US stock index futures rose on Tuesday after a losing Monday. Traders are ramping up purchases in the hope of holding on to the bullish rally seen last week. Dow Jones Industrial Average futures added 165 points or 0.5%. S&P 500 futures rose 0.5% and Nasdaq 100 futures rose 0.4%.

Following the results of yesterday, the blue-chip Dow index fell by about 60 points, while the S&P 500 fell by 0.3%. The high-tech Nasdaq Composite lost 0.7%.

The most difficult thing right now is to determine the moment between an upward rebound in a bear market and the beginning of a more sustained bullish growth in stocks. The 8% rebound that occurred in the last 4 trading days was impressive, but it still does not signal any noticeable internal improvement in stock markets, especially before the Federal Reserve raises interest rates by 0.75% next month. The slowdown in economic growth, which is now visible, as well as the lack of willingness of investors to take risks in the current conditions against the background of withdrawal of additional liquidity from the central bank, makes them skeptical about the durability of the recovery.

Traders may be also reviewing their portfolios based on the results of the first half of the year, which gives the market a small bullish impulse. Getting rid of unprofitable assets in favor of more promising ones may lead to a slight bullish rally in the near future.

Shares of travel companies gained at price after China yesterday eased its restrictions on COVID for arriving travelers, reducing their quarantine time to seven days. Wynn Resorts and Las Vegas Sands grew by more than 6%. American, United, and Delta Air Lines added more than 1%.

The banking sector is also trading in the black. Yesterday, JPMorgan Chase and Citigroup said that stricter capital requirements force them to keep dividends unchanged. However, their competitors from Bank of America, on the contrary, announced a 5% increase in quarterly dividends to 22 cents per share. Morgan Stanley also noted that they are increasing the payout by 11% to 77.5 cents per share.

Wells Fargo increased its dividend by 20% to 30 cents per share, but Goldman Sachs seems to have become the leader in raising its dividend by 25% to $ 2.50 per share.Today, investors will follow the data on the consumer confidence index for June, as well as the change in housing prices in April this year. This will allow us to assess the state of the economy. Let me remind you that fears of a recession have intensified recently, as the Federal Reserve is trying to combat rising inflation with aggressive rate hikes.

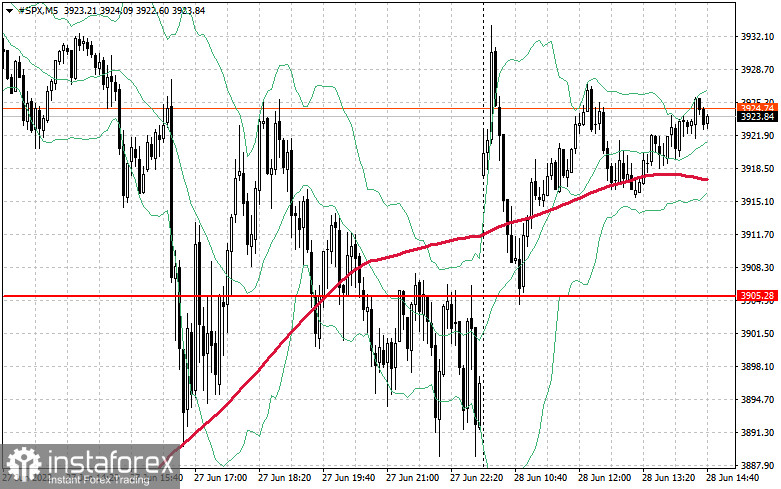

As for the technical picture of the S&P 500

Whether the bullish rally will continue is a big question. To do this, buyers today need to take control of the resistance of $ 3,942, which was tested earlier this week. A break in this range will push the trading instrument up to the $ 3,975 area, where large sellers will return to the market again. At a minimum, there will be those who want to lock in profits on long positions. A more distant target will be the $ 4,013 level. In case of pessimism and another talk about high inflation and the need to fight it, the trading instrument will easily update the nearest support of $ 3,905, but this will not greatly harm the market. It's another matter if the bulls bring $ 3,870 to the test. A breakdown of this range will lead to a new sale at $ 3,826 and $ 3,788.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română