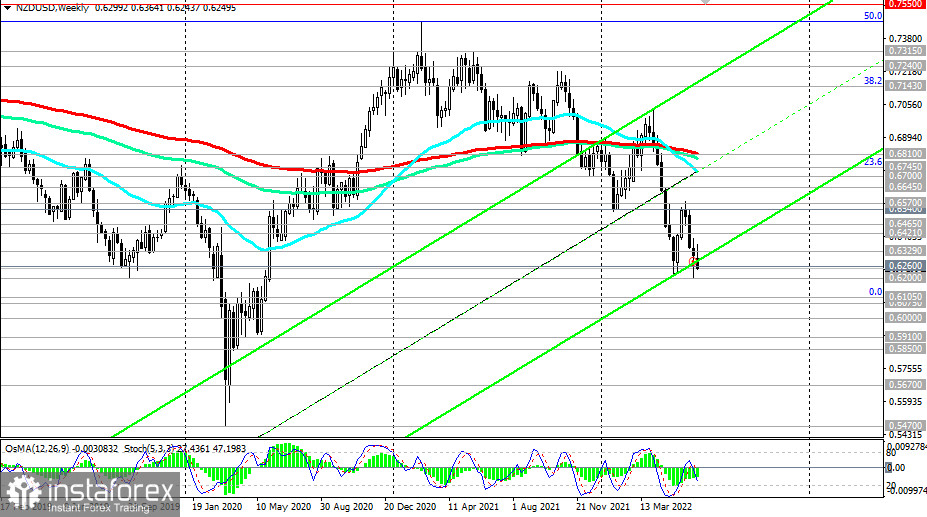

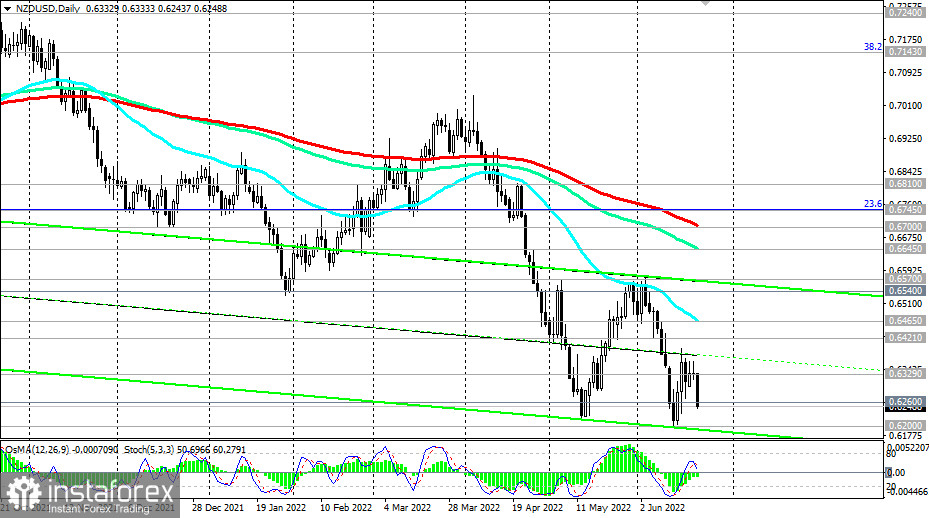

For the third month in a row, NZD/USD has been trading in the bear market zone, remaining below the key resistance levels of 0.6810 (200 EMA on the weekly chart), 0.6745 (23.6% Fibonacci retracement in the global wave of the pair's decline from 0.8820 in 2014-2015), 0.6700 (200 EMA on the daily chart).

NZD/USD is trading at 2-year lows at 0.6247, developing downward momentum towards the 2014–2015 low at 0.6105, while the negative investor sentiment about the risks of recession in the commodity market has intensified the global economy.

One of the determining factors in the dynamics of NZD/USD is also the tightening course of the Fed's monetary policy.

Last week, the price made a new 2-year low, breaking through the 0.6200 mark. Even though the price bounced off this mark, NZD/USD is under pressure from the strengthening US dollar.

In general, the downward dynamics of NZD/USD prevails, and after a retest of the local support level of 0.6200, the price is likely to move lower towards 0.6105 (the low of the pair's decline wave from the level of 0.8820 in 2014–2015). And the breakdown of the level of 0.6000 will open the way to the marks of 0.5700, 0.5800, and possibly lower to 0.5500, where the price was in March 2020.

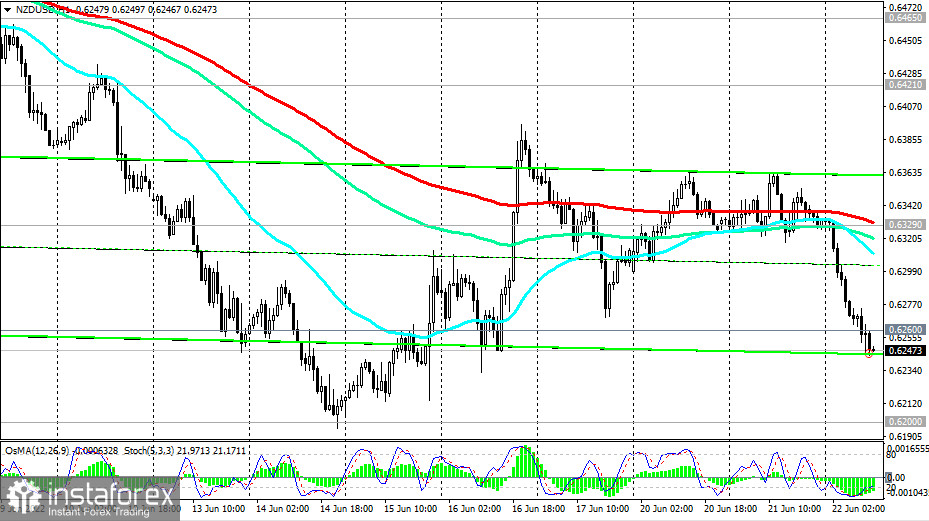

In an alternative scenario, NZD/USD will head towards local resistance levels 0.6540 and 0.6570, and the signal for this will be a consistent breakdown of resistance levels 0.6329 (200 EMA on the 1-hour chart), 0.6421 (200 EMA on the 4-hour chart).

Support levels: 0.6200, 0.6105, 0.6100, 0.6075, 0.6000, 0.5910, 0.5850

Resistance levels: 0.6260, 0.6300, 0.6329, 0.6400, 0.6421, 0.6465, 0.6540, 0.6570

Trading Tips

Sell Stop 0.6240. Stop-Loss 0.6310. Take-Profit 0.6200, 0.6105, 0.6100, 0.6075, 0.6000, 0.5910, 0.5850

Buy Stop 0.6310. Stop-Loss 0.6240. Take-Profit 0.6329, 0.6400, 0.6421, 0.6465, 0.6540, 0.6570

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română