EUR/USD 5M

The EUR/USD pair showed cheerful movements on Friday. First, it fell by 100 points, so it rose by 100 points, and all this was accompanied by constant pullbacks against the main trend. Thus, it was very difficult to trade the pair on Friday. The circumstances were mitigated by the fact that three really important reports were published at once at the very beginning of the US trading session: the unemployment rate, changes in average wages and NonFarm Payrolls. Naturally, the last report had the greatest impact. The number of new jobs outside the agricultural sector amounted to 372,000, and the value of the previous month was revised to 384,000. Thus, this report can be called positive, but the US dollar, which initially began to grow after the release, eventually continued to fall, which was observed in the US trading session. Consequently, traders generally reacted illogically to this report. However, we warned that given the dollar's growth throughout the week, it could fall on Friday, whatever the report on Nonfarm.

As for trading signals, none were formed on Friday, as there are still no extreme levels at current price values. The Ichimoku indicator lines were located much higher than the price, that's why not a single signal was formed. It may even be for the best, since Friday's movements were difficult.

COT report:

The latest Commitment of Traders (COT) reports on the euro over the past six months have raised a huge number of questions. The chart above clearly shows that they showed a blatant bullish mood of professional players, but at the same time, the euro was falling at the same time. At this time, the situation has changed, and NOT in favor of the euro. If earlier the mood was bullish, but the euro was falling, now the mood has become bearish and... the euro is also falling. Therefore, for the time being, we do not see any grounds for the euro's growth, because the vast majority of factors remain against it. During the reporting week, the number of long positions increased by 7,700, and the number of shorts in the non-commercial group increased by 14,000. Accordingly, the net position decreased again, by almost 7,000 contracts. The mood of the big players remains bearish and has even increased slightly in recent weeks. From our point of view, this fact very eloquently indicates that at this time even commercial traders do not believe in the euro. The number of longs is lower than the number of shorts for non-commercial traders by 17,000. Therefore, we can state that not only the demand for the US dollar remains high, but also the demand for the euro is quite low. This may lead to a new, even greater fall of the euro. In principle, over the past few months or even more, the euro has not been able to show even a tangible correction, not to mention something more. The highest upward movement was about 400 points.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. July 11. Hello, did you order "coronavirus"?

Overview of the GBP/USD pair. July 11. Boris Johnson's lies cost him his political career.

Forecast and trading signals for GBP/USD on July 11. Detailed analysis of the movement of the pair and trading transactions.

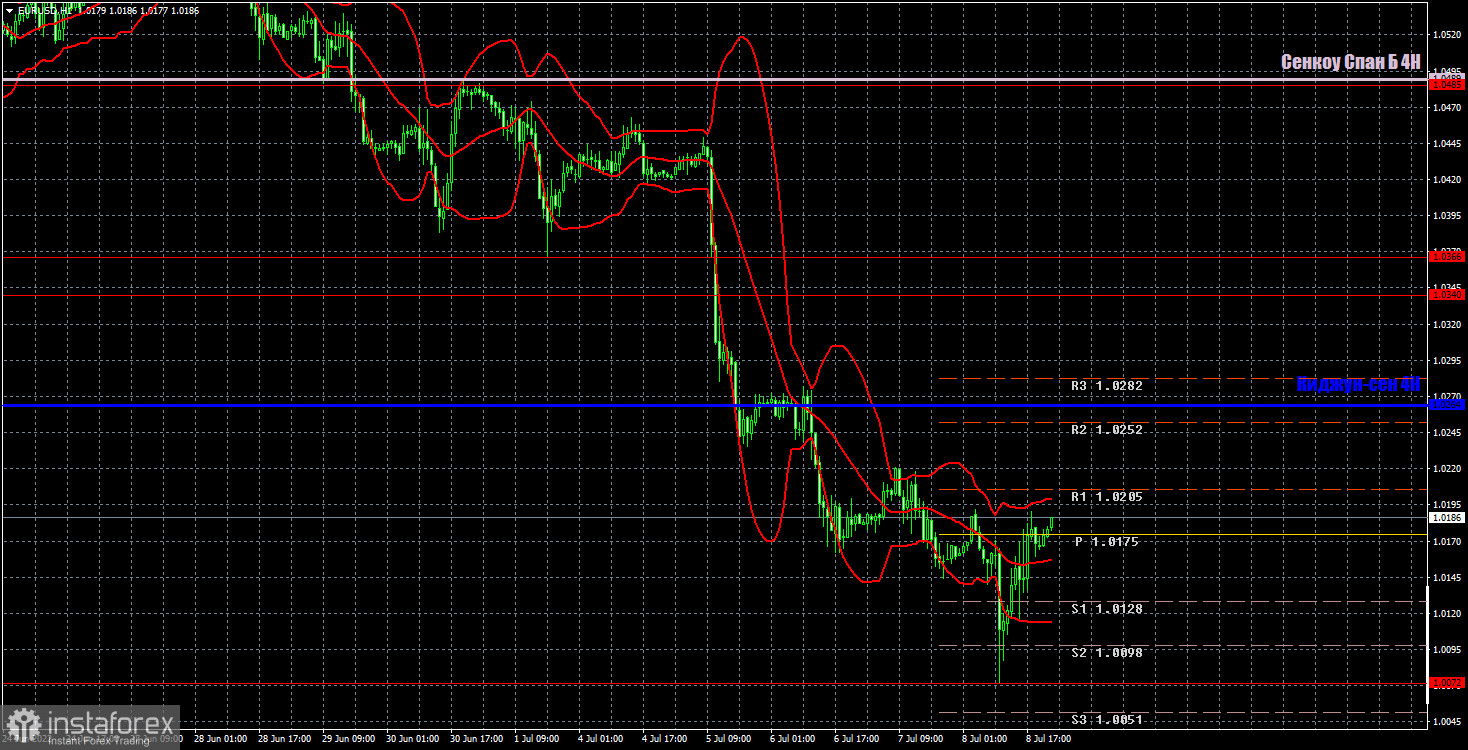

EUR/USD 1H

The downward trend continues on the hourly timeframe, which is hardly surprising to anyone. An upward correction began on Friday, which may continue for some time with the Kijun-sen line as the target. It is difficult to say how high the euro will climb this time, since almost all factors continue to work against it. In addition, the Federal Reserve's next meeting will be held soon, at which the rate will be raised by 0.75%, almost guaranteed. We allocate the following levels for trading on Monday - 1.0072, 1.0340-1.0366, 1.0485, as well as the Senkou Span B (1.0489) and Kijun-sen (1.0264) lines. Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. There are also secondary support and resistance levels, but no signals are formed near them. Signals can be "rebounds" and "breakthrough" extreme levels and lines. Do not forget about placing a Stop Loss order at breakeven if the price has gone in the right direction for 15 points. This will protect you against possible losses if the signal turns out to be false. Not a single important event planned in the European Union and in the United States on July 11. Thus, the pair may continue to correct for at least another day or two. The US will publish the most important report on inflation on Wednesday, which may provoke a new growth of the dollar.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română