Details of the economic calendar from July 7

The minutes of the European Central Bank's June meeting stated the regulator's intentions to further tighten monetary policy. Based on the document, ECB board members were arguing about the possibility of a larger interest rate hike in July and wanted to leave the door open for bigger moves at subsequent meetings to fight inflation.

Fearing that rapid inflation will take hold, the ECB planned a 25 basis point rate hike in July and possibly a larger hike in September, followed by a more gradual tightening of policy.

But part of the ECB's message was rewritten at an emergency meeting just six days later, when the board of governors decided to develop a new bond-buying scheme aimed at curbing yield growth on the bloc's periphery, especially in Italy.

The ECB also said that it would not publish the minutes of the emergency meeting on June 15.

Thus, the actions of the ECB are becoming vaguer every day.

Analysis of trading charts from July 7

The EURUSD currency pair, after a short stop, resumed its decline. This move led to a breakdown of the level of 1.0150, thereby increasing the chances of sellers to see historical parity.

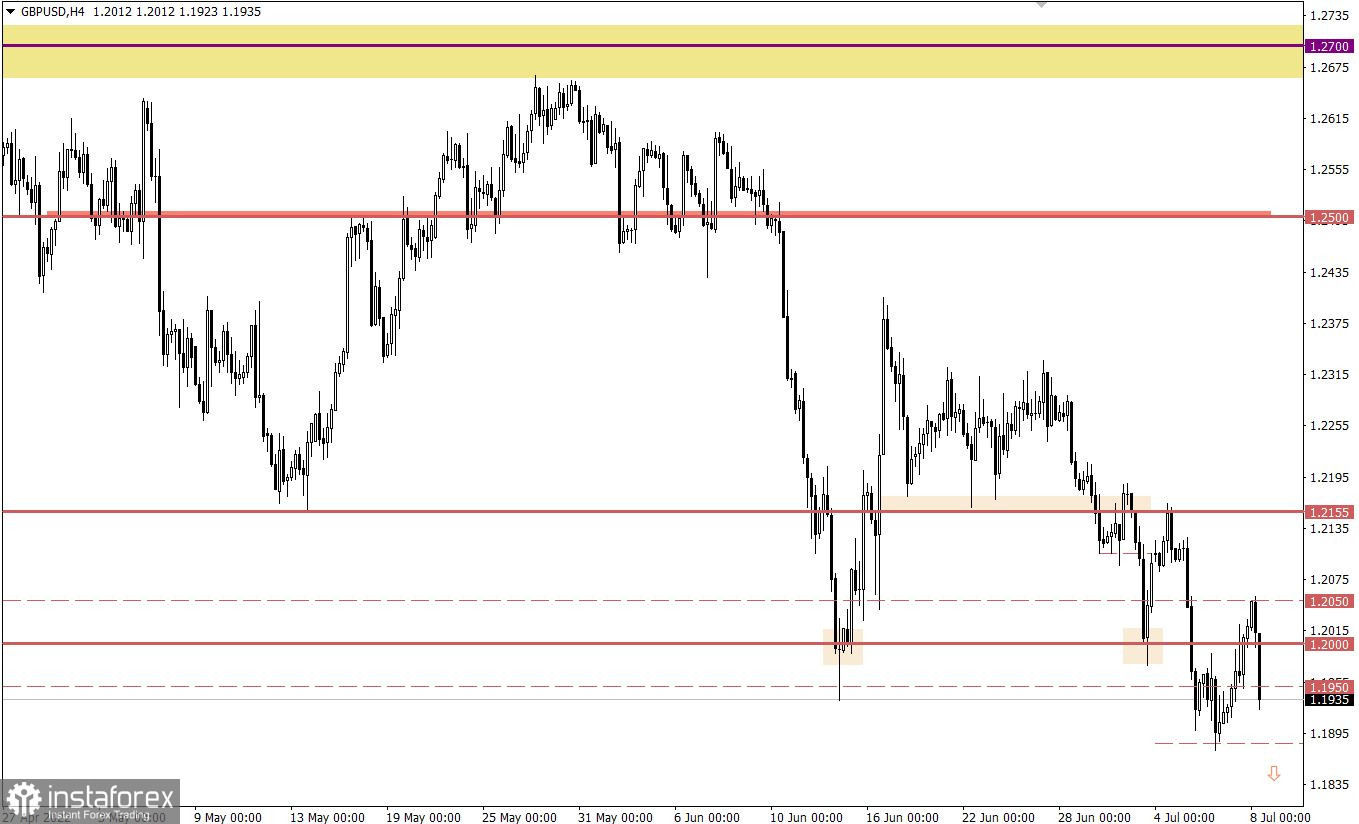

The GBPUSD currency pair at the stage of regrouping trading forces rolled back to the upper border of the psychologically important level of 1.2000 (1.1950/1.2000/1.2050). This movement fits into the downward cycle, which has a positive effect on the volume of short positions.

Economic calendar for July 8

The main macroeconomic event of the outgoing week is the report of the US Department of Labor, which predicts that the unemployment rate should remain unchanged, while 268,000 new jobs can be created outside of agriculture, which is noticeably less than 390,000 in the previous month. This indicates a loss of recovery momentum and the appearance of signs of the beginning of a deterioration in the situation in the labor market.

If expectations coincide, the US dollar may be under pressure from sellers.

Time targeting

US Department of Labor Report - 12:30 UTC

Trading plan for EUR/USD on July 8

There are only a few points left before parity, which means that the speculative hype is increasing. It is worth considering that the initial convergence with such an important psychological level can provoke traders to chaotic price jumps. This may lead to a reduction in the volume of short positions, which will lead to a technical pullback.

At the same time, holding the price below the control level may cancel a number of technical signals, which will lead to an inertial move towards the value of 0.98.

Trading plan for GBP/USD on July 8

The pound sterling rushed down through a positive correlation with the eurodollar. With the current mood of speculators, updating the local low of the downward trend is not excluded.

What is reflected in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română