Details of the economic calendar from June 21

Tuesday was not much different from Monday in terms of the macroeconomic calendar. Important statistics in Europe, the UK, and the United States were not published. The only thing that could serve as an incentive for speculators was the return of traders from the United States to the markets after the weekend.

Analysis of trading charts from June 21

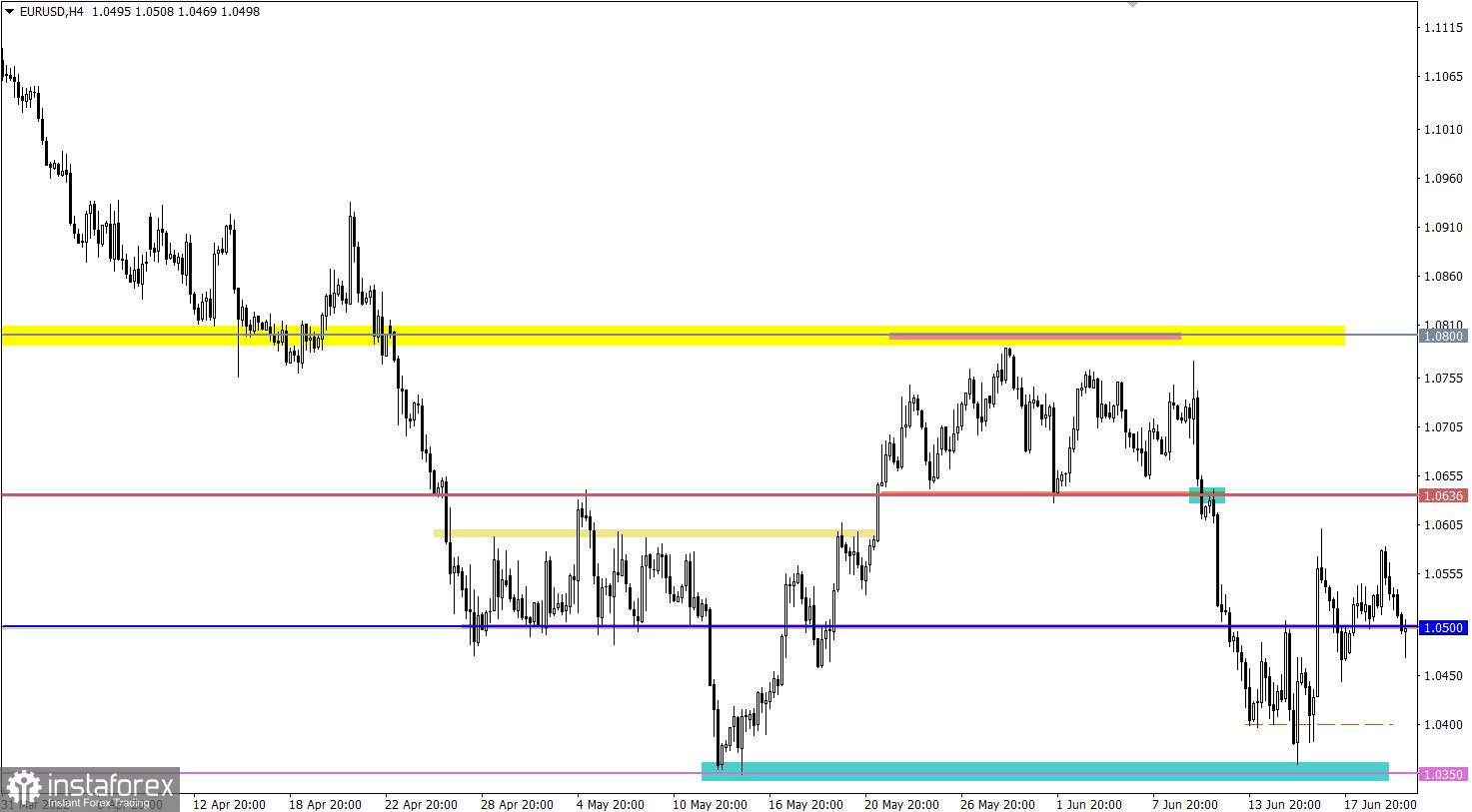

The EURUSD currency pair returned to the mirror level of 1.0500 after a short upward momentum. This amplitude movement indicates a high speculative interest among market participants.

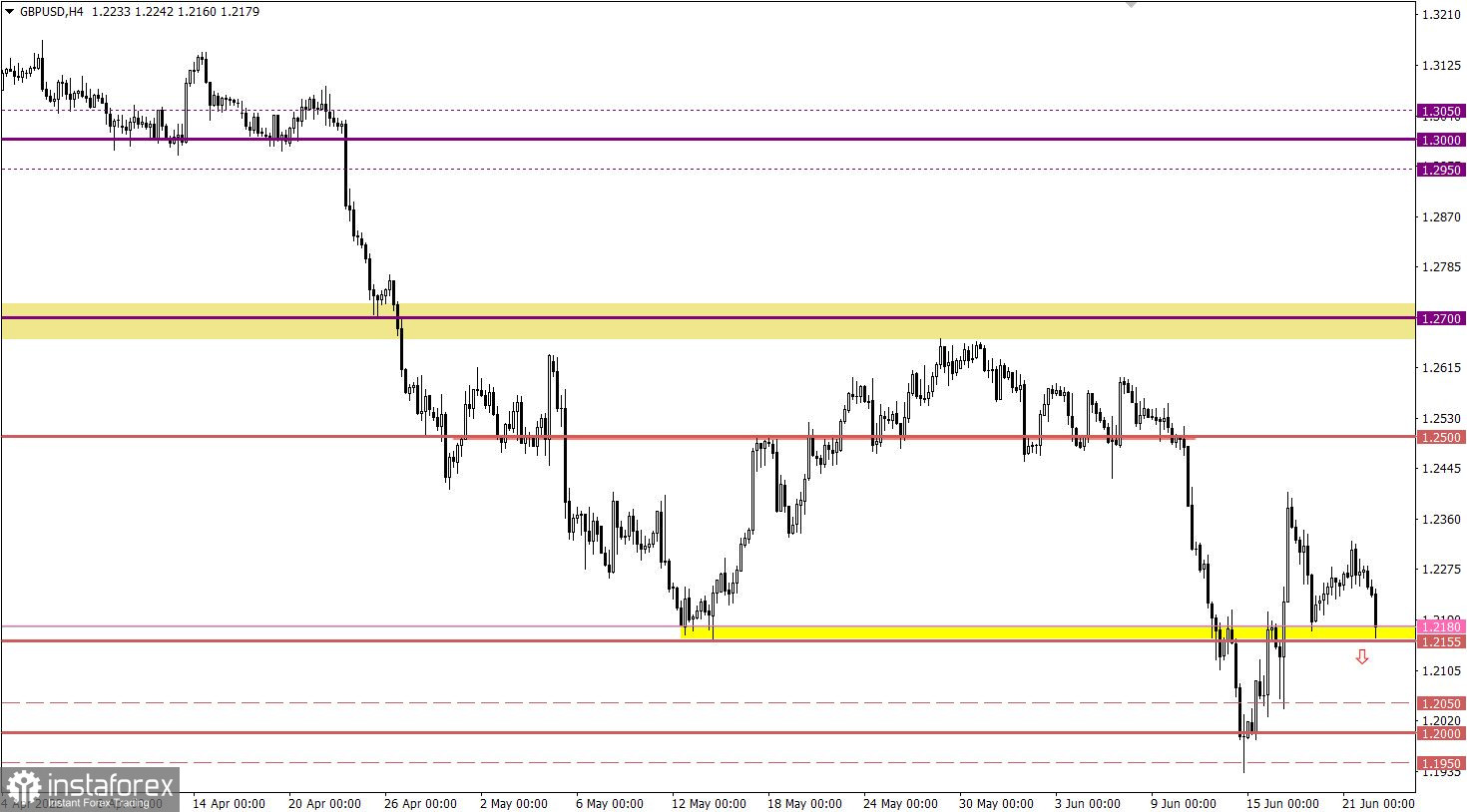

The GBPUSD currency pair rushed down following the euro, winning back the recent price rebound from the support area of 1.2155/1.2180. In fact, we have a signal to resume the downward cycle.

Economic calendar for June 22

Today, data on inflation in the UK were published, where further growth was recorded. The growth rate of consumer prices accelerated from 9.0% to 9.1%, which once again proves the further actions of the Bank of England in terms of raising the interest rate.

Trading plan for EUR/USD on June 22

A stable holding of the price below the level of 1.0500 may lead to a subsequent increase in the volume of short positions. In this case, there will be an increase in the downward move towards the values of 1.0470, 1.0400, 1.0350.

An alternative scenario considers a regular repetition of the past associated with the level of 1.0500. This can lead to stagnation followed by a price rebound.

Trading plan for GBP/USD on June 22

In this situation, the main increase in the volume of short positions will occur after the price holds below the value of 1.2155 in a four-hour period. This move will lead to further weakening of the British currency towards the psychological level of 1.2000.

Otherwise, the current support area could slow down the downward cycle, eventually leading to a rebound.

What is reflected in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română