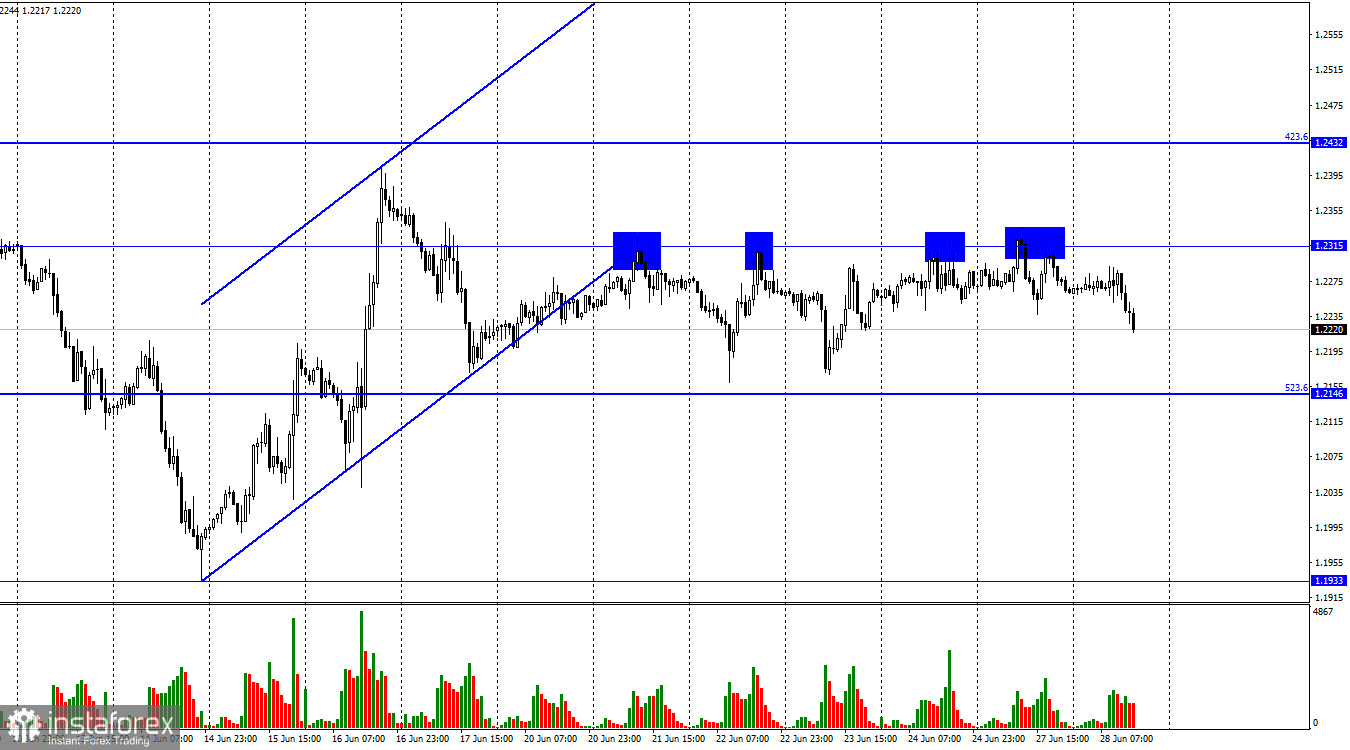

On Monday, the GBP/USD pair made the fourth pullback from 1.2315 on the hourly chart. So, the picture looks like a "fence" on the chart, though I use this word in my articles with a little different meaning. However, bulls failed to break through the level of 1.2315 in four or five attempts. At the moment the UK currency made a U-turn and started falling down again towards the correctional level of 523.6%, 1.2146, which it is unlikely to reach this time. The "fence" will end sooner or later. It may finish at any moment, but taking into account the fact that there is almost no information background for the GBP and the USD today, I see no reason to expect its end. There will be some interesting events this week. For example, all three central bank presidents - Lagarde, Bailey, and Powell - will be speaking at the economic forum in Portugal tomorrow.

All of them can make an important statement that may wake traders up. Tomorrow, there will be the final Q1 GDP report in the US. Maybe, this report will be not as important as the previous one or coincide with traders' expectations. In other words, traders will have something to react to during the week. However, they paid no attention to the report on durable goods orders yesterday. Volumes of all categories of goods rose more than expected, but the US dollar showed no growth after that report. I can conclude that traders did not notice the released data. Likewise, they might not notice the central bank leaders' speeches tomorrow or the US GDP report. On Thursday, the Q1 GDP report is to be released in the UK. From my point of view, the first thing to do is to wait for the completion of the "fence" and then pay attention to the information background.

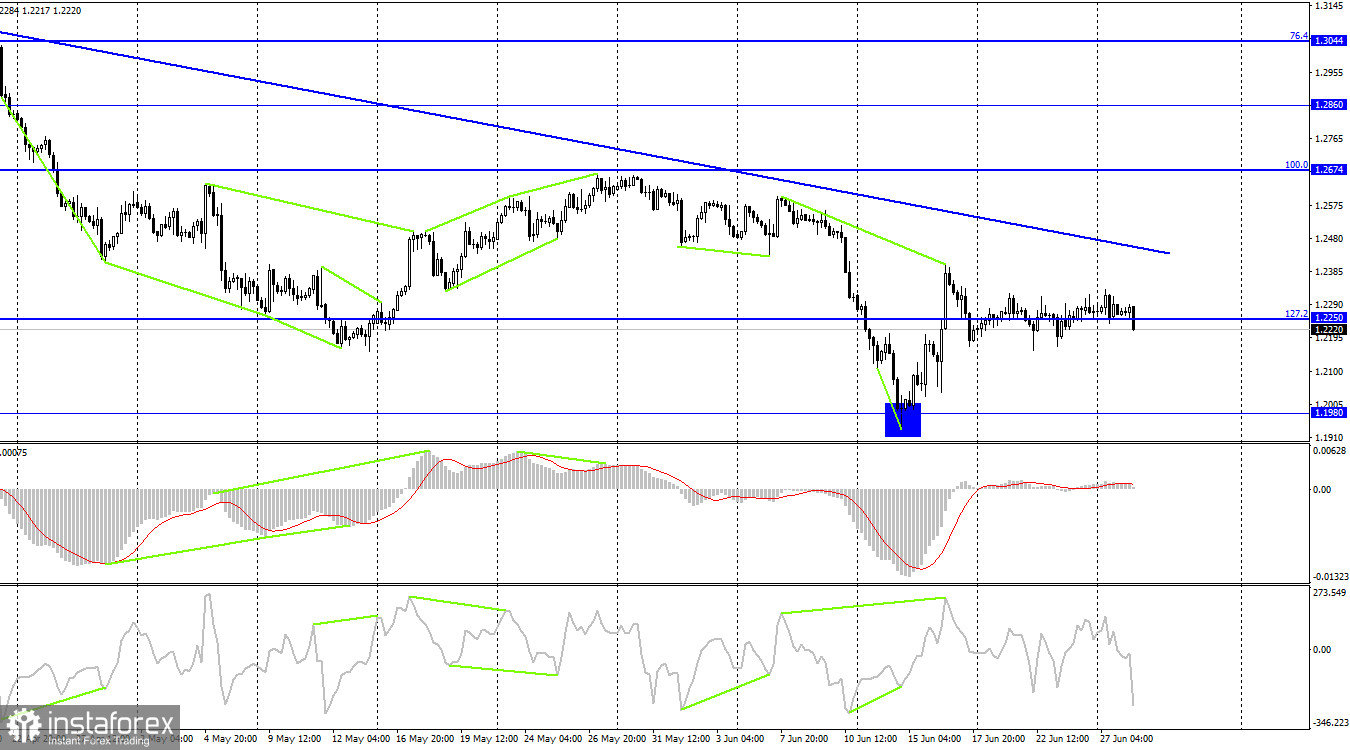

On the 4-hour chart, the pair performed a reversal in favor of the US currency after the CCI indicator showed a bearish divergence. the pair returned to the correctional level of 127.2%, 1.2250. The pair's consolidation under this level will again allow expecting further decline towards 1.1980, which was the starting point of the rise of the British pound. The downtrend line confirms that traders' sentiment remains bearish. I do not expect strong growth of the British pound until the price closes above the trend line.

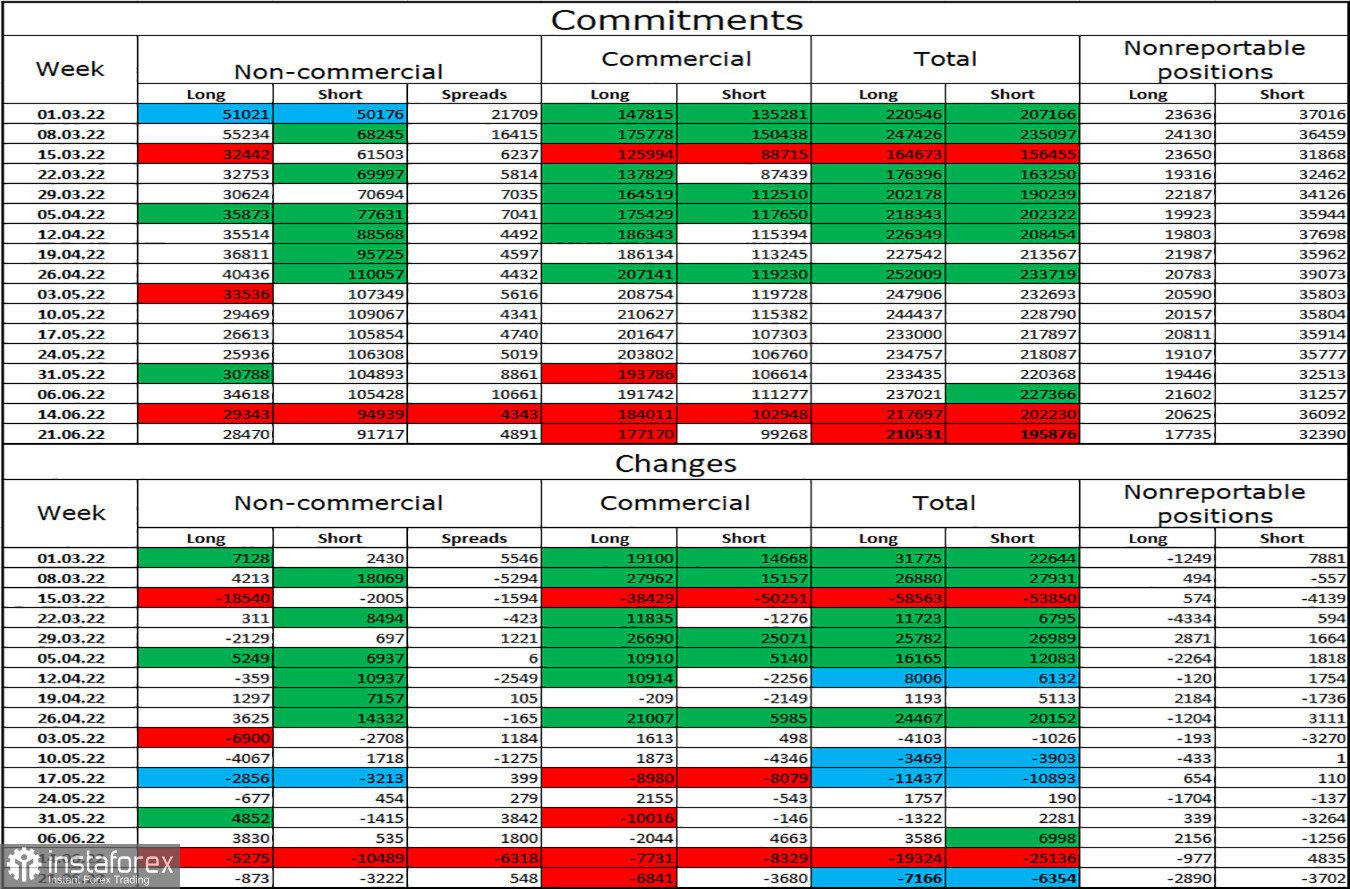

Commitments of Traders report:

Non-commercial traders have become a bit more bullish this week. The number of Long contracts decreased by 873, and the number of Short ones dropped by 3,222. Thus, the sentiment of big players remained bearish, and the number of Long contracts still exceeds the number of Short contracts by several times. Large players continue to sell off the pound for the most part and their sentiment has not changed much lately. Thus, I think the British pound could resume its decline over the next few weeks. The strong divergence of the Long and Short contract numbers may indicate a trend reversal, but the information background is clearly more important to the big players right now. The news background does not support the British pound now. There is clear evidence that speculators are selling more than buying.

Economic calendar for US and UK:

On Tuesday, the economic calendars in the UK and the US are completely empty. The pound is showing active trading, but its movements so far fully fit the concept of the "fence", which we have seen in the last few days. Information background will have no influence on traders' sentiment for the rest of the day.

GBP/USD forecast and recommendations for traders:

You may sell the pound if it rebounds from 1.2315 on the hourly chart with the target at 1.2146. You can buy the pound if it fixes above the trend line on the 4-hour chart with the target of 1.2674.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română