Details of the economic calendar from June 22

Inflation in the UK continues to accelerate. The growth rate of consumer prices accelerated from 9.0% to 9.1%, which once again proves the further actions of the Bank of England in terms of raising the interest rate.

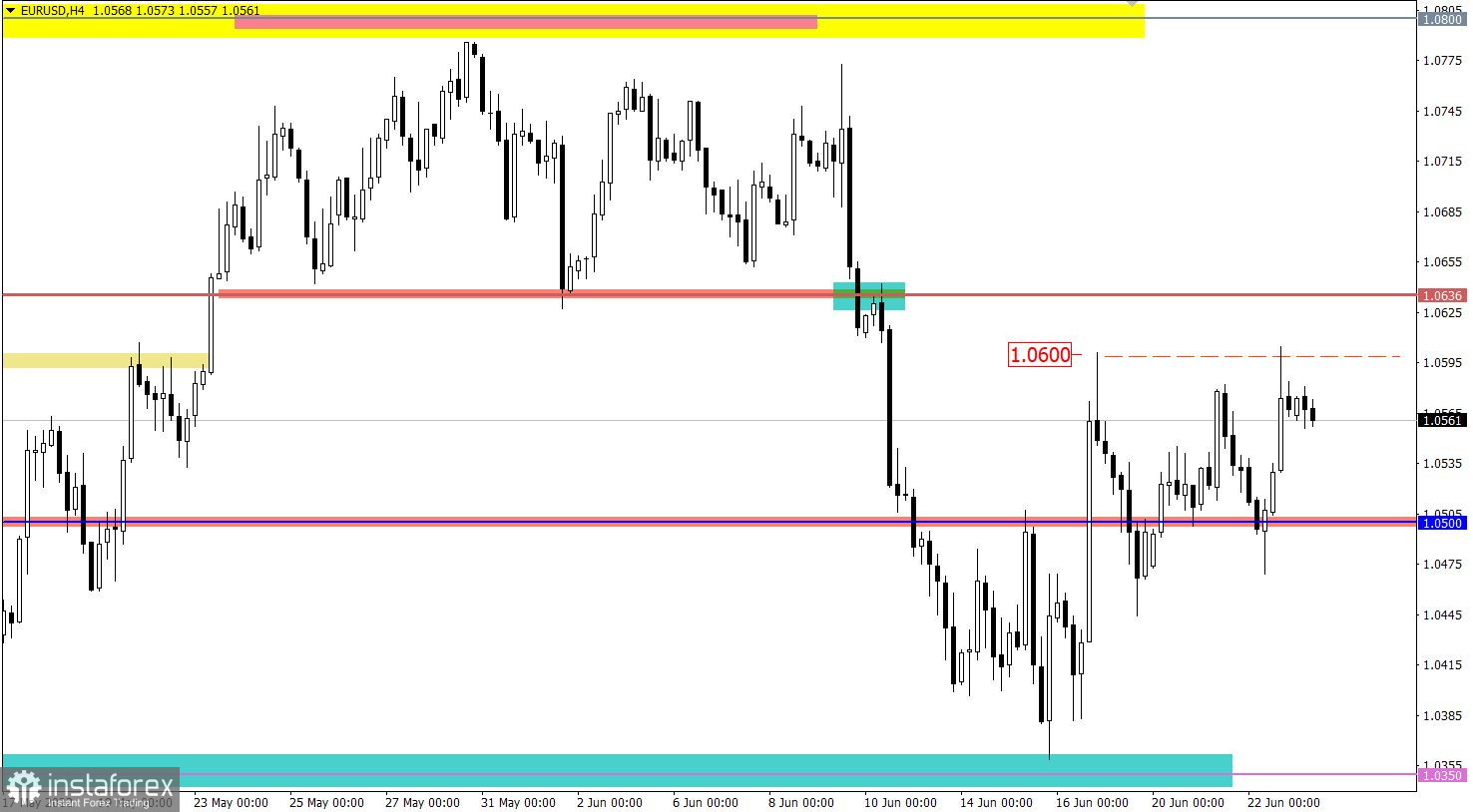

Analysis of trading charts from June 22

The EURUSD currency pair jumped in value by more than 130 points. This intense upward move led to a prolongation of the corrective movement from the 1.0350 support area.

The GBPUSD currency pair showed strong activity following the market: about 150 points of an upward move could be observed in the past day. This movement returned the quote to the area of the local low on June 21, where there was a reduction in the volume of long positions.

Economic calendar for June 23

Today, preliminary data on business activity indices will be published in Europe, the UK, and the United States, where nothing good can be expected. Thus, variable turbulence in the market is possible.

As for the weekly data on jobless claims in the US, a slight increase in the overall figure is expected. This is a negative factor for the US labor market.

Statistics details:

The volume of continuing claims for benefits may increase from 1.312 million to 1.315 million.

The volume of initial claims for benefits may be reduced from 229,000 to 227,000.

Time targeting

EU business activity indices - 08:00 UTC

UK business activity indices - 08:00 UTC

US Jobless Claims - 12:30 UTC

US business activity indices - 13:45 UTC

Trading plan for EUR/USD on June 23

To confirm the signal about the prolongation of the correction, the quote needs to hold above the value of 1.0600 in a four-hour period. Otherwise, we expect another pullback to the level of 1.0500.

Trading plan for GBP/USD on June 23

Despite a number of impetuous impulses, the quote has a characteristic sideways amplitude of 1.2150/1.2320. This indicates the uncertainty of traders in the next move. In this situation, the optimal trading tactic is considered to be a breakdown relative to the given boundaries.

What is reflected in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română