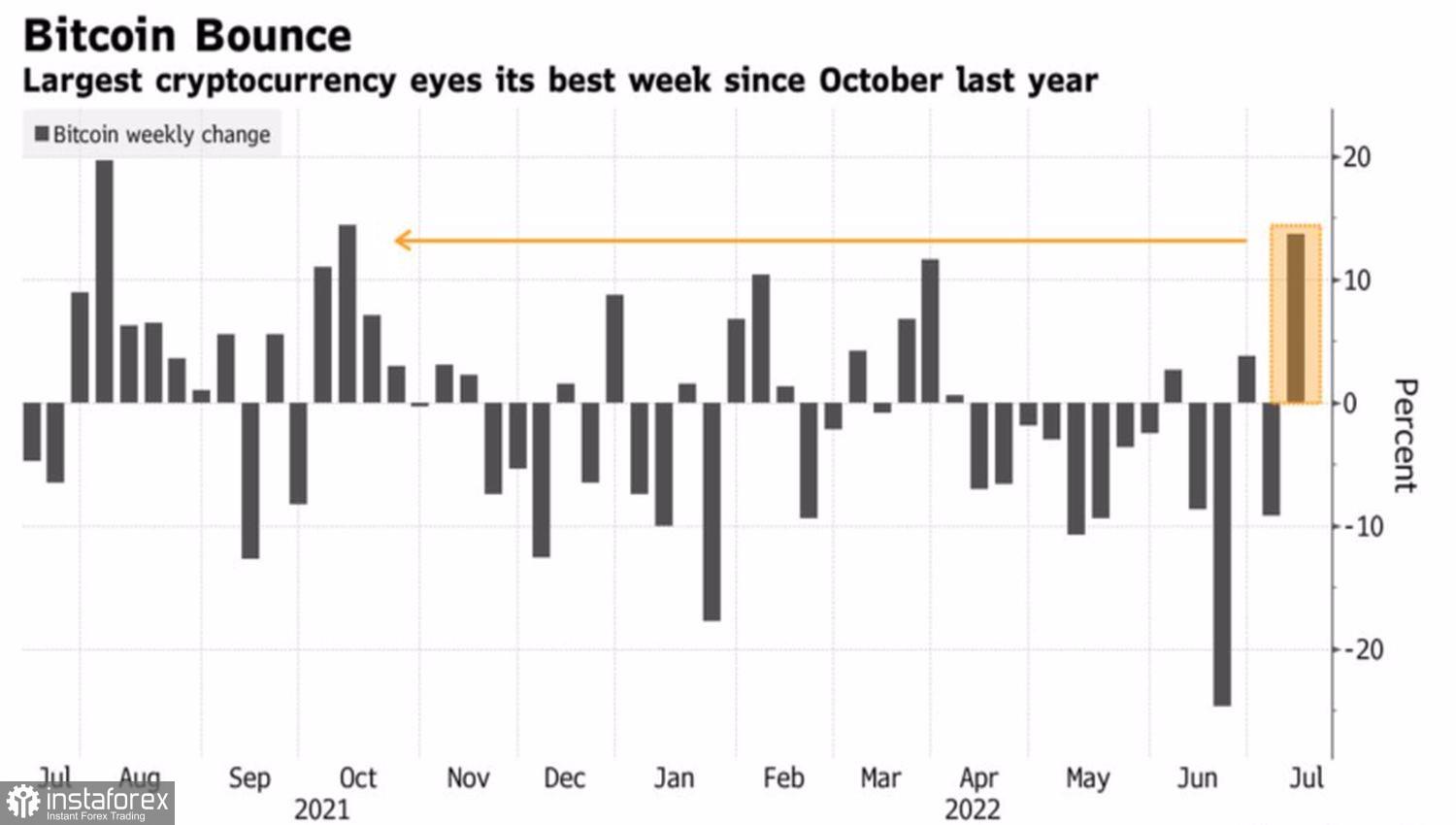

Is winter over for cryptocurrencies? Bitcoin is on the cusp of its best week since October, but it's not the holders' fault. With financial markets rising across the board and risk appetite gradually recovering, BTCUSD bulls simply cannot stand aside. They are actively using the opportunity provided, although not all institutional market participants are sure that the leader of the cryptocurrency sector has found the bottom. Some are waiting for the other shoe to drop.

Bitcoin weekly dynamics

By whatever means, they tried to determine whether bitcoin reached its local low or not. The identification of fair value and the share of buyers remaining in the money was replaced by the definition of their activity. When the holders are scared, they withdraw the cryptocurrency from their wallets to the exchanges in order to sell. Activity is currently down 13% from its November highs, and according to Glassnode, crypto exchange balances are down 20% from their peak in January.

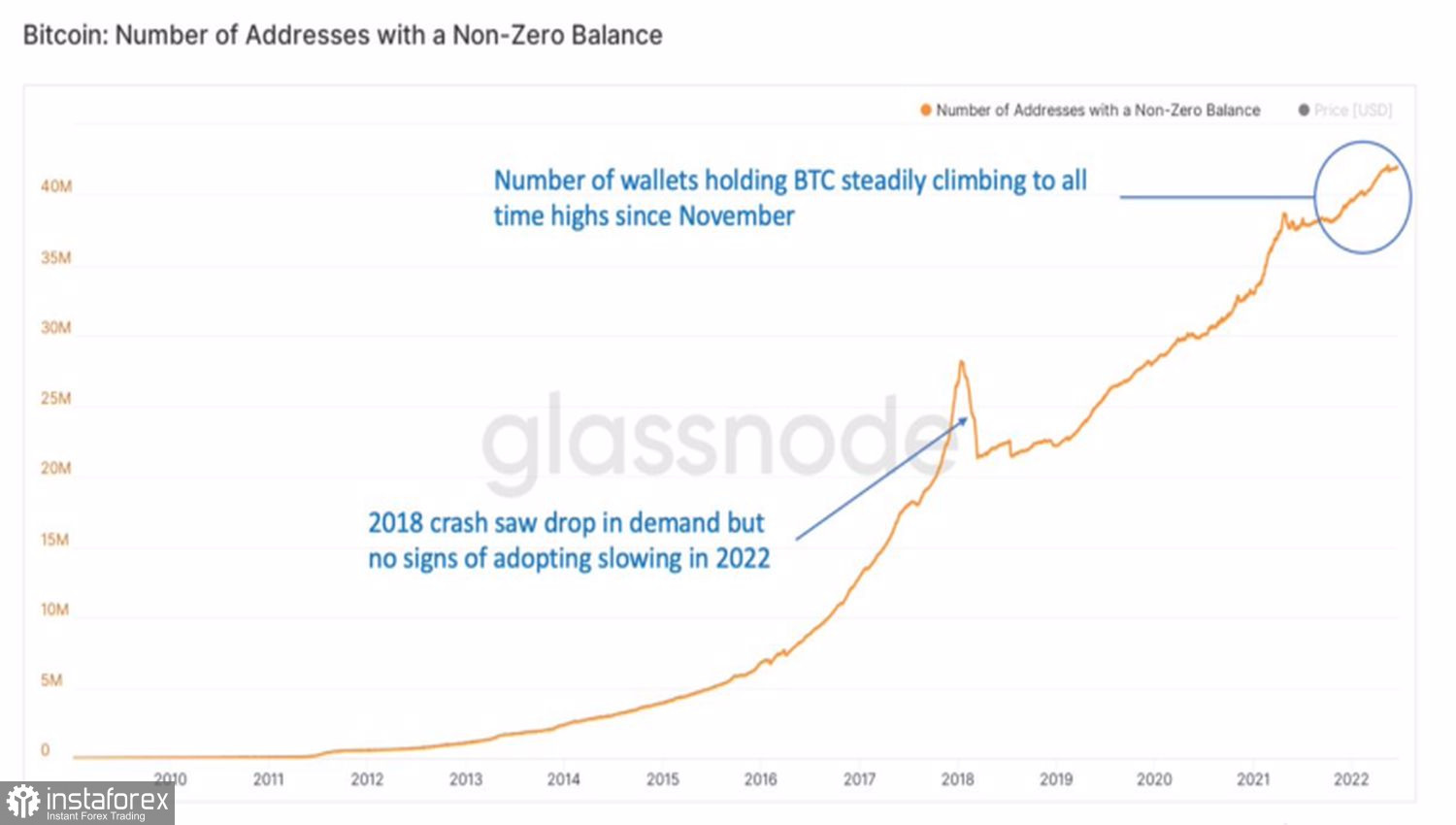

The situation is different from 2018 when the fear of losing money reduced the number of wallets with a non-zero balance. This is currently not happening. Holders hold on to the token with their teeth. This circumstance, despite the outflow of capital from Bitcoin-oriented ETFs by 50%, up to $1.3 billion, in April-June, allows BTCUSD bulls to be optimistic about the future. On the other hand, Arcane Research believes that activity generally increases during upward and downward trends but decreases during periods of consolidation. What we are seeing now is consolidation, so the drop in the indicator looks logical.

Dynamics of the number of wallets with a non-zero amount

I continue to take the position that the causes of all the troubles and successes of bitcoin should be found in traditional financial markets. In the past few weeks, investors have been fixated on the recession. No matter how events unfolded, they predicted its onset. If inflation does not slow down, the Fed will continue to aggressively tighten monetary policy, which will eventually lead to a decline in GDP. If, however, consumer price growth starts to fall, this will be evidence of a reduction in domestic demand and will still turn into a recession.

However, a series of positive data on the US economy gave food for talk that Jerome Powell and his team will be able to perform a miracle in the form of a soft landing. At some point they will turn around and start cutting rates, which will save the US from a hard landing. Against this backdrop, US stock indices marked a four-day rally, lending a helping hand to cryptocurrencies.

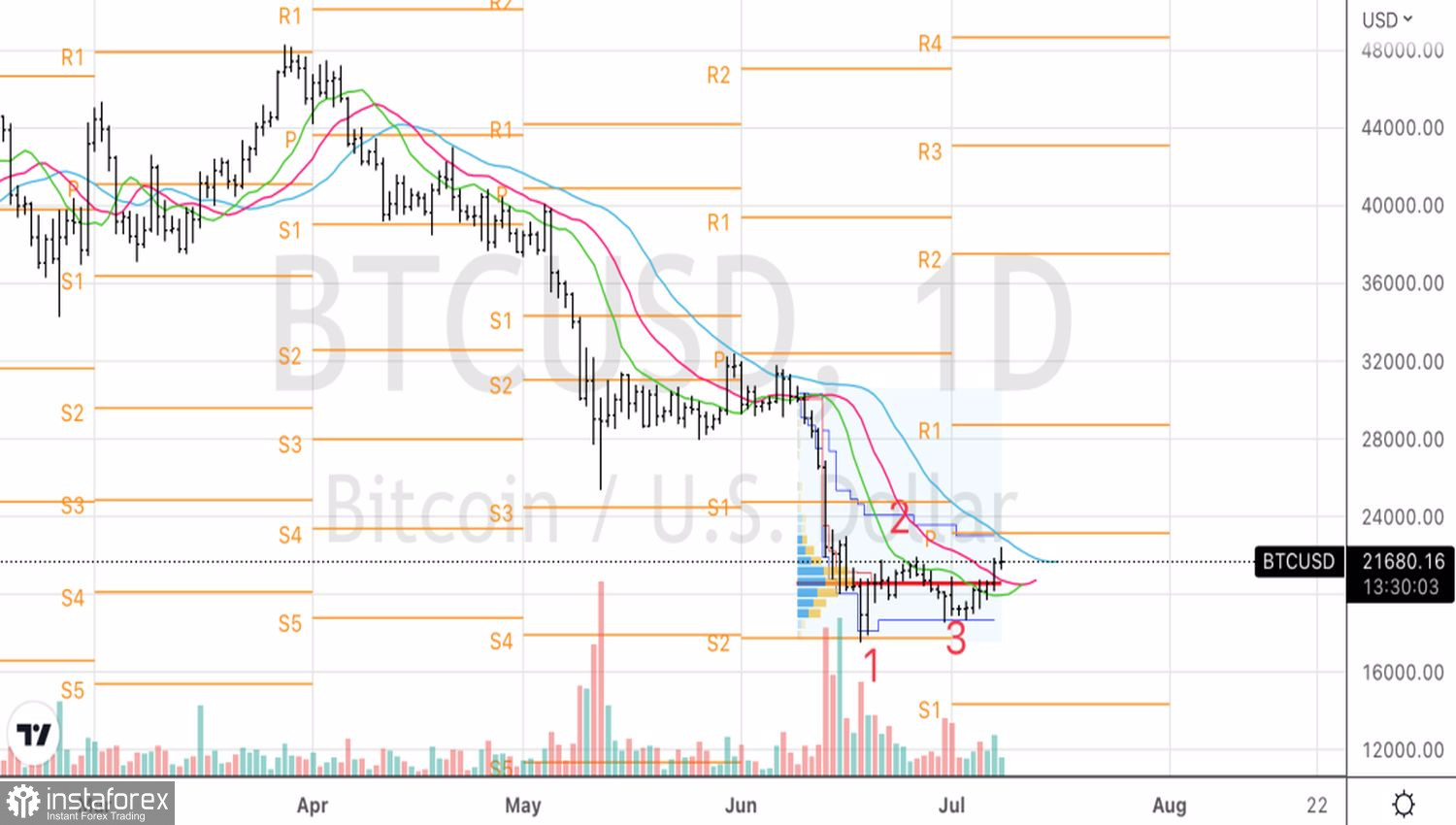

Technically, on the daily chart, bitcoin is trying to implement the 1-2-3 reversal pattern, which we talked about in the previous article. Longs formed from the level of 20,800 will increase in case of updating the local high at 22,440. Closing the day below the updated fair value at 20,720 is a reason to reverse.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română