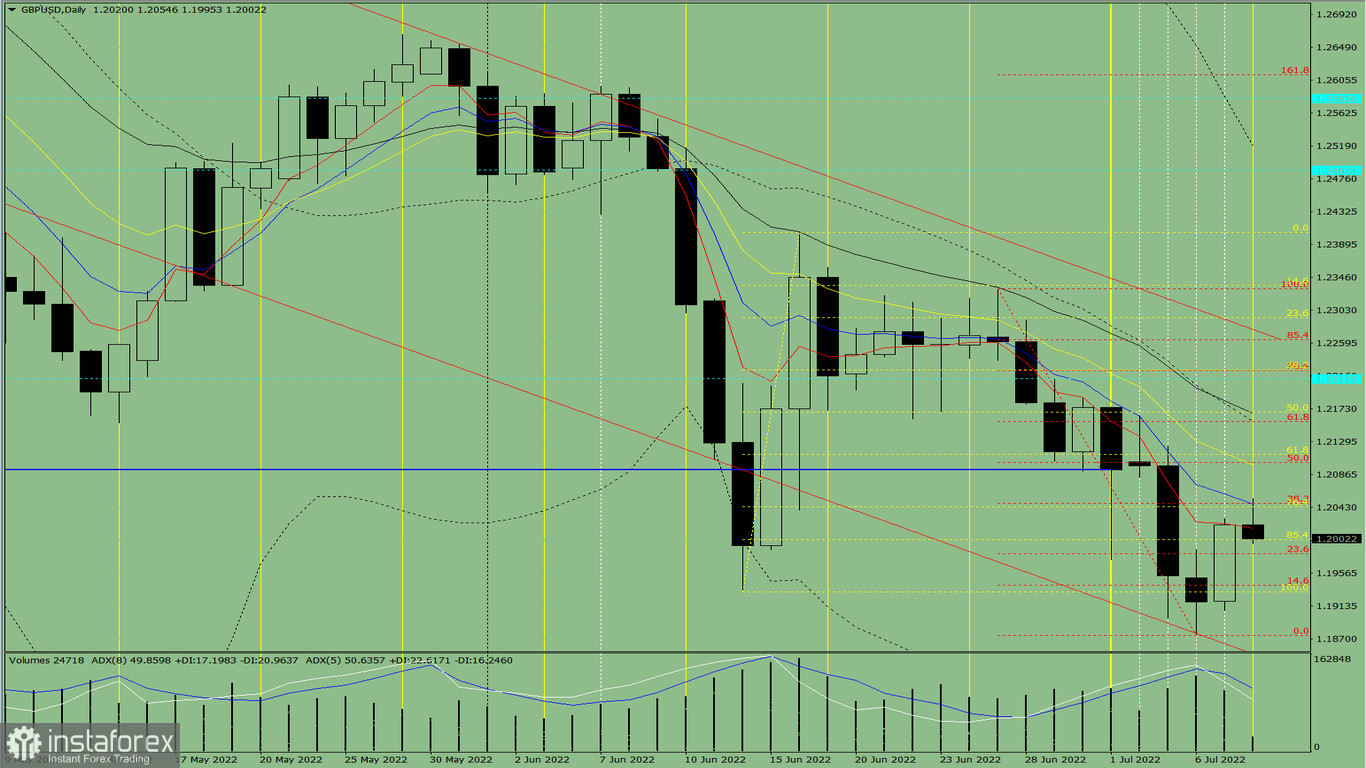

Trend analysis (Fig. 1).

The pound-dollar pair may move downward from the level of 1.2020 (close of yesterday's daily candle) to the target of 1.2001, the 85.4% retracement level (yellow dotted line). After testing this level, the price may move upward with the target of 1.2102, the 50.0% retracement level (red dotted line). Upon reaching this level, the price may continue to move up.

Fig. 1 (daily chart).

Comprehensive analysis:

- Indicator analysis – down;

- Fibonacci levels – down;

- Volumes – up;

- Candlestick analysis – top;

- Trend analysis – down;

- Bollinger bands – down;

- Weekly chart – up.

General conclusion :

Today, the price may move downward from the level of 1.2020 (close of yesterday's daily candle) to the target of 1.2001, the 85.4% retracement level (yellow dotted line). After testing this level, the price may move upward with the target of 1.2102, the 50.0% retracement level (red dotted line). Upon reaching this level, the price may continue to move up.

Alternative scenario: from the level of 1.2020 (close of yesterday's daily candle), the price may move upward with the target of 1.2048, the 38.2% retracement level (red dotted line). After testing this level, a downward movement is possible with the target of 1.1875, the lower fractal (red dotted line). Upon reaching this level, the price may move up.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română