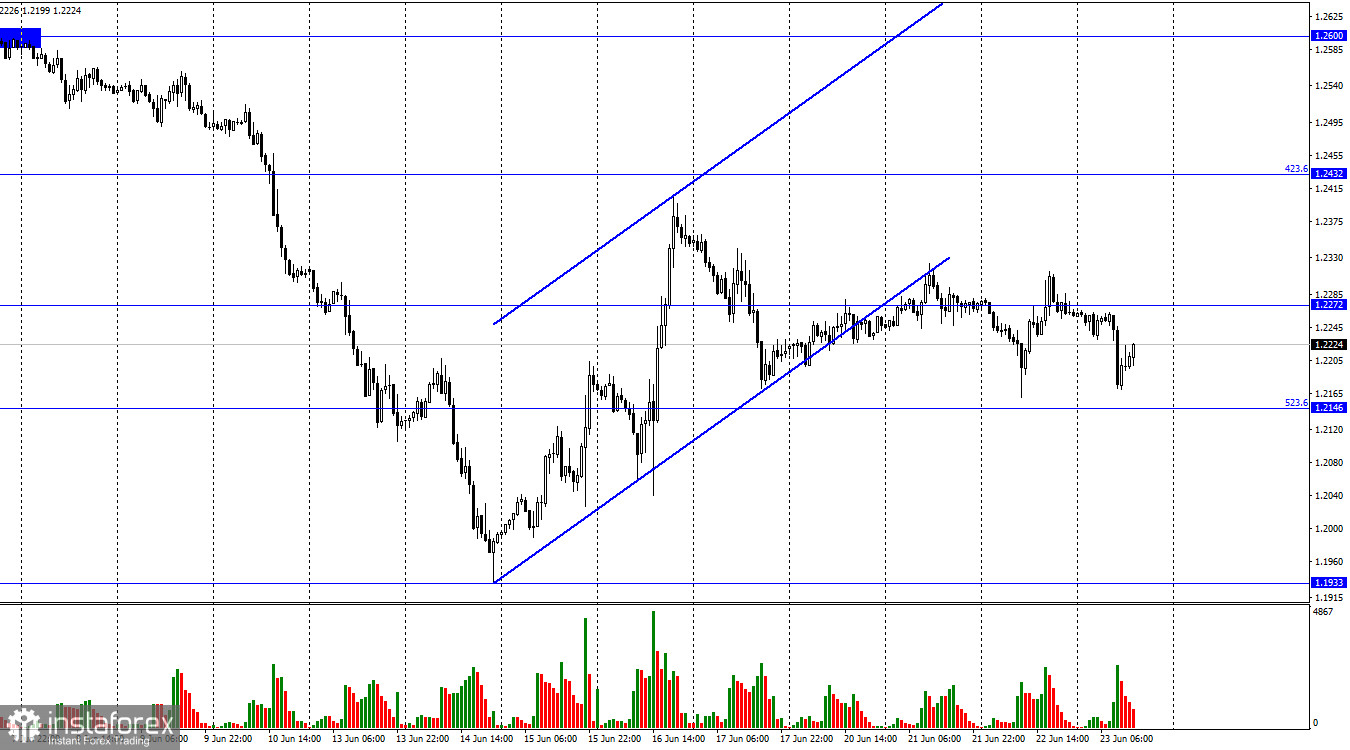

Hello, dear traders! On the hourly chart, the GBP/USD pair returned to the level of 1.2272 yesterday, then it rebounded from it. Today, the pair reversed in favor of the US dollar and fell towards the 523.6% correctional level at 1.2146. Overall, the British pound completely repeated yesterday's moves of the euro. The fact is the GBP/USD pair has difficulties with following its own direction. However, there are considerable differences between the euro and the pound. To begin with, the ECB has not raised interest rates yet, while the Bank of England has already raised them five times. Nevertheless, the pound is still as weak as the euro. Moreover, the UK and EU economies are no longer closely linked. Therefore, there should be some differences in the pound and the euro's moves. However, both currencies are trading as if they belong to two neighboring states within the same bloc.

Yesterday, Fed Chair Jerome Powell gave his semiannual monetary policy report in the US Senate Banking Committee. Powell assured the senators that he would continue to pursue his initiative to bring inflation down to the target level, which is considered the key goal for the US regulator. This means that the Fed will most likely raise the rate in July and will probably raise it during the year. Therefore, the dollar declined amid this hawkish rhetoric! Moreover, the dollar's moves look even stranger this morning as it started rising. As for the euro, this growth could be caused by weak business activity data. However, the situation is the opposite for the pound as the ISM Services and ISM Manufacturing indexes in the UK were not weak. Nevertheless, the pound has completely followed the euro's trend as well. It means that traders either do not know how to trade in the current situation, or misinterpreted Powell's speech yesterday. Therefore, the dollar first fell and then rose.

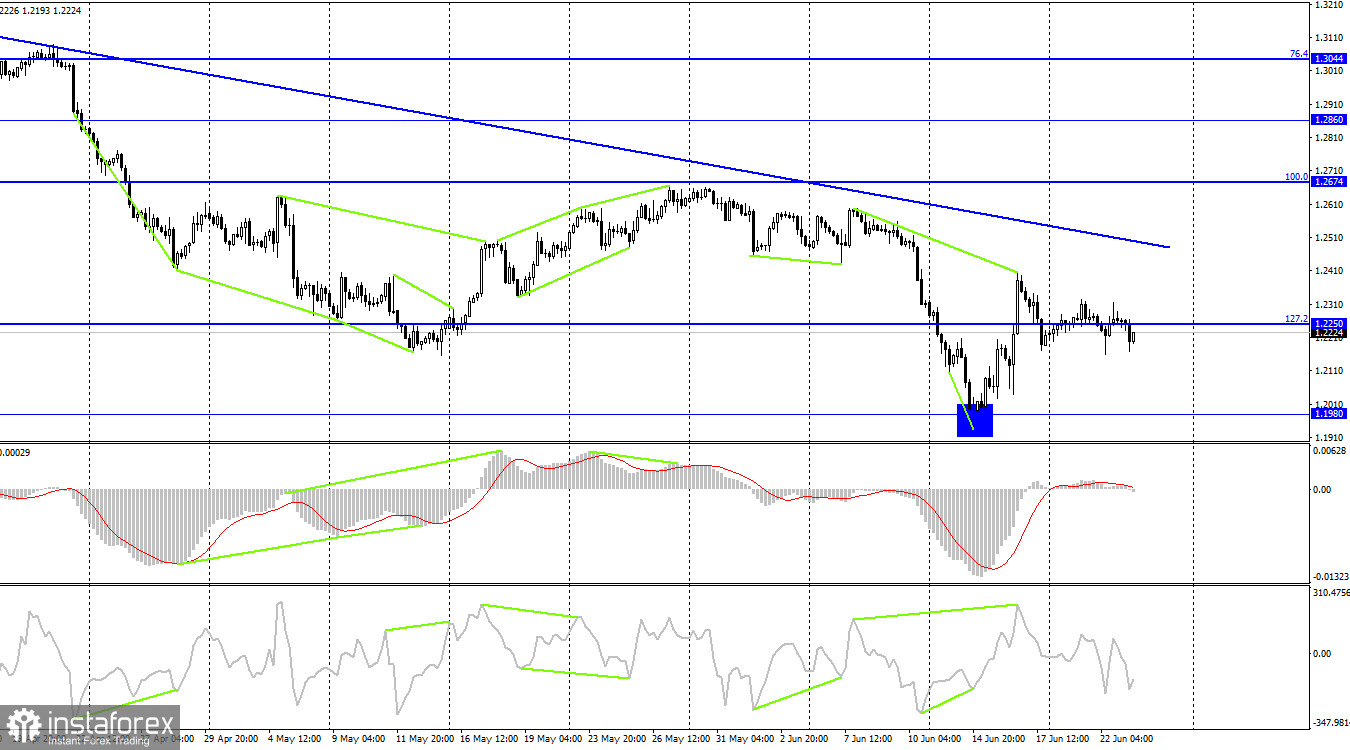

On the 4H chart, the pair reversed in favor of the US dollar after the CCI indicator formed a bearish divergence and returned to the 127.2% correction level at 1.2250. The pair's consolidation below this level will again lead to further decline towards 1.1980, where the pound began its growth. The descending trend line continues to characterize traders' sentiment as bearish.

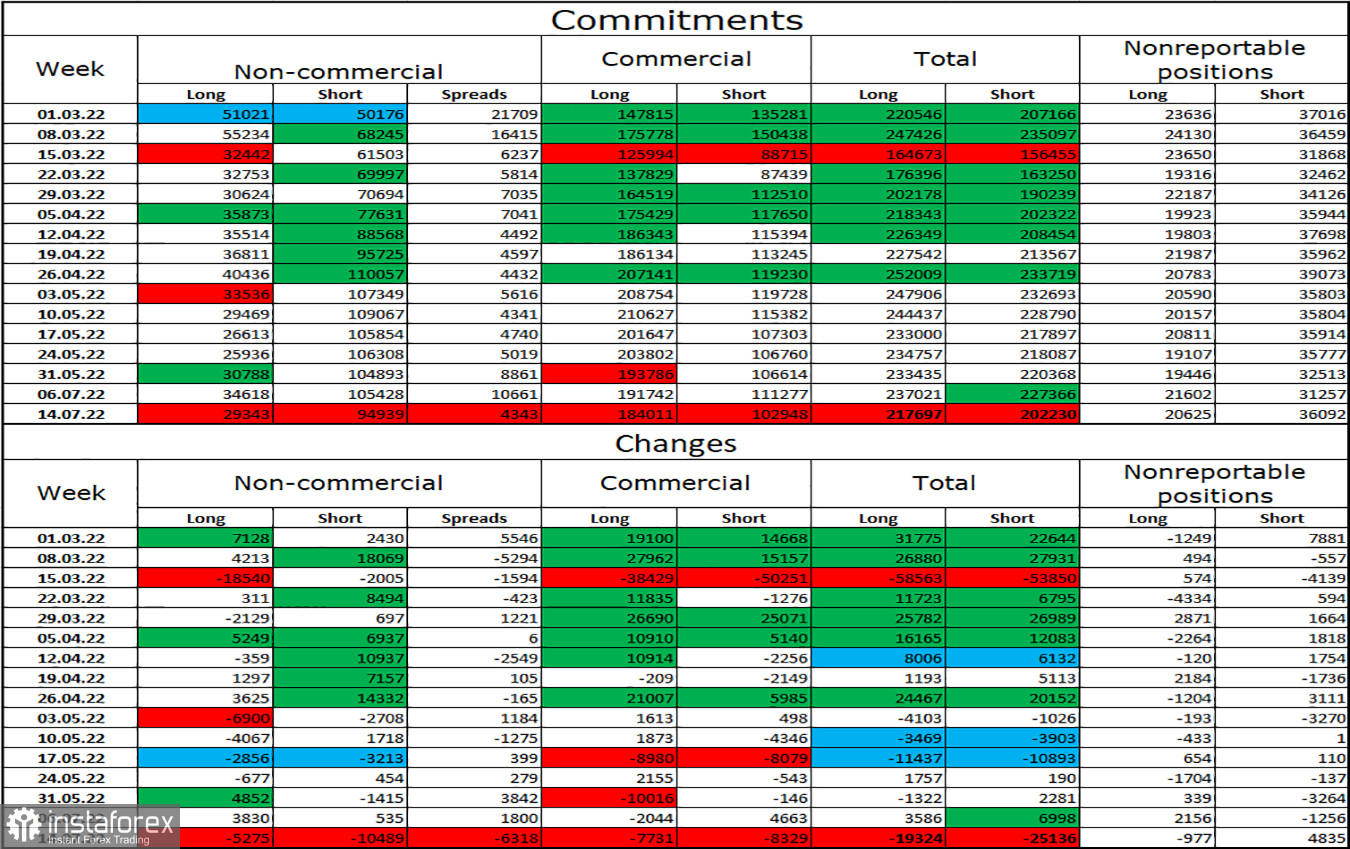

COT report:

The sentiment of non-commercial traders has become slightly more bullish over the past week. The number of long contracts held by speculators decreased by 5,275, while the number of short contracts fell by 10,489. Thus, the general sentiment of major players remained bearish. Moreover, the number of long contracts exceeds the number of short contracts several times. Major players continue to sell-off the pound and their sentiment has not changed much lately. Thus, I think the British pound could continue declining over the next few weeks and months. A wide divergence of the long and short contracts may indicate a trend reversal. However, the news background is clearly more significant for major players now. Currently, it is obvious that speculators sell more than buy.

US and UK economic news calendar:

UK - ISM Services and Manufacturing Indexes (08-30 UTC).

US - ISM Services and Manufacturing Indexes (13-45 UTC).

US - Jerome Powell's speech in US Congress (14-00 UTC).

On Thursday, the UK and US economic calendars contain a few interesting entries. ISM Services and Manufacturing Indexes are due today. Moreover, Powell will deliver his second speech to Congress. The news background may significantly affect traders' sentiment during the day.

GBP/USD outlook and recommendations for traders:

I recommended selling the pound when the pair closes below the ascending channel on the hourly chart with targets of 1.2146 and 1.1933. New sales are possible in case of a rebound from the level of 1.2272 with the same targets. I recommend buying the pound if the pair consolidates above the trend line on the 4H chart with the target of 1.2674.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română