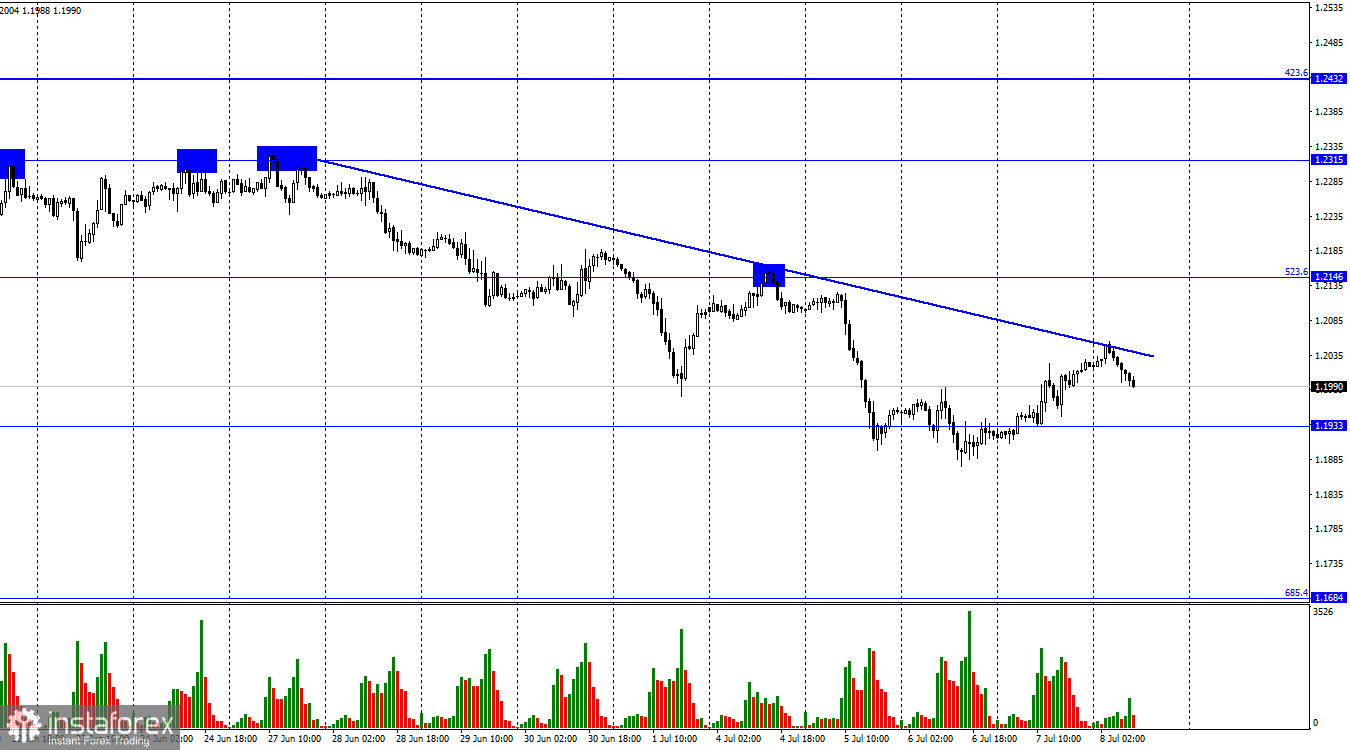

According to the hourly chart, the GBP/USD pair increased to the falling trend line and generated a strong sell signal around it. The rebound of quotes from the trend line favored the US dollar and marked a new decline toward 1.1933. Fixing the pair's rate below this level will raise the likelihood of a further decline towards the corrective level of 685.4% (1.1684). I will not consider British purchases before the consolidation above the trend line. Yesterday was a terrible day for the political elite of the United Kingdom. Under pressure from parliament and his fellow party members, Boris Johnson agreed to leave. Almost fifty ministers and their subordinates had resigned before this.

Simply put, nearly all positions of significance declined to continue working under Johnson's leadership. During the COVID pandemic and lockdowns, when all Britons were forbidden to leave their homes, even to visit relatives, Johnson threw parties at his home with other officials of the administration. This conflict persisted for several months.

Due to this incident, they attempted to announce a vote of no confidence in him, but they could not collect enough signatures. As soon as the public shifted away from this incident, Johnson became involved in another. This time, he appointed to a high position a member of staff who was involved in the investigation of the harassment of British Parliament members. Johnson was aware of this information but appointed "his man." The ministers then proceeded to quit, fearing another scandal involving the prime minister would palliate the entire British government. Under pressure from the British parliament, Johnson also tendered his resignation to the British monarch. It is anticipated that he can continue working until the Conservative Party elects a new leader in the fall. The British economy increased slightly due to these events, but with the release of crucial American numbers in a few hours, it has already begun to decline.

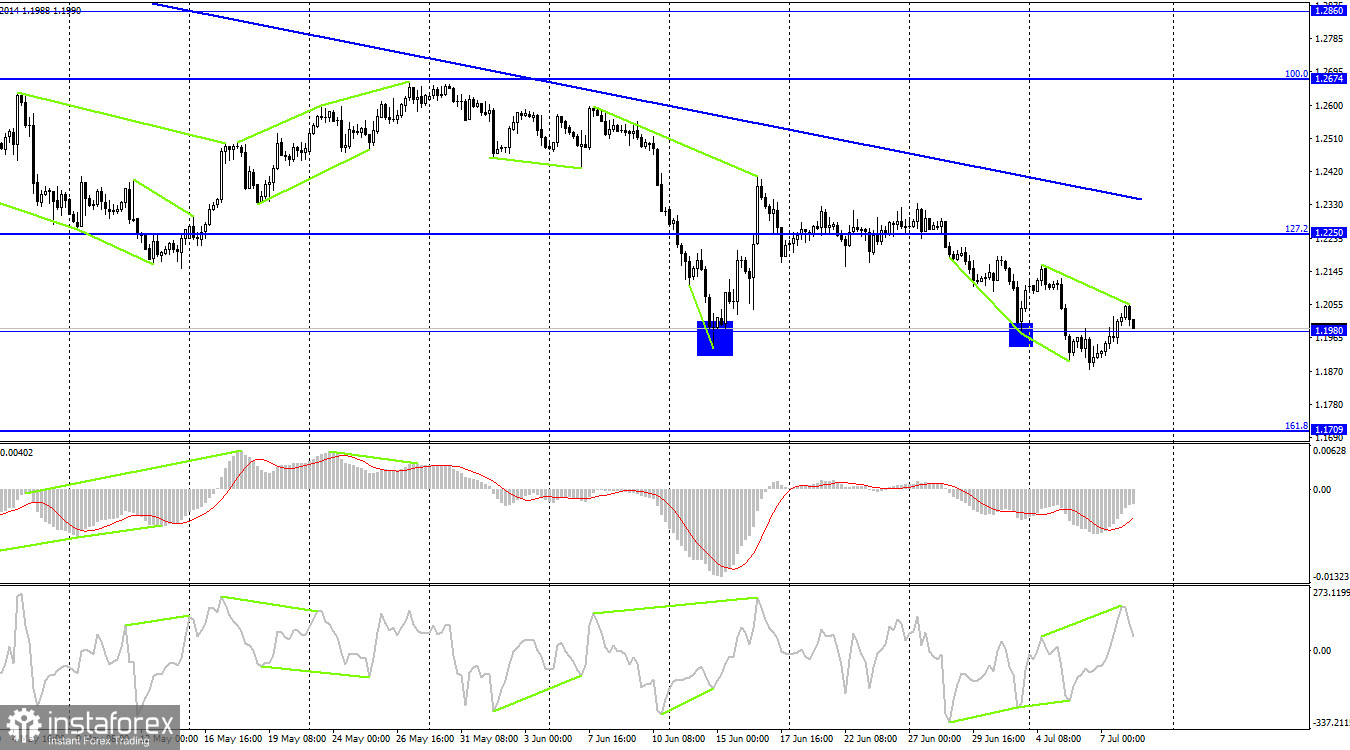

On the 4-hour chart, the pair executed a new reversal in favor of the US dollar and found support below the 1.1980 level. Consequently, the falling process can continue in the direction of the subsequent corrective level of 161.8% (1.1709). The CCI indicator also created a "bearish" divergence, which enhances the chance of a resumption of the pound's decline. I do not yet anticipate the growth of the British population.

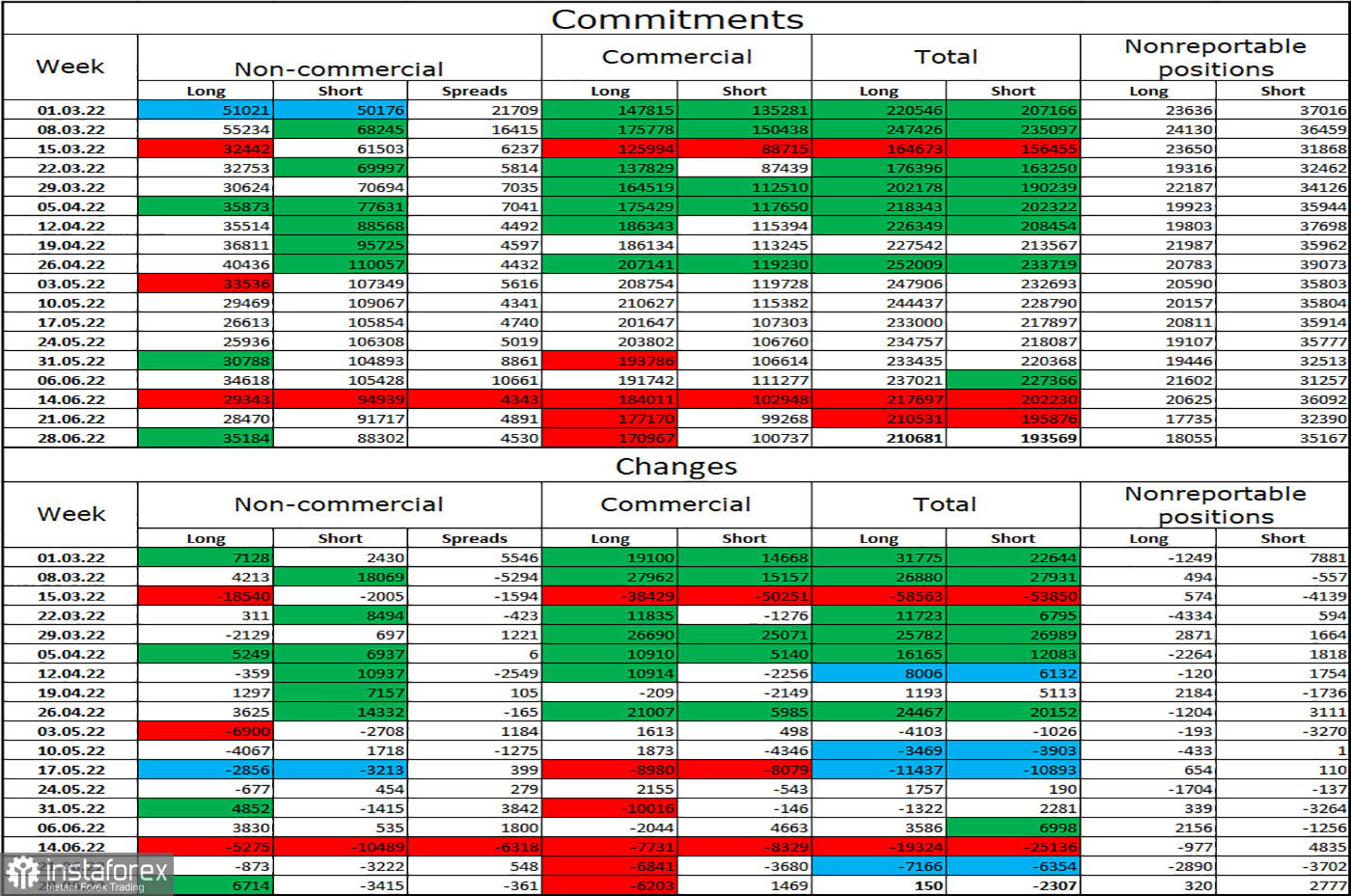

Report on Commitments of Traders (COT):

Over the past week, the sentiment of "Non-commercial" traders has become slightly more "bullish." The number of long contracts held by speculators climbed by 6,714 contracts, while the number of short futures declined by 3,415 contracts. Thus, the general sentiment of the key participants remained unchanged at "bearish," and the number of long contracts continues to outnumber short contracts by a factor of three. Most major players continue to shed pounds, and their mood has not changed significantly recently. Consequently, I believe the British pound could continue to drop over the next few weeks. A significant disparity between the number of long and short contracts may signal a trend reversal, but the context of the information is currently of greater importance to key players. And it continues to be against the pound. To date, it makes no logic to dispute that speculators sell more than they purchase.

News calendar for the United States and the United Kingdom:

US - change in the number of people employed in the non-agricultural sector (12:30 UTC).

US - average hourly wage (12:30 UTC).

US - unemployment rate (12:30 UTC).

There are no economic events scheduled in the United Kingdom on Friday. Thus, only American reports will be of interest to traders today, and I believe that the information background will significantly impact their mood today.

GBP/USD forecast and recommendations to traders:

On the hourly chart, I suggested selling the British pound when it rebounded from 523.6% (1.2146), with a goal of 1.1933. This objective has been attained. When closing at 1.1933 with a target of 1.1709, there are new sales (if they were not opened when rebounding from the trend line). I suggest purchasing the British pound when the price closes above the trend line on the 4-hour chart, with a target of 1.2674.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română