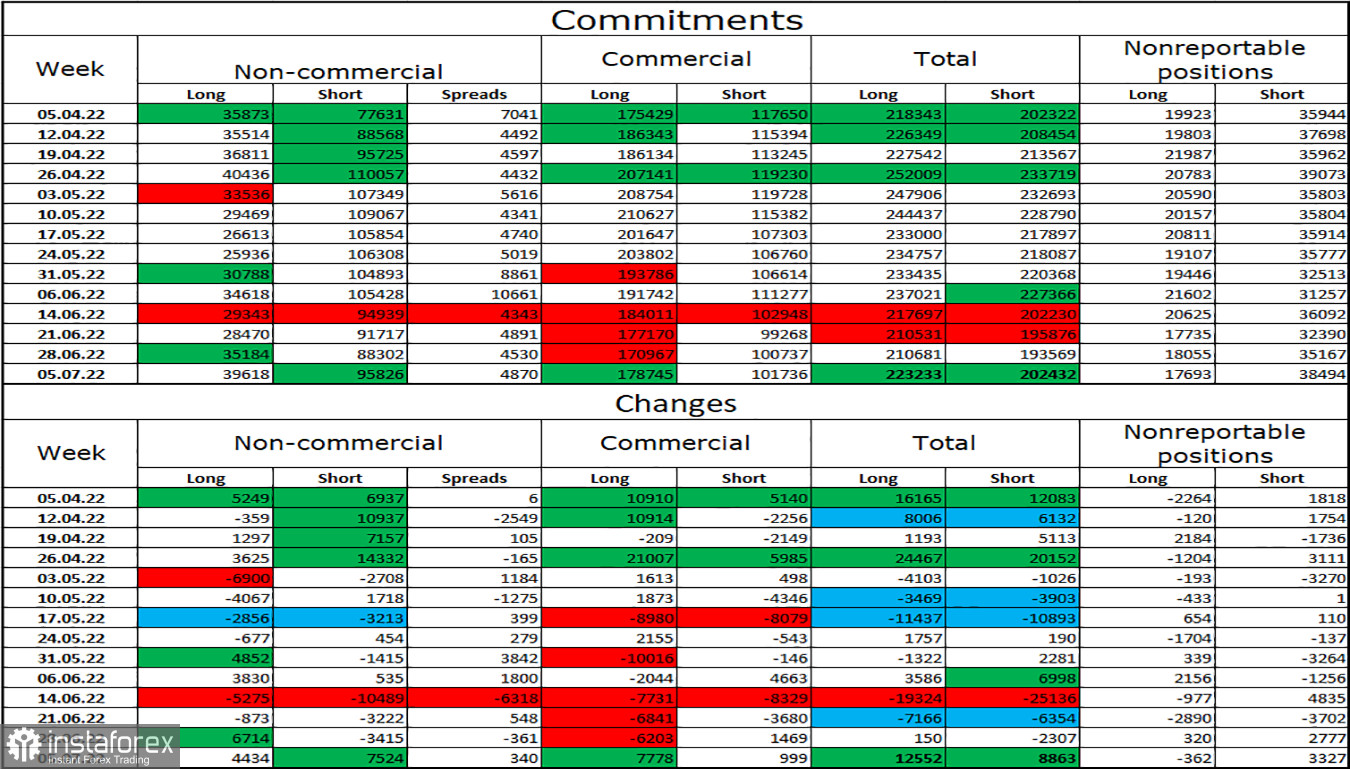

Commitments of Traders (COT) report:

The market sentiment of the non-commercial category of traders turned more bearish last week. The number of long contracts increased by 4,434, whereas speculators opened 7,524 more short contracts. All in all, the overall trading sentiment among large market players remained bearish. Besides, the number of short contracts is a few times as high as the number of long ones. Large market makers are still poised to sell the pound sterling. The bearish sentiment has got stuck onthe currency market for quite a while. I reckon that the pound sterling is likely to extend its weakness for a few more weeks. A sharp difference between long and short contracts might indicate a trend reversal, but market makers give priority to the information background nowadays. To sum up, speculators are mainly selling the sterling than buying it.

Economic calendar for US and UK

The economic calendar is empty for the US and the UK on Monday. Therefore, the information background will not influence trading sentiment today. Nevertheless, the pound sterling could keep on falling.

Outlook for GBP/USD and trading tips

I would recommend selling GBP immediately after its drops off the trendline on the 1-hour chart with the downward targets at 1.1933 and 1.1709. We could consider buying GBP after the currency pair settles above the trendline on the 4-hour chart with the target at 1.2674.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română