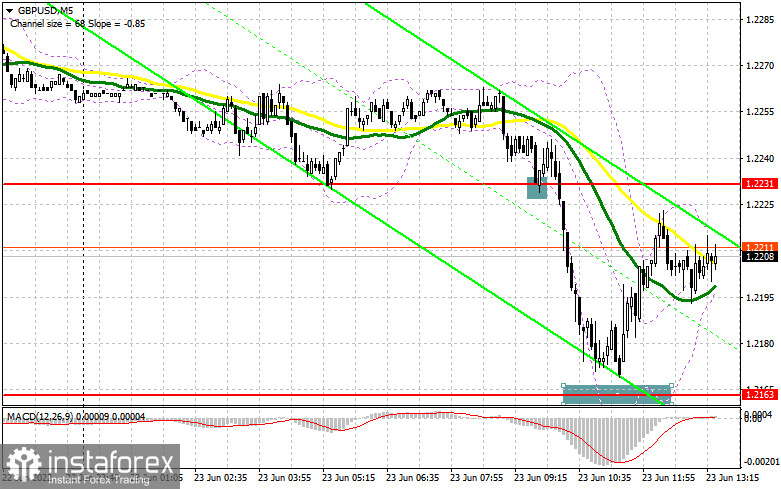

In my morning forecast, I paid attention to the 1.2231 level and recommended making decisions from it. Let's look at the 5-minute chart and figure out what happened there. The data on activity in the UK turned out to be not as bad as it might seem, but this led to a sharp decline in the British pound. A false breakout in the area of 1.2231 formed at the beginning of the European session gave a buy signal, but as you can see, it brought losses. It was not possible to reach 1.2163: only a couple of points were missing to see a false breakdown and a signal to open long positions there. And what were the entry points for the euro?

To open long positions on GBP/USD, you need:

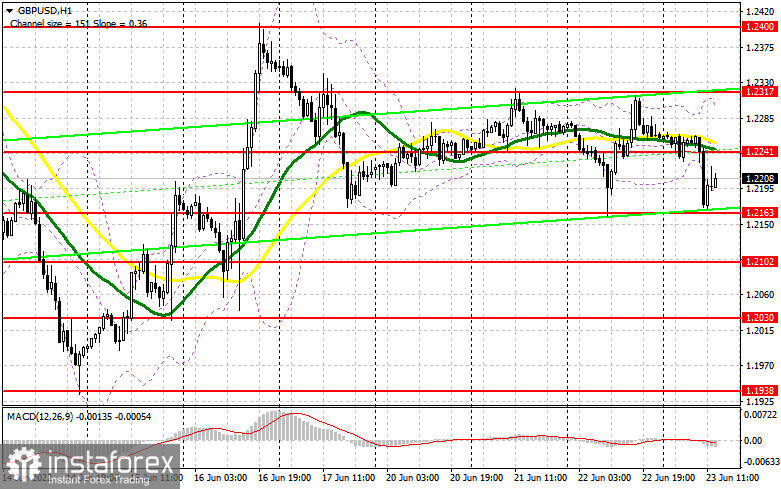

For the American session, the technical picture has changed. It is unlikely that anything will depend on the statements of Jerome Powell since nothing new is planned in his speech on the second day of speeches. If the US data does not impress traders, and they must objectively exceed economists' forecasts for this, the pound will have every chance of an upward correction. The primary task of the bulls will not be a breakthrough of 1.2241 – a new level of resistance formed by the results of the first half of the day, but the protection of the nearest support of 1.2163. If GBP/USD falls during North American trading, only the formation of a false breakdown at 1.2163 will give a signal to open new long positions in the expectation that the pair will return to the middle of the 1.2241 side channel. Although the 1.2241 level is not critically important for the bulls, the return of control over it will allow us to target the upper border of the channel. Therefore, a breakout and a top-down test of 1.241 will give a buy signal based on the update of 1.2317, and then an exit to a new maximum of 1.2400. A similar breakthrough at this level will lead to another entry point into long positions with the prospect of updating 1.2452, where I recommend fixing the profits. A more distant target will be the 1.2484 area. If GBP/USD falls and is absent at 1.2163 after Powell's speech, the pressure on the pair will increase. I advise you to open new long positions only on a false breakout from 1.2102. You can buy GBP/USD immediately for a rebound from 1.2030, or even lower – around 1.1938 with the aim of correction of 30-35 points within a day.

To open short positions on GBP/USD, you need:

The bears did everything possible to return to the market and even took advantage of the UK data, carefully following the stop orders of buyers. However, this did not lead to extensive sales. Now the bears need to think about how to take control of the level of 1.2163, formed following the results of the morning session. Only the consolidation below and the reverse test from the bottom up will give an entry point into short positions with the prospect of a decline to 1.2102. For complete capitulation of buyers, it is necessary to get even lower – to 1.2030, where I recommend fixing the profits. We will be able to reach this area only in case of new interesting surprises that the Fed, together with Jerome Powell, has prepared for the US Congress and the markets. With the GBP/USD growth option, the bears will certainly manifest themselves in the resistance area of 1.2241. A false breakout will be an excellent signal to open short positions. If there is no activity of sellers there, I advise you to postpone sales. Only a false breakout at 1.2317 will give a new entry point to short positions in the expectation of a resumption of the downtrend. Short positions can be viewed immediately for a rebound from 1.2400, or even higher – from 1.2452, counting on the pair's rebound down by 30-35 points inside the day.

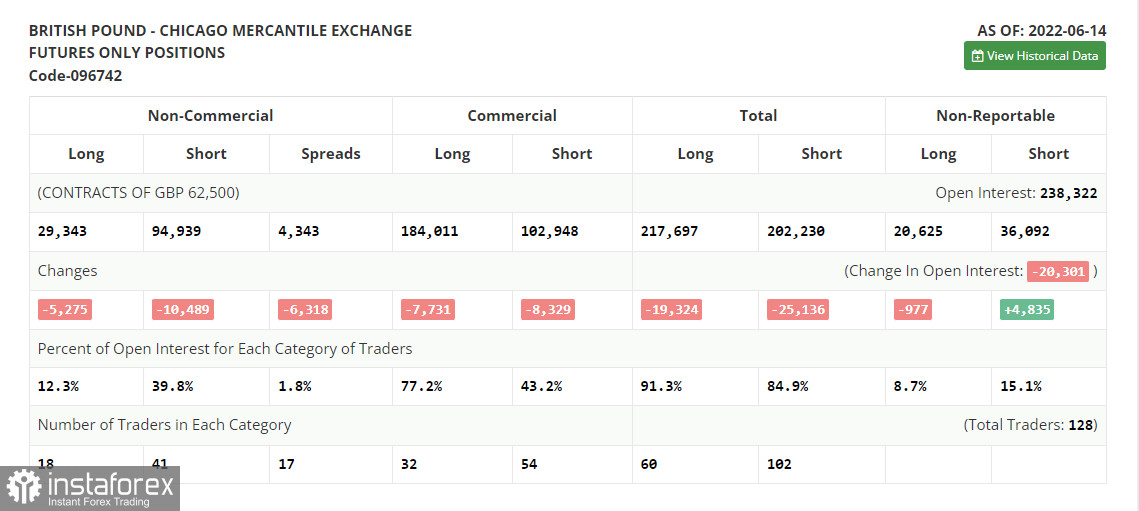

The COT report (Commitment of Traders) for June 14 recorded a reduction in both long and short positions, which led to a slight decrease in the negative delta. After the meeting of the Bank of England, at which it was announced that it would adhere to the previous plan to raise interest rates and combat high inflation, the pound strengthened its position, which will affect future COT reports. Surely the big players are taking advantage of the moment and buying back the much cheaper pound, despite all the negative that is happening with the UK economy now. However, one should not rely too much on the pair's recovery in the near future, since the policy of the Federal Reserve System will seriously help the US dollar in the fight against risky assets. The COT report indicates that long non-commercial positions decreased by 5,275 to the level of 29,343, while short non-commercial positions decreased by 10,489 to the level of 94,939. This led to a decrease in the negative value of the non-commercial net position from the level of -70,810 to the level of -65,596. The weekly closing price decreased to 1.1991 against 1.2587.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 daily moving averages, which limits the upward potential of the pair.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the average border of the indicator around 1.2310 will act as resistance. In the case of a decline, the lower limit of the indicator in the 1.2200 area will act as support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română