The dollar rally has slowed down today, but there is no question of weakening the momentum of the dollar's growth. Investors' nervousness about the recession plays into the greenback's hands. The influx of investments in safe havens continues to stimulate demand for the dollar. The upward momentum was marked overnight due to the hawkish FOMC minutes, which caused the growth of US bond yields along the entire curve.

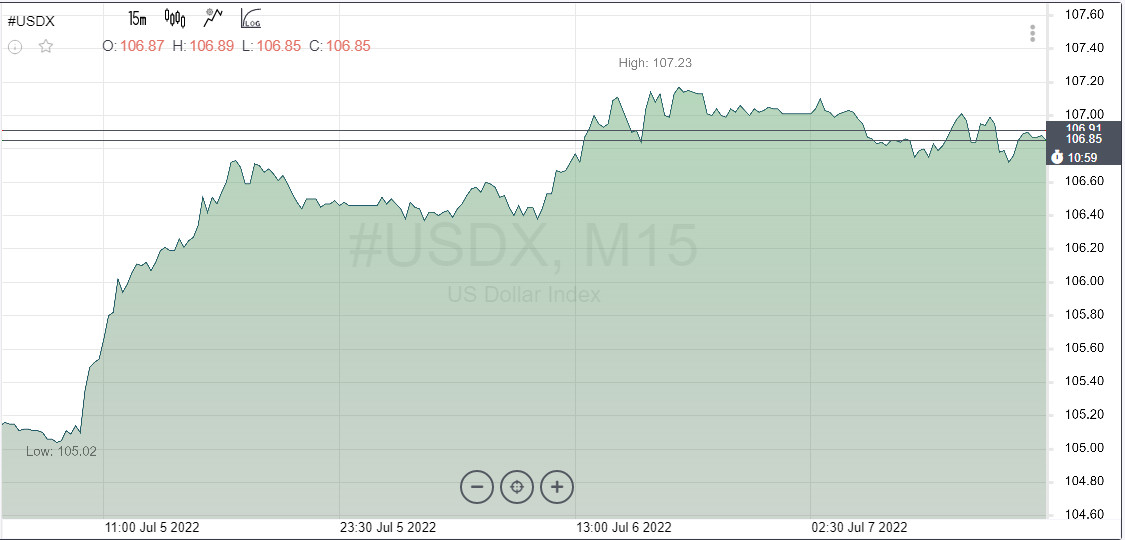

The dollar index jumped to 107.04 at the moment, plunged to 106.87 in the Asian session, and tried to stabilize within 106.90 during the European session. The technical picture remains constructive, although looking at the daily chart, we can say that the index is in the overbought zone, which implies a temporary downward correction.

A further increase in the greenback remains likely in the short term. Against this background, the index may return to the peak levels of December 2002 at 107.30, the next target will be the high of October 2002 at 108.74. The value of 107.30 is now a strong barrier in the way of bulls.

Dollar: Reuters poll

A Reuters poll conducted between July 1-6 suggests that the dollar is likely to maintain bullish momentum for at least the next three months. The upward momentum will be stimulated by expectations of an aggressive Federal Reserve rate hike and demand for safe assets.

Three quarters of Reuters respondents (37 out of 48) are waiting for the continuation of the current trend in the dollar for at least three months. Of these, 19 called the period from three to six months, 10 analysts said that the US currency will grow for another year, four – for at least two years. Eleven turned out to be pessimistic, they predicted the growth of the dollar for less than three months.

The median forecast obtained during the last survey, which was attended by about 70 analysts of the foreign exchange market, indicates a gradual weakening of the dollar in the next 12 months.

Thus, the euro has an increased recovery potential of almost 8%, and by the middle of 2023 its exchange rate may reach the level of 1.1000 against the dollar.

The pound is expected to regain about half of the positions lost this year, as the Bank of England, apparently, intends to continue raising interest rates.

EUR/USD

At the moment, the EUR/USD pair remains under pressure, as the problems with the recession in the eurozone are higher than in the US. The quote fell to 1.0185 overnight before rising to 1.0200 in Asian trading. However, it was not possible to keep this level at the European session, and the euro plunged lower again.

The energy vulnerability of the euro bloc continues to put pressure on the single currency, and the agreement on the Norwegian strike, oddly enough, did not have a positive impact on the euro. The oversold currency is now evident, which may lead to a longer recovery with resistance at 1.0300 and a breakthrough of 1.0350, followed by 1.0600. Support is located at 1.0160, then at 1.0000.

At the moment, the 1.0200 level plays an important role. The EUR/USD pair has moved into a consolidation phase around this mark. If the quotes fail to rise higher and market players do not start using it as support, additional losses may be observed in the near future.

GBP/USD

The political chaos puts additional pressure on the pound. At the same time, the GBP/USD pair managed to grow to the area of 1.1960, despite the political games on Downing Street. Be that as it may, the risks of falling to 1.1500 remain high.

Markets have little faith that Boris Johnson will be able to hold on to the post of prime minister until next week. This will lead to "the election of the Conservative leader and, possibly, to earlier fiscal stimulus than expected," experts write.

Pound traders are waiting for new information. After it became known that Johnson would announce his resignation, a Downing Street spokesman said that the leader of the Conservative Party would make a statement to the people of the UK on Thursday.

The GBP/USD pair remains vulnerable to a global recession. The downside risks remain first towards 1.1700, and then towards 1.1500.

The EUR/GBP pair looks even more volatile, as the BoE demonstrates a more aggressive attitude towards tightening policy compared to the European Central Bank.

There is one interesting point here. When the euro and the pound begin to rally against the dollar, this situation is likely to develop in favor of the euro in this currency pair. The EUR/USD pair is oversold stronger than GBP/USD, so the rebound of the euro will be stronger. If a rally starts soon, the EUR/GBP pair may bounce higher.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română