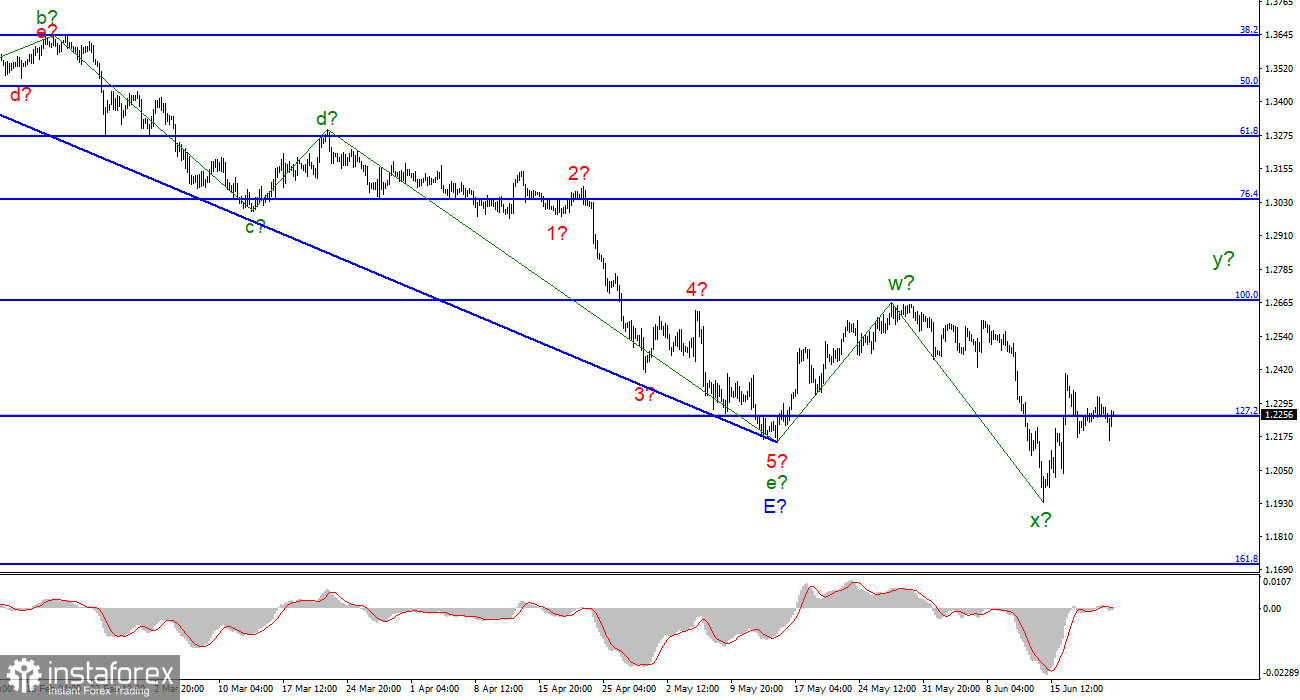

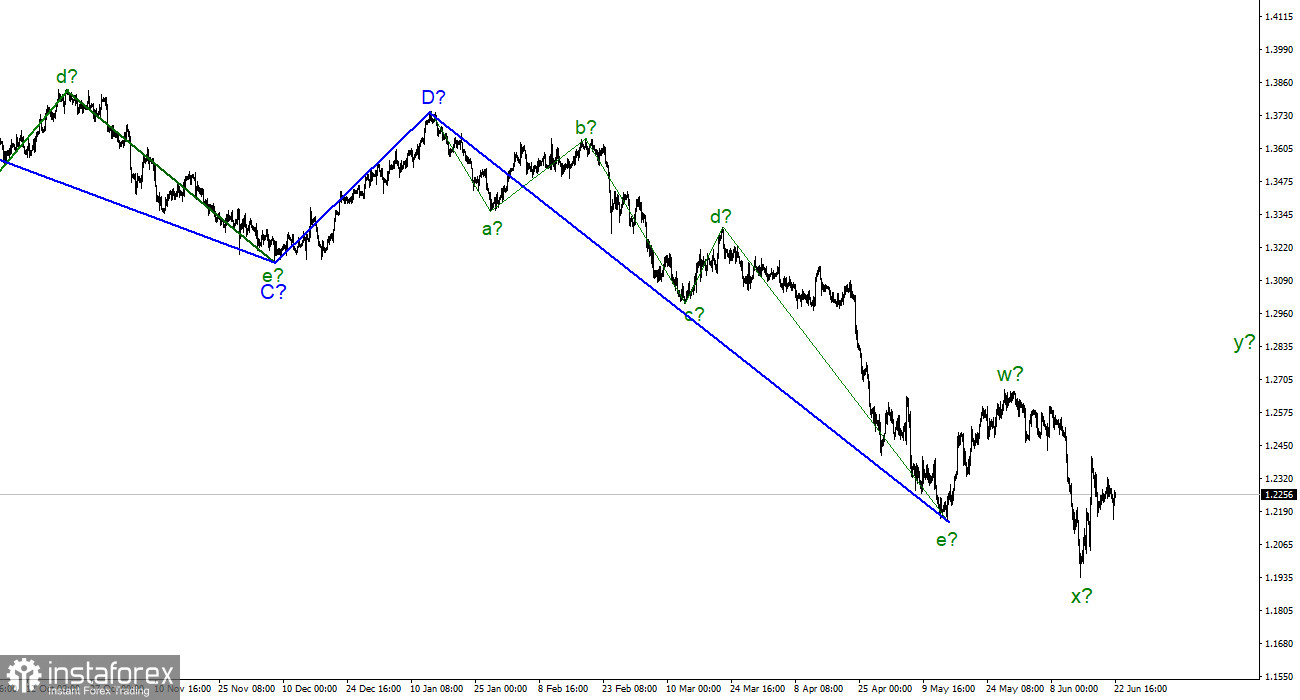

According to the pound/dollar instrument, the wave marking now requires additions and adjustments, but it may still take a more or less digestible form. At the moment, the last downward wave has gone beyond the low of the expected downward trend segment, which I consider completed. Thus, we will no longer see the classical correction structure a-b-c. Nevertheless, wave analysis allows the construction of various correction structures, so a more complex three-wave formation w-x-y can be constructed. Anyway, the pound and the euro continue to show a very high degree of correlation, and both instruments should build approximately the same sections of the trend. Ascending. At the same time, according to the euro currency, it can be a classic a-b-c, and according to the pound, a rarer w-x-y. But in both cases, the instruments should now build an ascending wave, which should go beyond the peak of the previous ascending one. The wave marking on the British now looks not quite unambiguous, but still has the right to life. The fact that a stronger appreciation of the US currency did not begin after the Fed meeting is encouraging and gives chances for building the necessary upward wave.

British inflation continued to rise but leaves questions

The exchange rate of the pound/dollar instrument increased by 0 basis points on June 22. Market activity on Wednesday increased slightly compared to Monday and Tuesday, but not by much. In the first half of the day, the demand for the British decreased, and in the second - grew. Thus, I can assume that the reaction to the British inflation report was negative. What did the next report show? The consumer price index increased by the end of May to 9.1%. In the previous month, it was 9.0% y/y. The acceleration was minimal, but it's still acceleration. Thus, the Bank of England still has all the necessary grounds to continue raising the interest rate, since inflation does not respond to the previous five increases. This information could have supported the demand for the pound sterling, but instead, the Briton declined. It's also good that it's not too strong since the instrument is located near the low wave x.

And on the eve of Jerome Powell's speech, demand for the US dollar began to decline. In both instruments. I would like to assume that this indicates that the market is waiting for "dovish" rhetoric from Jerome Powell, but I can't do it. Now there is no reason to make such a conclusion. Therefore, instead of a strong increase in the pound, we may see a new decline in the instrument at the end of Wednesday. But let's not jump to conclusions. After all, the market has repeatedly shown that it can react differently to important events. And not always the way you expect it from him. Even if the instrument rises slowly, this is already good, since at least a three-wave correction structure is needed to close all questions about wave marking. The growth potential of the British dollar is about 400 basis points, which almost coincides with the potential of the euro currency. Even here, both instruments have similar indicators.

General conclusions

The wave pattern of the pound/dollar instrument has become clearer. I still expect the construction of an upward wave within the corrective upward structure. If the current wave marking is correct, then the instrument will continue to increase with targets located above the calculated mark of 1.2671, which corresponds to 100.0% Fibonacci. I recommend buying on each MACD signal "up".

On an older scale, the entire downward trend section looks fully equipped but may take on a more extended form. If the current correctional structure still takes an even more non-standard form, then adjustments will have to be made.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română