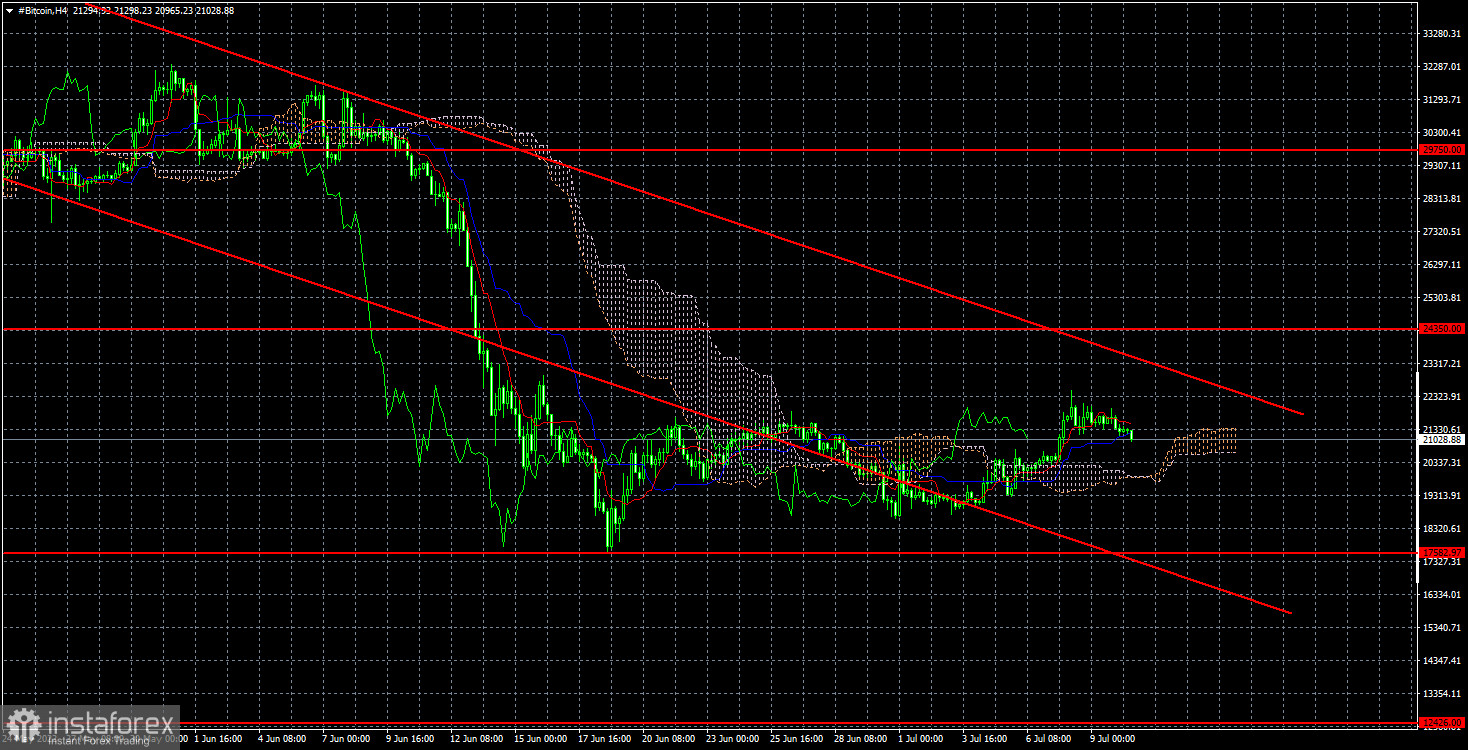

The present Bitcoin picture on the 4-hour TF is also quite eloquent and does not generate any questions. A clear descending channel has been maintained for an extended period. The cryptocurrency is not even attempting to get a foothold above it, as it continued to move toward its upper limit this week. Nonetheless, one must also consider that the upper bound lowers over time. In the following days, they may meet, and then the fate of bitcoin for the next few weeks will be decided. The most intriguing aspect is that even under the current conditions, bitcoin may easily increase by $ 5,000 to $ 10,000. This assumption is based on the fact that no instrument can continuously fall. And for bitcoin, the difference between $ 5,000 and $ 10,000 is negligible. Nevertheless, we anticipate that the "bearish" trend will persist at least through the end of the year. And there are numerous explanations for this.

The failure of the "foundation" for hazardous assets is currently the most critical factor. Remember that it is not just the bitcoin market that is declining now. For example, the US stock market is likewise plummeting. And stocks are demonstrably more stable than unbacked cryptocurrency. The money supply in the United States began to shrink on July 1 due to the QT (quantitative tightening) program. The Fed's interest rates have been increasing, are increasing, and will continue to increase. We view the Fed's tightening monetary policy as the most influential factor in predicting the future of bitcoin. Remember that the last "bullish" trend occurred when rates were cut to zero, and the Fed injected five trillion dollars into the economy out of thin air. Now that the process reverses, it is reasonable to predict that bitcoin will decline. As a result of high inflation and the likelihood of its reduction, investors seek the most secure assets. The myth that bitcoin is a hedge against inflation is nothing more than an attempt by interested parties to attract as many "hamsters" as possible to cryptocurrencies. Bitcoin could easily be called "the best protection against natural disasters." Therefore, it is illogical to anticipate a new rise until the Fed begins to suggest a relaxation of monetary policy. In addition, each rally concluded with a decline of 80 to 90 percent, followed by a period of stability that can last many years. Therefore, even if the bearish trend stops tomorrow, the construction of a positive trend will not commence immediately.

In the 4-hour time frame, "bitcoin" prices exceeded the $ 24,350 threshold. It was unable to obtain a foothold above the downward channel. Thus the current objective of $ 12,426 stays in place. In general, it is not advisable to contemplate purchasing bitcoin at this time; instead, you should wait until at least a consolidation above the channel. There is also a municipal minimum intermediate level of $ 17,582 per year. When the price is above this threshold, it will announce new sales.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română