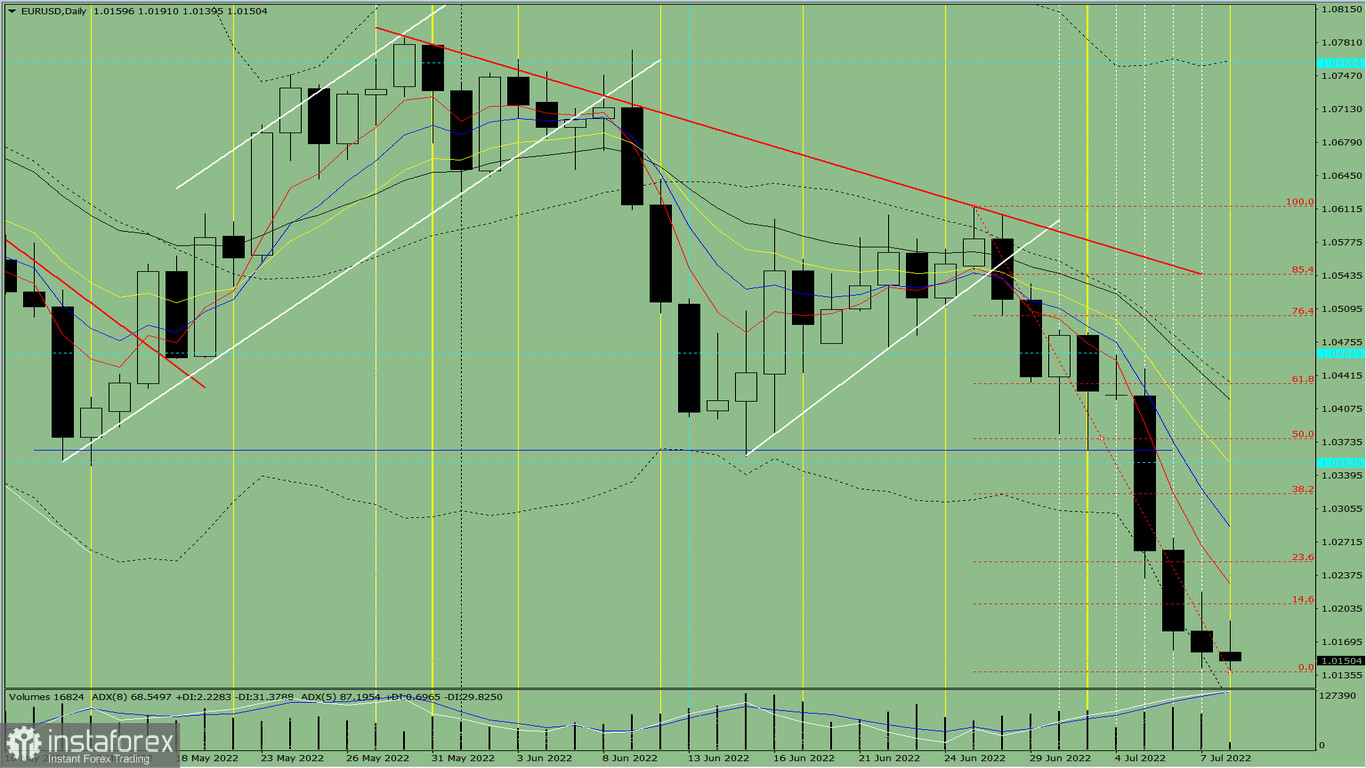

Trend analysis (Figure 1).

On Friday the market from yesterday's daily candle closing level of 1.0160 may start moving upward with the target to reach the 14.6% pullback level, 1.0208 (red dotted line). After testing this line, upside movement is expected with a target of 1.0251, a pullback level of 23.6% (red dotted line). Once this level is reached, continuation of downward movement is expected.

Figure 1 (daily chart).

Complex analysis:

- indicator analysis - up;- Fibonacci levels - up;- volumes - up;- candlestick analysis - up;- trend analysis - down;- Bollinger bands - down;- weekly chart - down.

Conclusion:

Today the price from yesterday's daily candle closing level of 1.0160 may start moving upwards with a target to reach the 14.6% pullback level, 1.0208 (red dotted line). After testing this line, an upside move is possible with a target of 1.0251, a pullback level of 23.6% (red dotted line). Once this level is reached, a continuation of the downside movement is expected.

Alternate scenario: price from yesterday's daily candle closing level of 1.0160 may start moving upwards with a target of 14.6% pullback level, 1.0208 (red dotted line). After testing this line, the pair is expected to move downward with the target of 1.0140, the lower fractal (red dotted line). Upon testing this level, upward movement is possible with the target to reach the 14.6% pullback level, 1.0160 (red dotted line).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română