The US labor market turned out to be too hot for the Fed to feel comfortable. Nonfarm payrolls rose by an impressive 372K, and with the two previous reports revised down by 74K, it doesn't look like it's going to slow down. Unemployment persisting at 3.6% and the labor force participation rate declining suggests that the Central Bank will remain a very aggressive hawk in the near future, which essentially leaves no chance for the EURUSD bulls.

The reaction of financial markets to the report on US employment was indicative. Equity futures collapsed, Treasury yields rose, and CME derivatives raised expectations for a 2022 federal funds rate hike to 180 bps. It seems that the issue with its increase by 75 bps in July has been resolved so that US dollar fans can sleep peacefully.

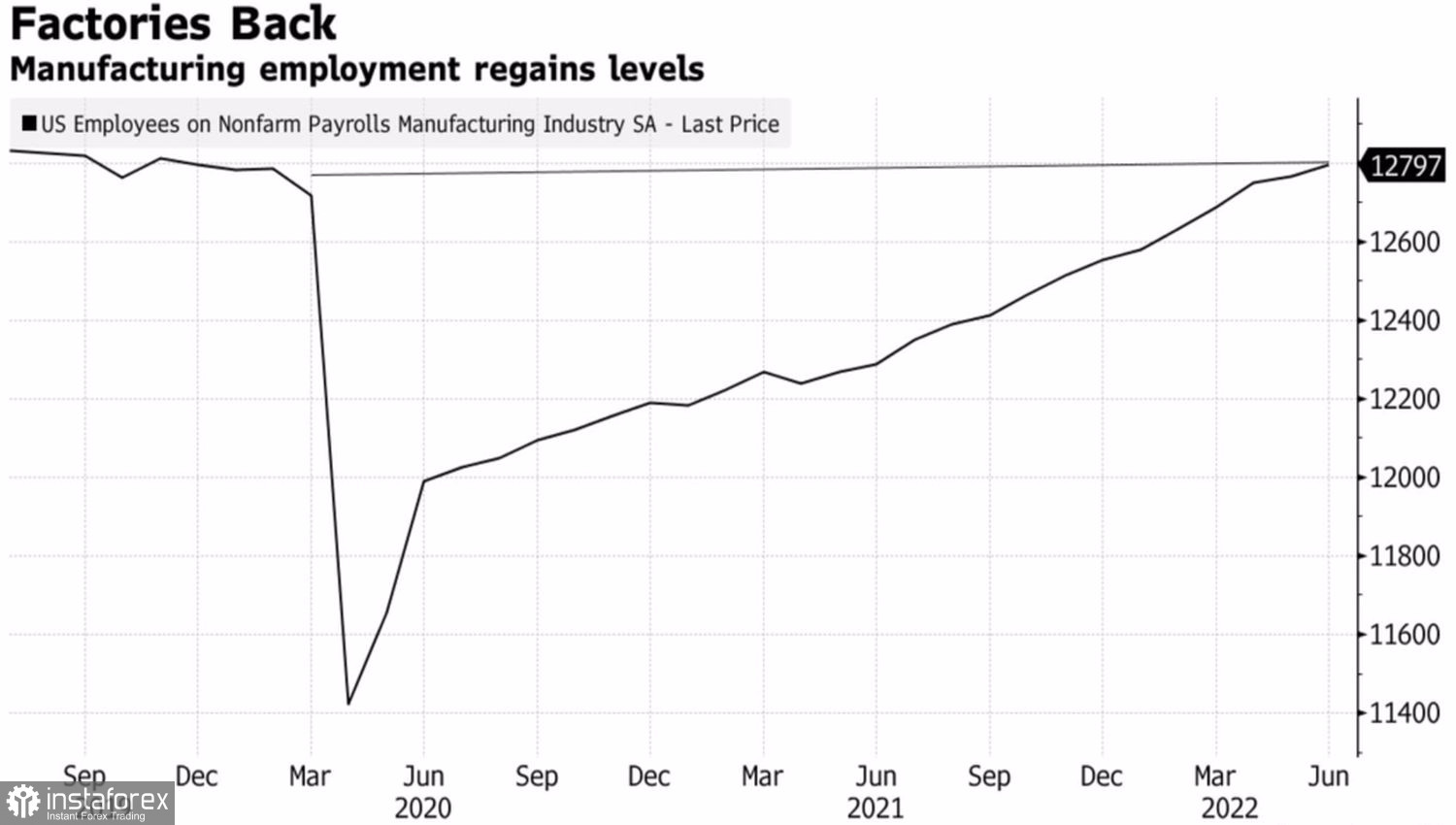

The labor market is indeed very hot: manufacturing employment is back to pre-pandemic levels, the number of vacancies is 11.2 million with 5.9 million job seekers.

Dynamics of employment in the manufacturing industry

Curiously, the local bottom for EURUSD was formed at the beginning of the European Forex session, after Goldman Sachs joined the opinion of ING about the imminence of a recession in the currency bloc. The Dutch bank said the recession would happen whether Russia shuts off gas or not.

A strong job market may help Jerome Powell with a soft landing. At the same time, a recession in Europe and other parts of the world will return the factor of American exceptionalism to the focus of investors' attention. Indeed, according to Wood Mackenzie, the euro area increased its imports of liquefied natural gas by 49% from the beginning of the year to June 19. By contrast, figures for India, China, and Pakistan declined by 16%, 21%, and 15% respectively. Europe, reducing its dependence on Russian blue fuel, is taking it away from other countries. And this circumstance is pushing the global economy into recession.

Thus, all the strongest trump cards of the US dollar remain in play. The American economy looks better than its main competitors. Expectations of a global recession increase the demand for safe-haven currencies. Finally, the Fed is tightening monetary policy faster than competitors, helped by favorable conditions, including a strong labor market.

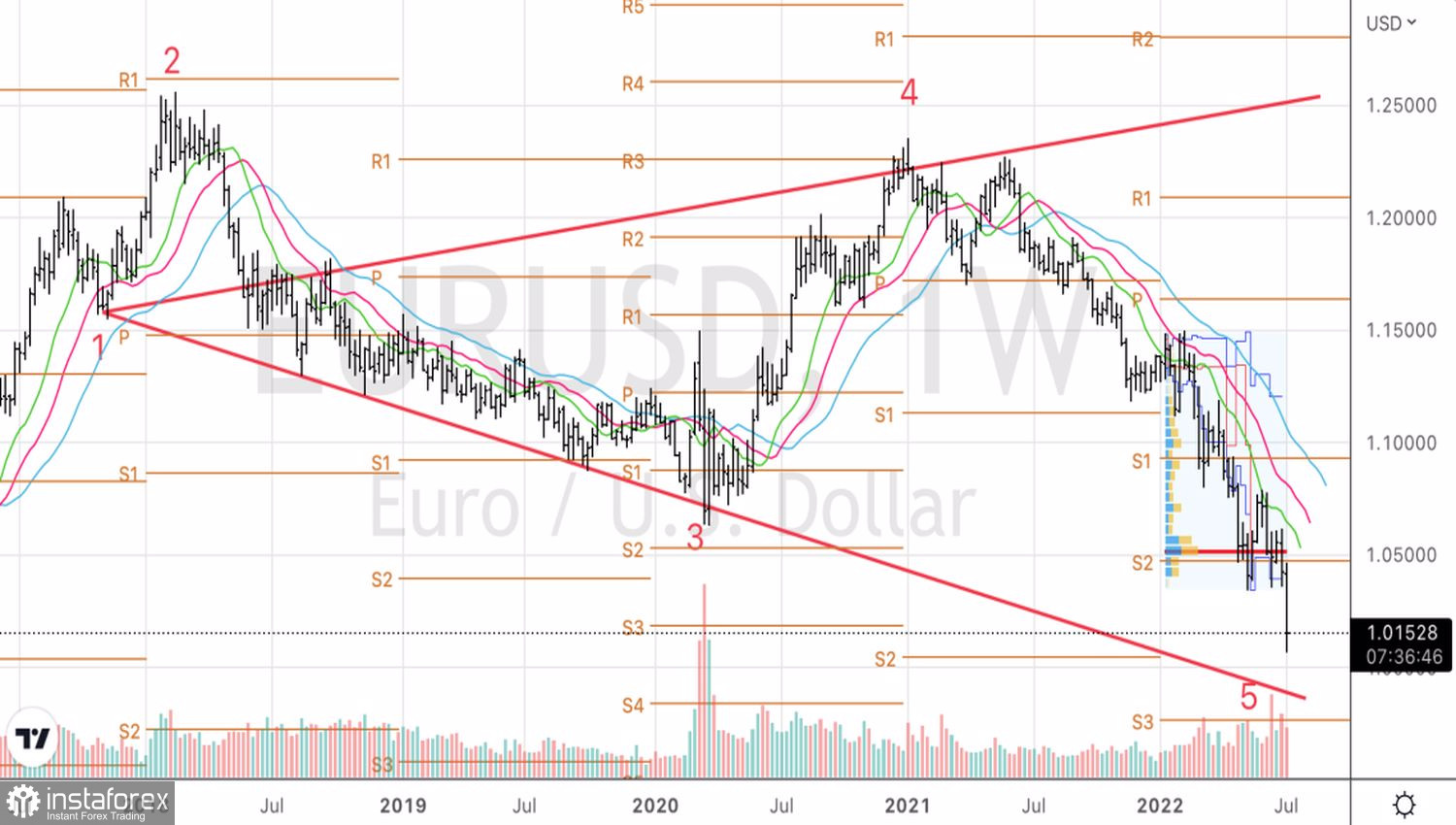

In my opinion, the stability of EURUSD against the background of strong statistics on US employment is associated with the desire of hedge funds to take profits on shorts. They counted on the implementation of the principle "buy a dollar on rumors, sell on facts." Nevertheless, strong data suggests that the downward trend will soon recover.

Technically, the Wolfe Wave pattern continues to form on the EURUSD weekly chart. Its point 5, most likely, will appear at one of the pivot points 1.005 or 0.985. The potential of the "bearish" trend is not disclosed, we continue to sell the euro on pullbacks.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română