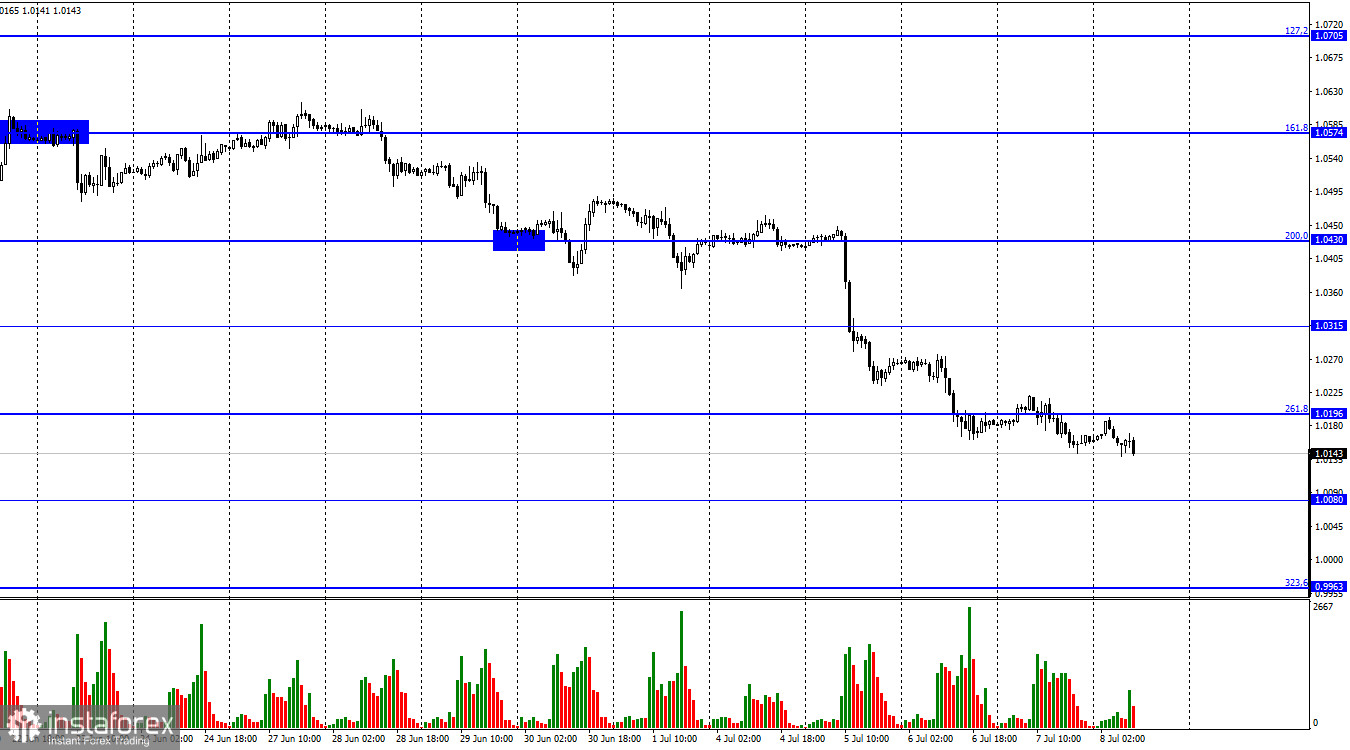

On Friday, the EUR/USD pair resumed its decline towards the nearest level of 1.0080. The return of quotes from this level may provide a reversal in favor of the European currency and a rise in the direction of the Fibonacci level of 261.8% (1.0196). A consolidation at 1.0080 will increase the likelihood of a further decline in the direction of the corrective level of 323.6% (0.9963). However, today, the information background will precede graphical signals and analysis. In the afternoon, the Nonfarm Payrolls report will be issued in the United States, causing significant market fluctuations. Not necessarily fashionable or rational, but almost always robust. In addition, the euro/dollar pair continues to trade at its lowest levels in twenty years. Thus, traders were unwilling to roll back up slightly so they could continue selling with renewed zeal.

From my perspective, this shows that they are anticipating a positive update on the labor market today. Forecasts indicate that new jobs were created between 270K and 300K by the end of June. Someone may argue that this is a low value, but I consider it quite high. Before the pandemic, a 200-300K rise in employment was remarkable. The epidemic then broke out, and payrolls dropped by 21 million in one month. Therefore, this indicator rebounded rapidly during the next two years, and traders are already accustomed to the notion that 400-700K new jobs are produced every month. Even if the actual value of payrolls is between 240 and 250 thousand, it will be favorable for the dollar. And traders have already begun (or rather, have been) buying it, so it makes no difference what the Nonfarm report will show if the US dollar is doing well without it. Only an extremely weak value can cause the euro/dollar exchange rate to rise.

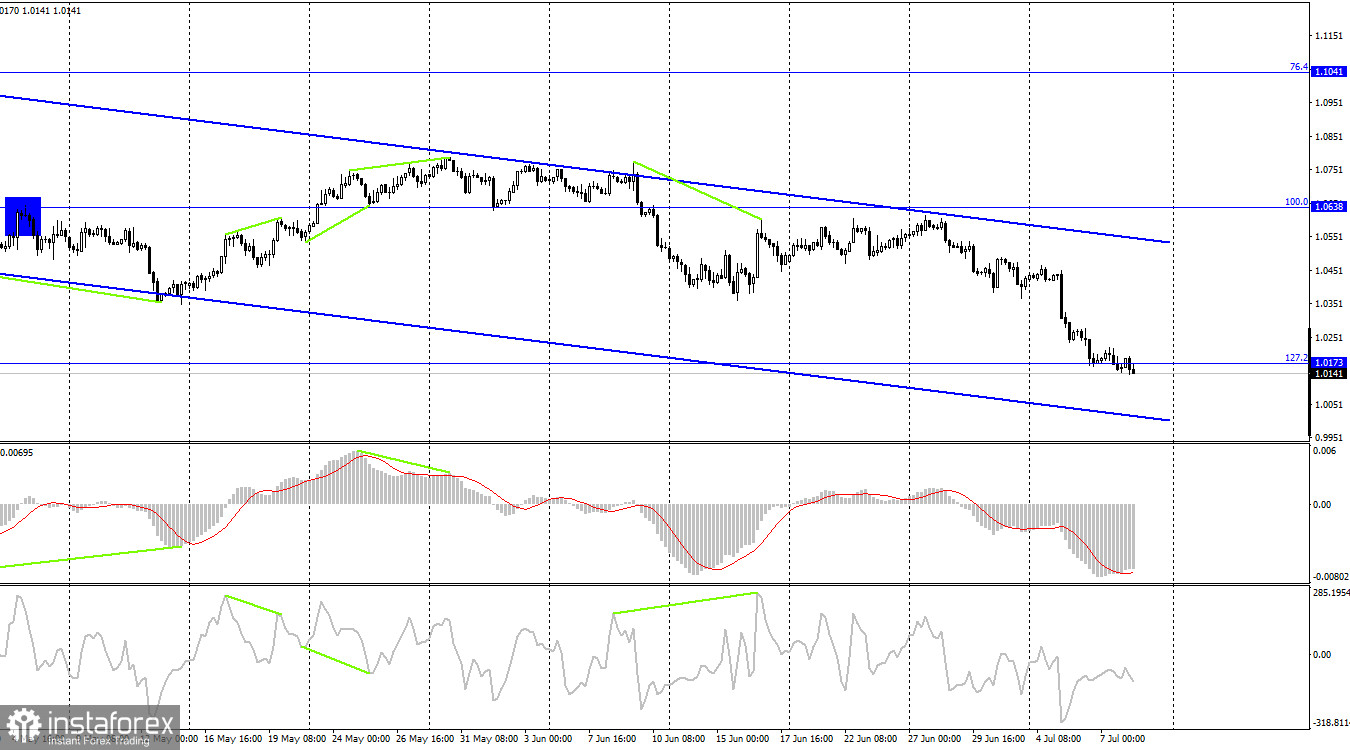

On the 4-hour chart, the pair fell to the corrective level of 127.2% (1.0173) and then anchored below it. Consequently, the price decline can continue in the direction of the subsequent corrective level of 161.8% (0.9581). Brewing divergences are not observed in any indicator at present. The downward trend corridor continues to reflect "bearish" sentiment among traders.

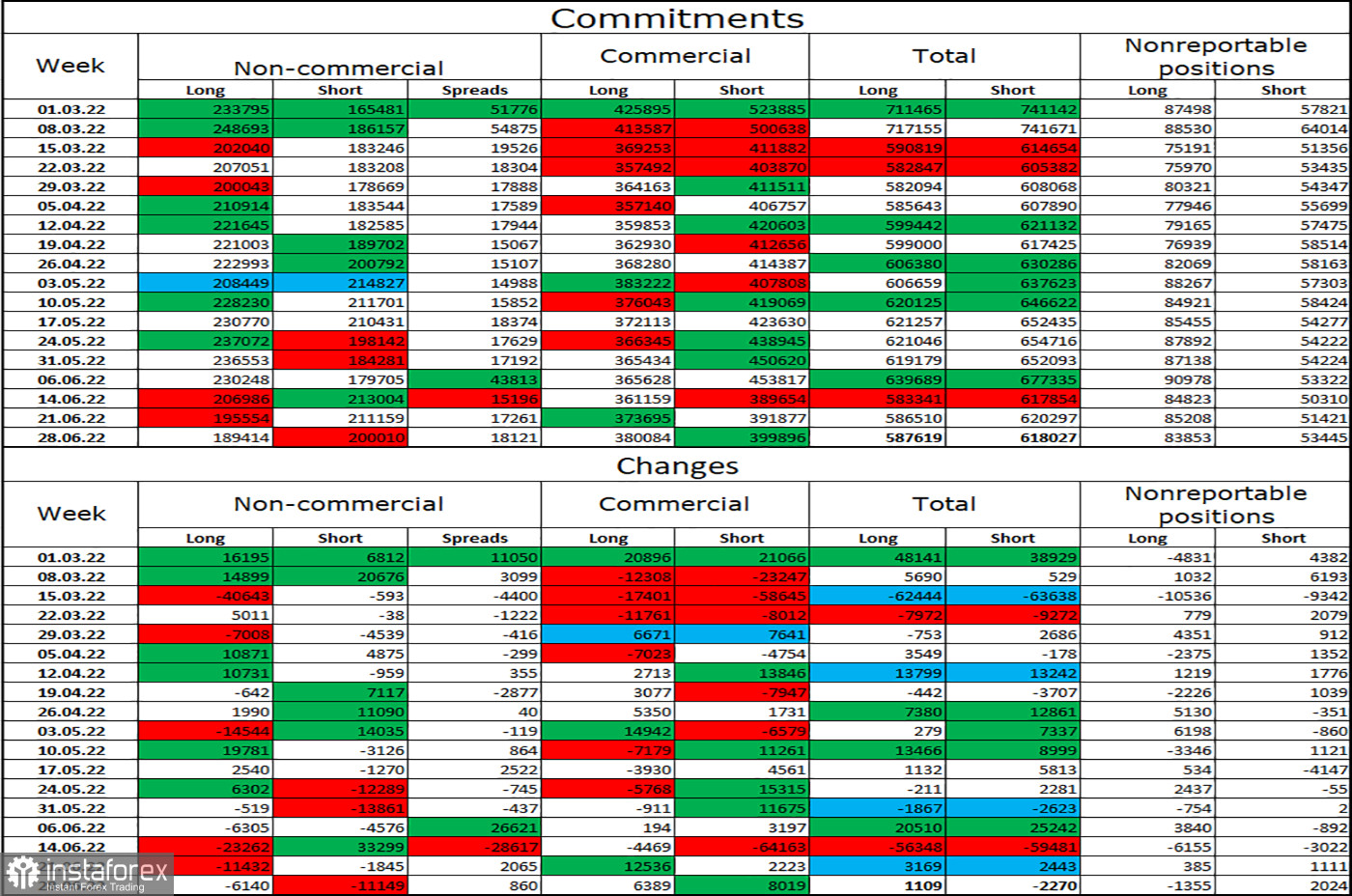

Report on Commitments of Traders (COT):

Speculators closed 6,140 long contracts and 11,149 short contracts during the previous reporting week. This indicates that the "bearish" sentiment of the key market participants has decreased a little but remains "bearish." The overall number of long contracts held by speculators is 189 thousand, and the number of short contracts is 200 thousand. The disparity between these numbers is negligible, but it does not benefit the bulls. Most "Non-commercial" traders have maintained a "bullish" outlook on the euro in recent months, which has not helped the euro currency. Recent COT figures indicate that new sales of the EU currency may follow, as speculators' sentiment has shifted from "bullish" to "bearish" during the past several weeks. The Fed and the ECB have not provided positive updates regarding the euro.

News schedule for the United States and Europe:

EU - ECB President Lagarde will deliver a speech (11:55 UTC).

US - change in the number of people employed in the non-agricultural sector (12:30 UTC).

US - average hourly wage (12:30 UTC).

US - unemployment rate (12:30 UTC).

The European Union and the United States' economic event calendars feature numerous intriguing entries for July 8. Lagarde's address and the Payroll report are the most significant. Today, the impact of the information context on the sentiment of traders might be significant.

EUR/USD prediction and trader recommendations:

I suggested selling the pair on the hourly chart when it anchored below 1.0315 with a target of 1.0196. This level has been adjusted. New sells were advised with objectives of 1.0080 and 0.9963 at the close of trading at 1.0196. On a 4-hour chart, I advise buying the euro when the price is above the corridor with a goal of 1.1041.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română