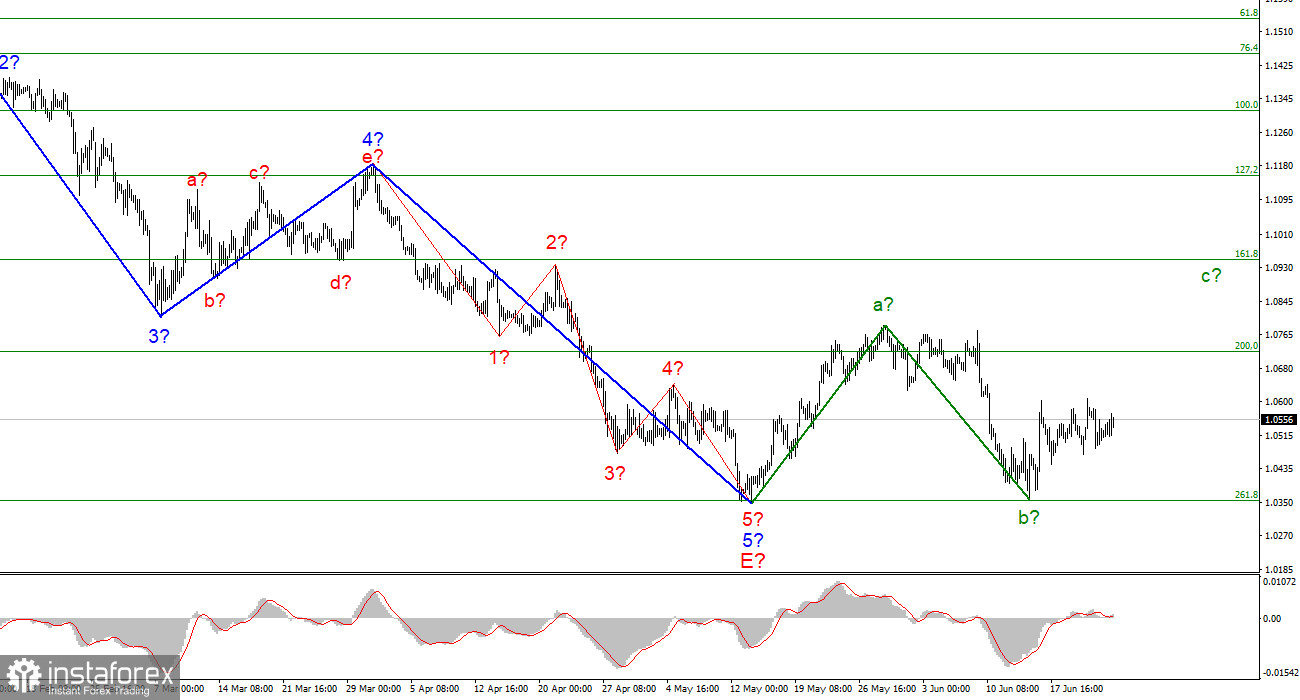

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing and does not require adjustments. The instrument has completed the construction of a downward trend segment. If the current wave marking is correct, then at this time the construction of a new upward trend section has begun. It can turn out to be three-wave, or it can be pulsed. At the moment, two waves of a new section of the trend are visible. Wave A is completed, and wave b is also presumably completed. If this is indeed the case, then the construction of an upward wave has now begun. The instrument has not declined under the low of the downward trend section, so the wave marking still retains its integrity. However, I note that the downward section of the trend may complicate its internal wave structure and take a much more extended form. Unfortunately, a very promising wave markup may be broken due to the news background, which led to a strong decline in demand for the euro currency. But at the moment, the chances of building an upward wave c remain. Only the news background can interfere.It's been a boring week.The euro/dollar instrument rose by 30 basis points on Friday. Market activity was very low. Let me remind you that on Monday and Tuesday, there was practically no news for the euro and the dollar. The same pattern was observed on Friday when the most important report of the day was the consumer sentiment index from the University of Michigan. Market expectations were low, but the value of the report was even lower – only 50.0. At the beginning of 2020, it was more than 100 points, and a year ago it was about 80. Thus, now we are seeing the lowest value in the entire history of the study of this indicator (more than 60 years). Although the indicator itself is not important, still its decline by historical lows says something. The market against the background of this index slightly lowered the dollar, but very slightly.The most important events of the week – Jerome Powell's speeches in Congress also did not attract the attention of the market. Powell repeats the same statements from time to time, so the market simply sees no reason for itself to win back the same thing every time. It is now obvious to everyone that the Fed's interest rate will rise no matter what. One can also recall the indices of business activity in the fields of production and services (as well as composite indices) for the EU and the USA. All six indices declined in June, indicating a noticeable drop in business activity. But since the indices fell both in the US and in the European Union, neither the euro nor the dollar could benefit from these data. As a result, we got a week when the instrument moved horizontally for all five days. The wave markings did not change at all, because there were no movements as such. Therefore, I continue to expect the construction of an ascending wave, according to the current wave markup. The euro currency is difficult, but it still has a chance to grow to 8 figures.General conclusions.Based on the analysis, I conclude that the construction of the downward trend section is completed. If so, then now you can buy a tool with targets located near the estimated mark of 1.0947, which equates to 161.8% Fibonacci, for each MACD signal "up". Wave b is presumably completed. An unsuccessful attempt to break through the level of 261.8% indicates that the market is not ready for new sales of the instrument.

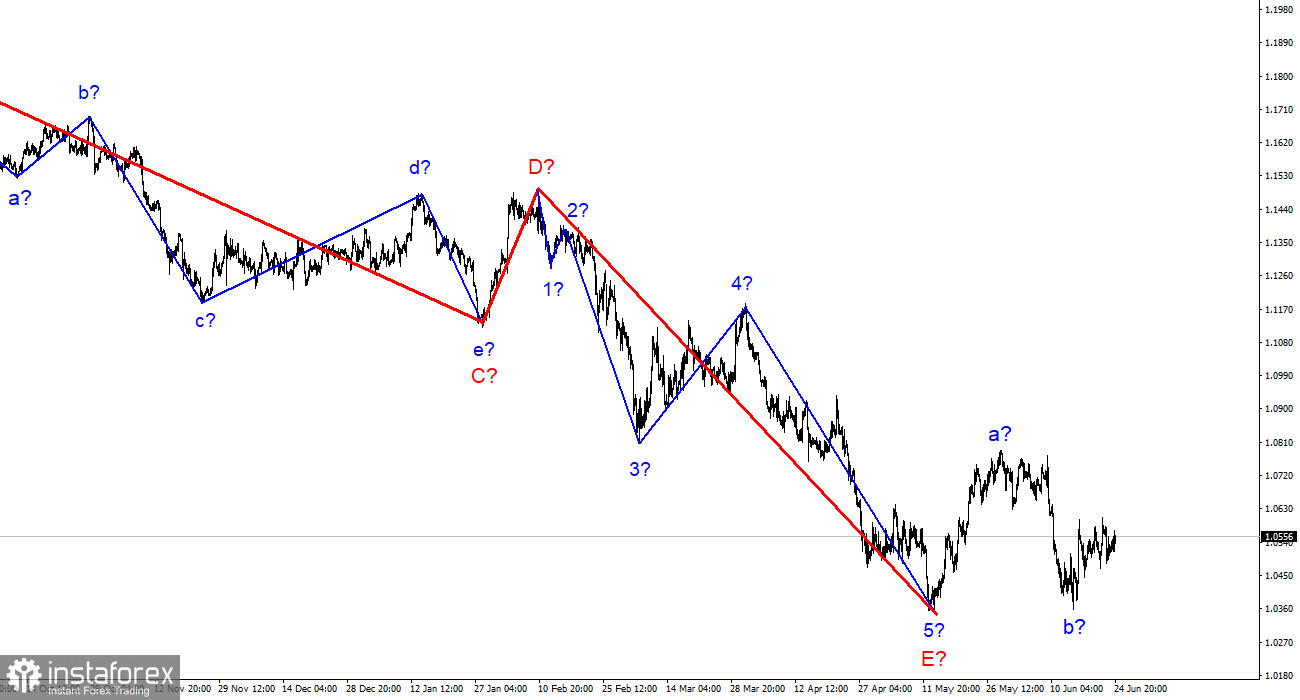

On a larger scale, it can be seen that the construction of the proposed wave E has been completed. Thus, the entire downward trend has acquired a complete look. If this is indeed the case, then in the future for several months the instrument will rise with targets located near the peak of wave D, that is, to the 15th figure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română