Political crises in the country rarely lead to an increase in the national currency. The pound became an exception to the rule, having strengthened against the dollar and the euro in response to the resignation of Boris Johnson. It seems that investors have decided that the departure of the prime minister will do more good than harm to the British economy. However, the joy of the "bulls" on the GBPUSD was short-lived. A very difficult macroeconomic background creates a serious headwind for the sterling. It is unlikely that politics will help it.

While the new Conservative leader may not hold parliamentary elections until 2025, many banks and investment firms, including Citigroup, Mizuho, and NatWest Markets, are talking about early voting. Elections can help the incumbent party in power to strengthen its position by unleashing the wallet and increasing government spending. The opposition Labour party can change the balance of power in the political Olympus of Britain. At the same time, there may be a resuscitation of topics such as Brexit and a referendum on Scottish independence.

Theoretically, new fiscal stimulus could help Britain avoid a recession and, at the same time, further accelerate inflation, forcing the Bank of England to raise rates aggressively. So far, the rate of its monetary restriction is lagging behind the Fed, which is the main driver of the GBPUSD collapse. However, BoE Chief Economist Huw Pill argues that if circumstances require, the central bank is ready to accept higher rates of repo rate hikes than everyone has seen in the current monetary restriction cycle. And it must be admitted that there are prerequisites for this.

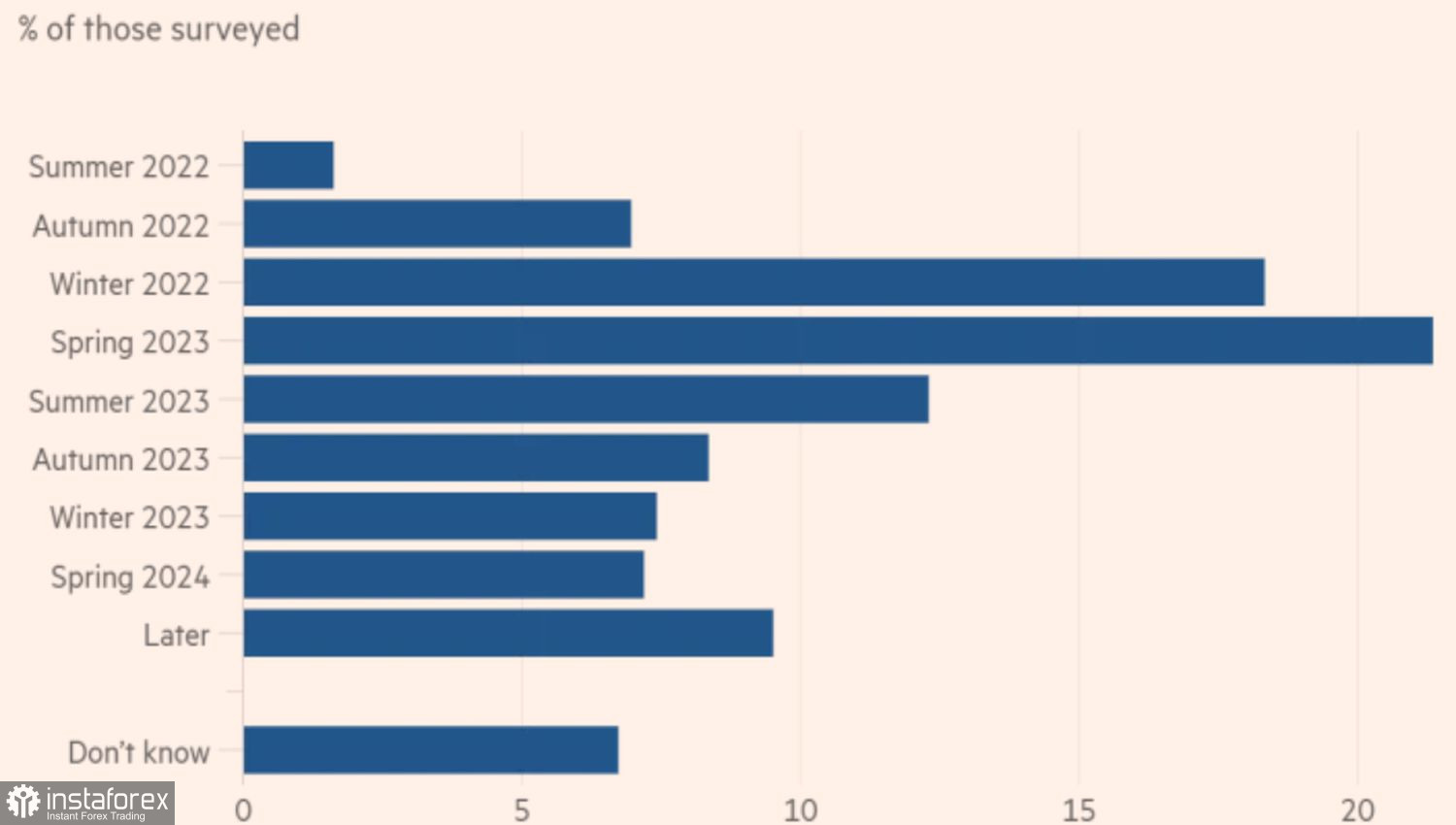

Only 27% of executives polled by the Institute of Directors believe that inflation in Britain will peak before spring 2023, which is in line with the opinion of the Bank of England. They predict a consumer price peak of 11% in October. While 21% of respondents believe that the peak will be reached next spring, and 45% say even later.

Forecasts of the leaders of British companies on the peak of inflation

Stimulating fiscal policy from the new leaders of the Conservative Party will certainly translate forecasts of later CPI extremes than currently expected into reality. As a result, the task of the Bank of England, which still seems very difficult, will become even more difficult. It will have to raise rates in a recession.

Investec predicts that Britain will face a recession from Q1 2022 to Q3 2023 amid strong inflation pressures and high borrowing costs. However, the recession promises to be mild. Unless, of course, Russia cuts off gas to the entire euro area. See how it goes. Meanwhile, the release of data on UK GDP for May may become a key event for the pound in the week of July 15.

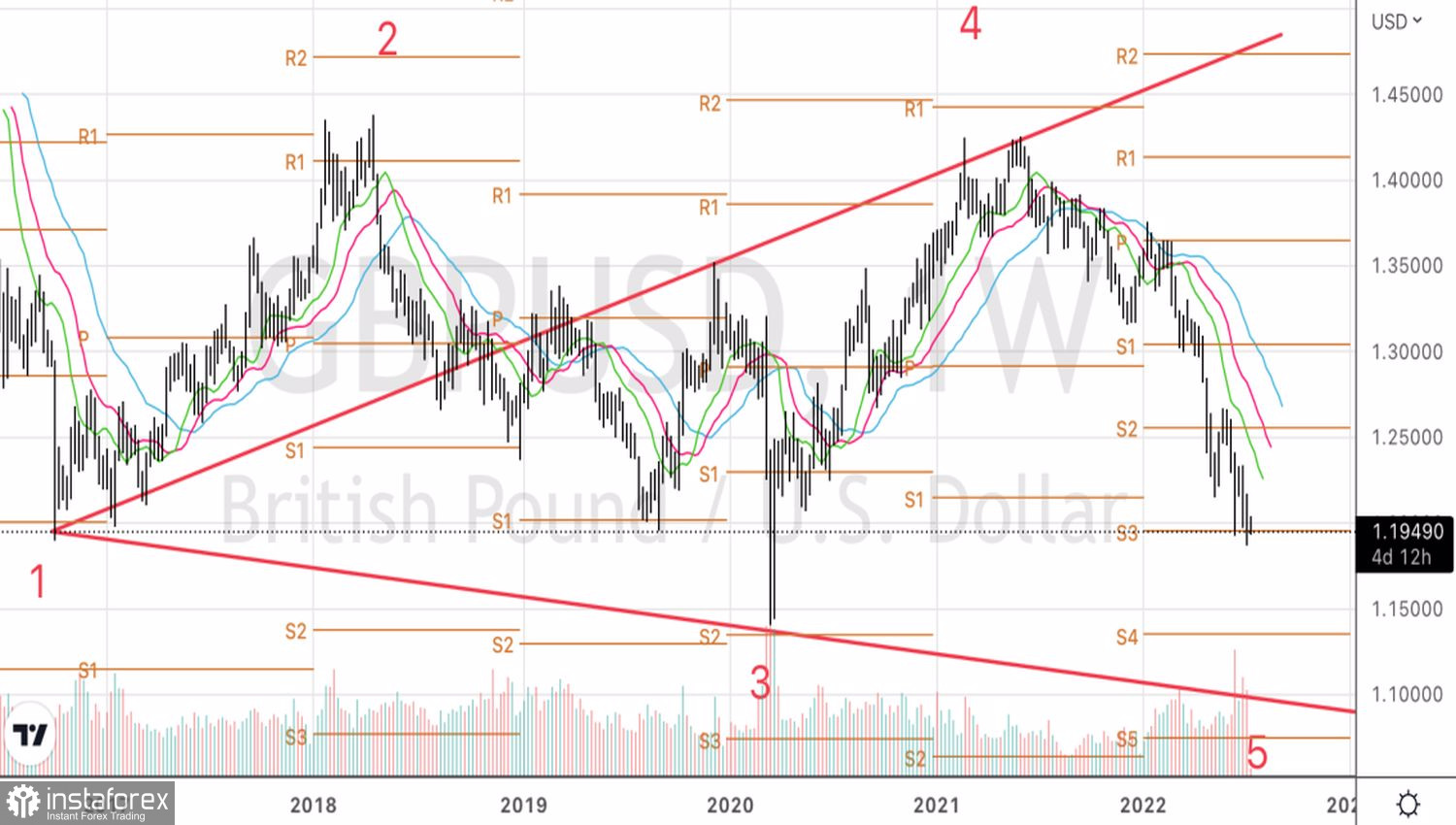

Technically, on the weekly chart, judging by the Wolfe Wave pattern, GBPUSD still has room to fall. Point 5 could be formed at 1.135 or even 1.09. We continue to sell the pair on pullbacks.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română