Each week becomes worse for Bitcoin than the previous one. It seemed that after the Fed meeting, the market would finally adapt to the new investment reality and begin to gradually join the small trend in the accumulation of BTC coins. This is partly what happened, because a significant part of investors believed in reaching the local bottom of the cryptocurrency near the $20k level. On some crypto exchanges, the volumes of longs repeatedly exceeded short positions. As a result, Bitcoin broke through the $20k level and dropped to $17k at the moment. And apparently, this is far from the limit for the decline of the cryptocurrency.

The downward breakdown of the $20k key level occurred due to the emergence of positive sentiment and the belief that the local bottom is close. As a result of this process, the volumes of long positions began to largely prevail over short ones. Large market players have repeatedly used this situation to collect liquidity by deceiving investors' expectations. Over the weekend, liquidation volumes once again exceeded $500 million. Last week we observed the disappearance of the last hope of the bulls for an early price reversal. As a result, the market should prepare for the fact that Bitcoin will trade in the range of $15k–$20k.

A series of mass liquidations has negatively affected absolutely all categories of investors. Most of the Bitcoin holders are at an average loss of 75%. The level of panic reached such a level that some wallets that bought BTC in the range of $60k–$65k began to sell them and received a loss of 75%. However, a more serious blow to the market was the record realized losses in the history of Bitcoin in the amount of $7.3 billion. In total, more than half a billion BTC coins have been transferred to exchanges over the past three weeks. There is no doubt that the panic in the market is reaching its apotheosis, and therefore the positions of sellers are strengthening, and an attempt to further pressure the price is quite likely.

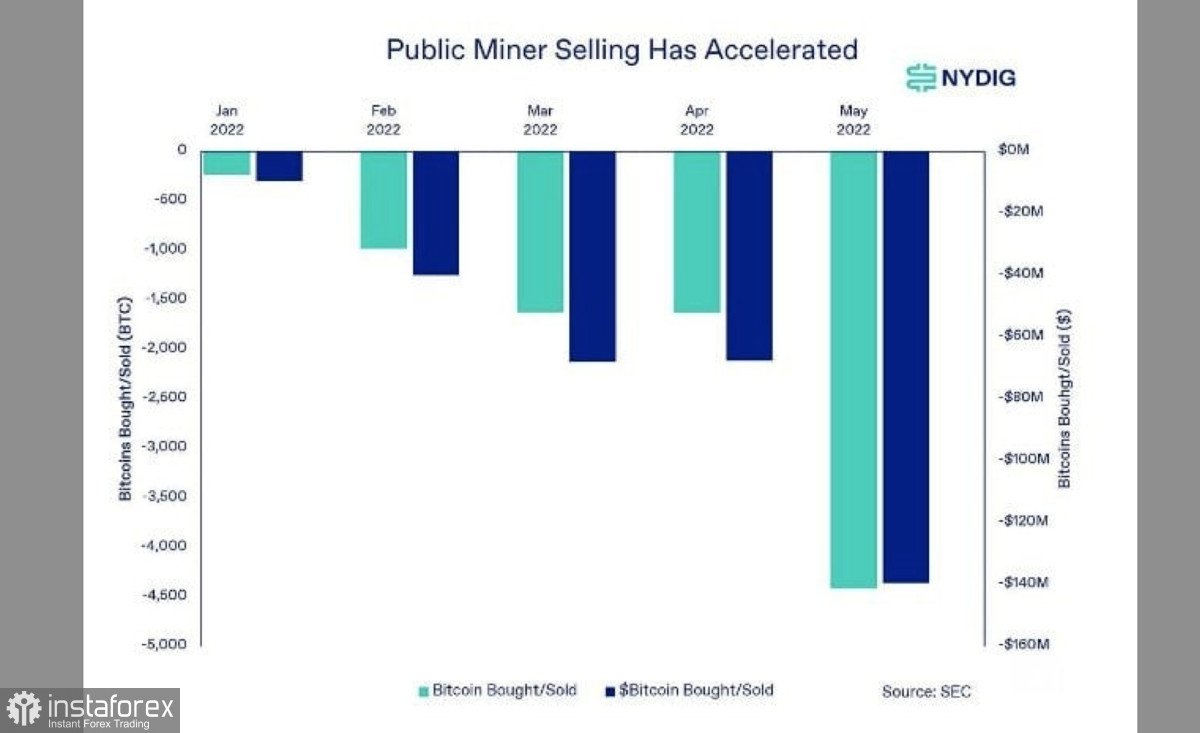

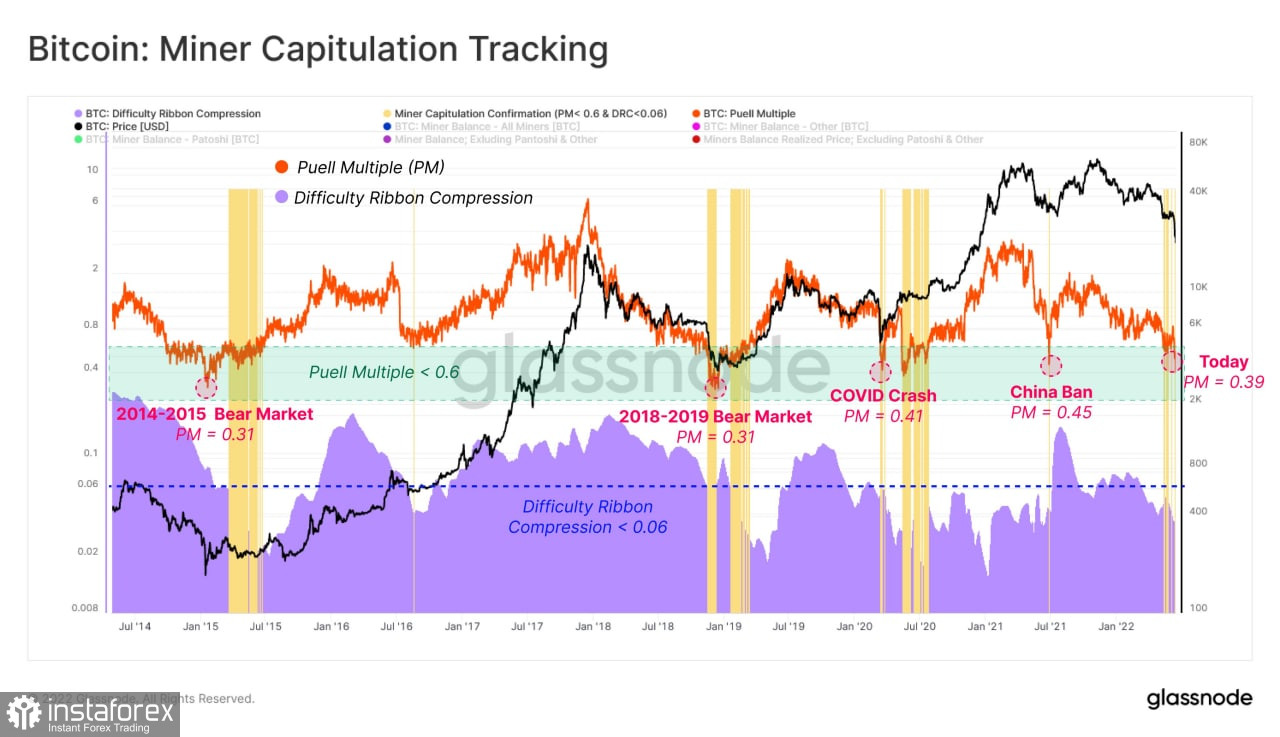

As the bear market tightens, Bitcoin has another sudden adversary. Miners continue to actively sell cryptocurrency, as they receive only 39% of regular revenue. This is evidenced by the Puell Multiple, which is also a kind of metric indicating the achievement of the local bottom of miners' sentiment. According to reports, public mining companies sold more than 4,000 BTC coins in May 2022, which is the largest result in the current year.

We see that the price of Bitcoin continues to fall, and all fundamental and technical factors point to the continuation of the downward trend. In addition, the historical context of each bear market indicates that during a massive price collapse, the decline is 85%–90%. As of June 20, Bitcoin has lost 74% of its ATH.

This suggests that the cryptocurrency may continue to decline to the $7k–$10k area. Given the unprecedented fundamental and economic factors, there is every reason to believe that the fall of Bitcoin will end in this area.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română