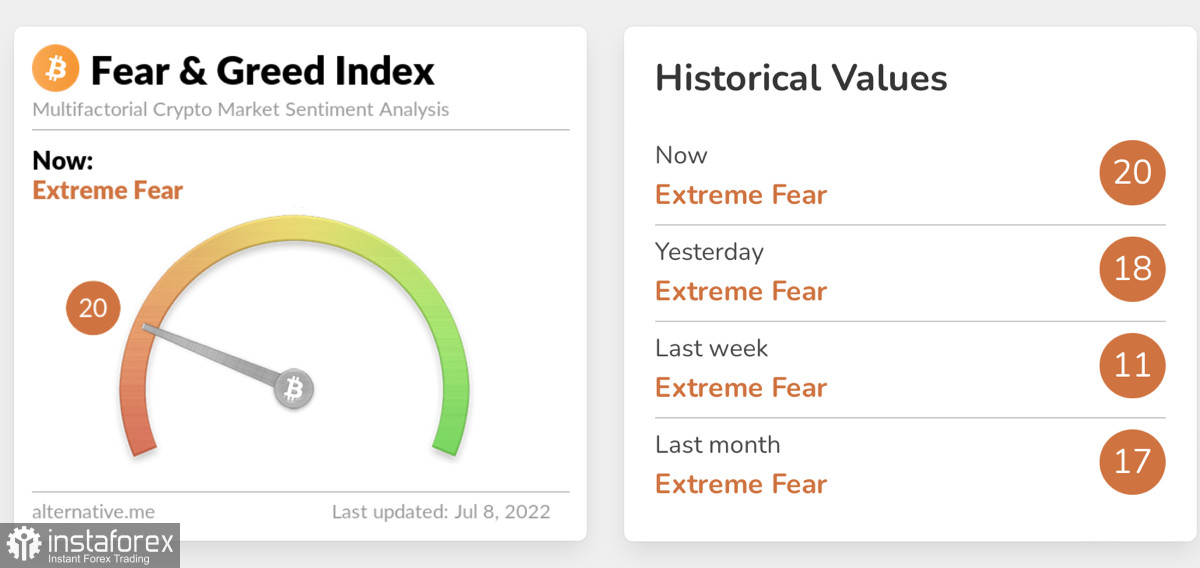

Bitcoin has started a recovery towards $22,000. Its upside momentum was driven by the need to bring down orders in the $21,800-$22,300 area. The cryptocurrency successfully hit the $22,300 level and then began to decline, forming a candlestick with a long upper shadow. For the first time since June 19, BTC saw an impulsive formation of the green candlestick, which indicates a gradual increase in bullish sentiment. The market situation has stabilized, the fear and greed index has risen to the level of 20, and everything indicates that the market is preparing for a rally.

From a technical point of view, the cryptocurrency seems to be overbought. The Stochastic oscillator reached the overbought zone at 84. Then it formed a bearish crossover and began to decline. The relative strength index indicates temporary consolidation around the 50 mark. The MACD indicator continues its upward movement towards the zero mark, which suggests a medium-term uptrend. With this in mind, it can be assumed that BTC/USD will make further attempts to break through the $22,300 level and continue its bullish run.

Bitcoin's recovery to the level of $22,300 was caused by a similar movement of the S&P 500 index. However, this correlation could lead to a series of potential problems for BTC. Yesterday, Fed Governor Christopher Waller and St. Louis Federal Reserve Bank President James Bullard spoke in favor of raising the key interest rate by 75 basis points. At the same time, officials are confident that the US economy will be able to withstand the current problems with liquidity and borrowed funds, provoked by the rate hike.

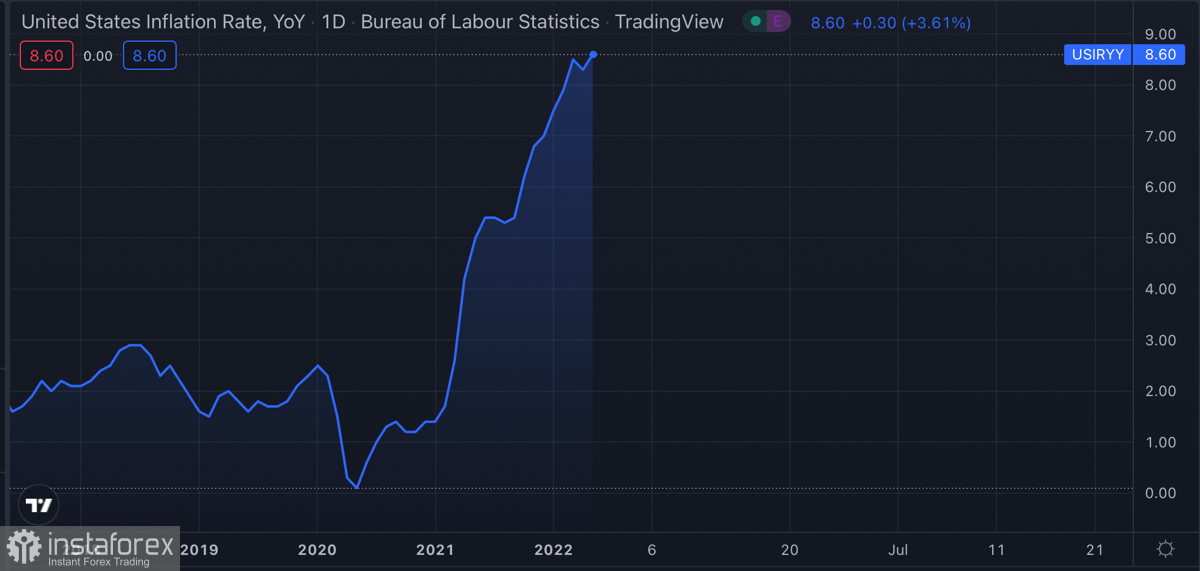

Fed members are ready to sacrifice economic growth in order to combat inflation, which has already hit a 40-year high. The officials' statements may indicate that the market is preparing for another increase in interest rates by 0.75% in July. In this case, the main destructive factor for the cryptocurrency will be its correlation with stock indices. This implies another wave of a capital outflow from crypto funds and, as a result, a decrease in market capitalization as well as the price of bitcoin. At the same time, it can be seen that the market has barely reacted to the statements of Fed members. This may mean that investors have finally adapted to the new conditions and are ready to accept the new rules of the game.

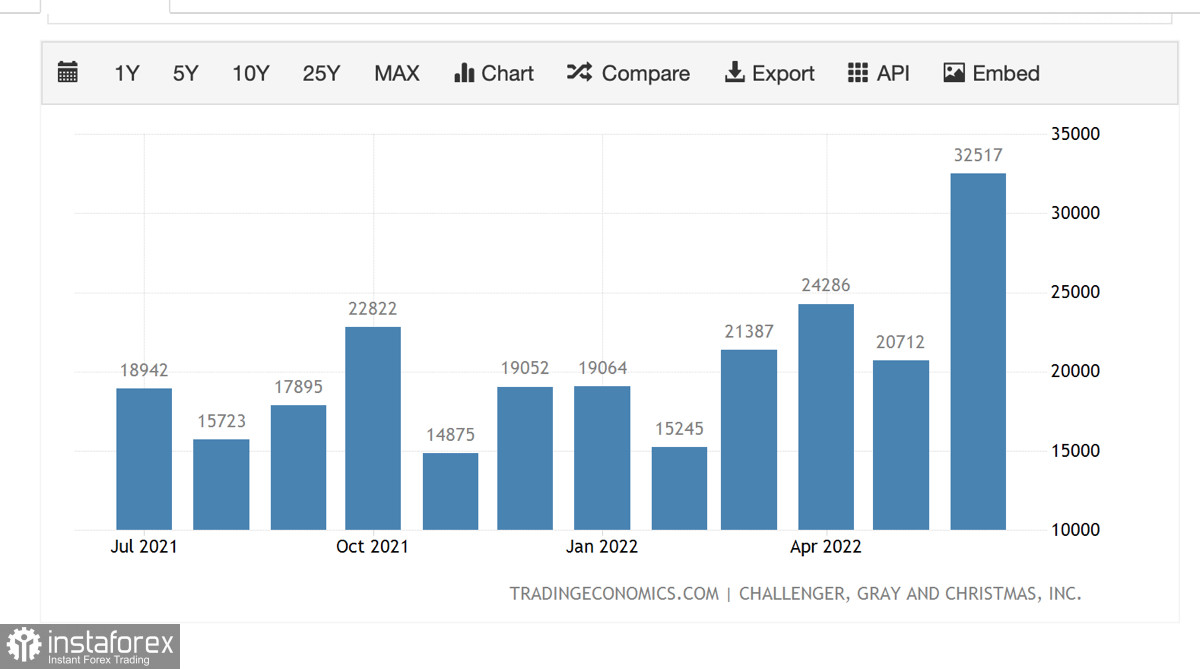

However, the local rise in bitcoin was mainly driven by two factors. The euro fell below $1.01 for the first time in 20 years, which negatively affected investments in the DXY index, which is 35% backed by the European currency. This allowed BTC and other savings assets to gain value, which caused a local surge in buying activity. The second positive factor contributing to the first cryptocurrency's growth is statistics on unemployment in the United States. Today's macroeconomic calendar includes US jobs data. Yesterday, it was reported that US initial jobless claims increased to 235,000, which could ease inflationary pressure on the US dollar.

iven that the situation is uncertain, market participants will await reports on unemployment and inflation in the US and EU to be published in mid-July. Major decisions regarding investments in cryptocurrencies will be made based on statistics that directly affect the Fed's monetary policy. In the coming days, the market is expected to be calm. However, it may see local spikes amid lower pressure on the price due to the weekend in the US. The following week will be key in determining the further movement of the price of bitcoin for July.

An upcoming increase in the key interest rate will most likely lead to a rise in the DXY index. This suggests a capital outflow from high-risk assets and a gradual slide in the price of bitcoin to the level of $20,000 and below. However, steep losses are unlikely as the majority of speculative investors have left the market. The primary advantage of BTC at this stage is its long-term value, which can be confirmed by a record outflow of BTC coins from crypto exchanges in July.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română