Long-term perspective.

The EUR/USD currency pair has decreased by 30 points during the current week. Volatility during the week was high, and the pair did not stand in one place at all, which is not surprising, since the results of the Fed meeting were announced on Wednesday. It should be noted right away that the market seems to have started working out the results of the meeting a few days before the end of this very meeting. The market was confident that the rate would be raised by at least 0.5%, and from Monday it expected an increase of 0.75%. After the next report on US inflation, which showed another acceleration, it became clear to traders that the Fed would tighten its already aggressive monetary approach. The state of the American economy allows you to raise the rate as much as necessary, so the question was only in the pace. And if a month ago we were talking about an increase of 0.5% at the June and July meetings, now we are talking about increases of 0.75% at the same two meetings. Naturally, in the medium term, the US currency receives additional support. It is noteworthy that on the day of the publication of the results of the meeting, the European currency rose, and the next day it rose even more. However, we warned that the market could have worked out any Fed rate hike in advance, so immediately after the announcement, we saw a reverse movement. But the general picture of the state of things does not change. The fundamental background was on the side of the dollar and remained. The geopolitical conflict both had a greater negative impact on the EU economy than on the United States, and it does. The ECB has not considered the possibility of a sharp increase in rates, and it is not considering it. Therefore, we believe that the euro may continue its decline in the next few months. It has already been around its 20-year lows for several weeks, it's time to update them already.

COT analysis.

The latest COT reports on the euro currency raised a lot of questions. Recall that in the last few months, they have shown a frank "bullish" mood of professional players, but at the same time, the European currency has been falling all the time. At this time, the situation is beginning to change, and again, not in favor of the euro currency. If earlier the mood was "bullish", but the euro was falling, now the mood has become "bearish". During the reporting week, the number of buy contracts decreased by 23.2 thousand, and the number of shorts from the "Non-commercial" group increased by 33.3 thousand. Thus, the net position fell by 56.5 thousand contracts in just one week. From our point of view, this fact very eloquently indicates that now even major players do not believe in the euro currency. The number of buy contracts is now lower than that of sell contracts for non-commercial traders by 6 thousand. Therefore, we can well expect that now not only the demand for the US dollar will remain high, but also the demand for the euro will decline. Again, this may lead to an even greater fall in the euro currency. In principle, over the past few months or even more, the euro has not been able to show even a strong correction, let alone something more. The maximum upward movement was about 400 points. All fundamental and geopolitical factors remain in favor of the US dollar.

Analysis of fundamental events.

During the current week, there was not a single important report in the European Union. Only the inflation report on Friday in the second assessment can be called "conditionally important", as traders were once again convinced that inflation in the European Union is growing and does not want to follow the hopes of Christine Lagarde, who seems to continue to believe that prices will stop rising "by themselves". Recall that Lagarde (like many other heads of central banks) very much expects that supply chains will recover after the pandemic, and oil and gas prices will someday stop rising. Naturally, it will happen someday. But what if inflation is already double-digit at that time? Is the ECB ready for this option? Judging by his rhetoric and plans, he is ready. Because at the moment we are talking about one or two rate increases this year. The Bank of England and the Fed have already proved that such a tightening of monetary policy will not even be noticed by inflation. Therefore, even an increase in the rate to 1% will not stop the acceleration of price growth in Europe.

Trading plan for the week of June 20-24:

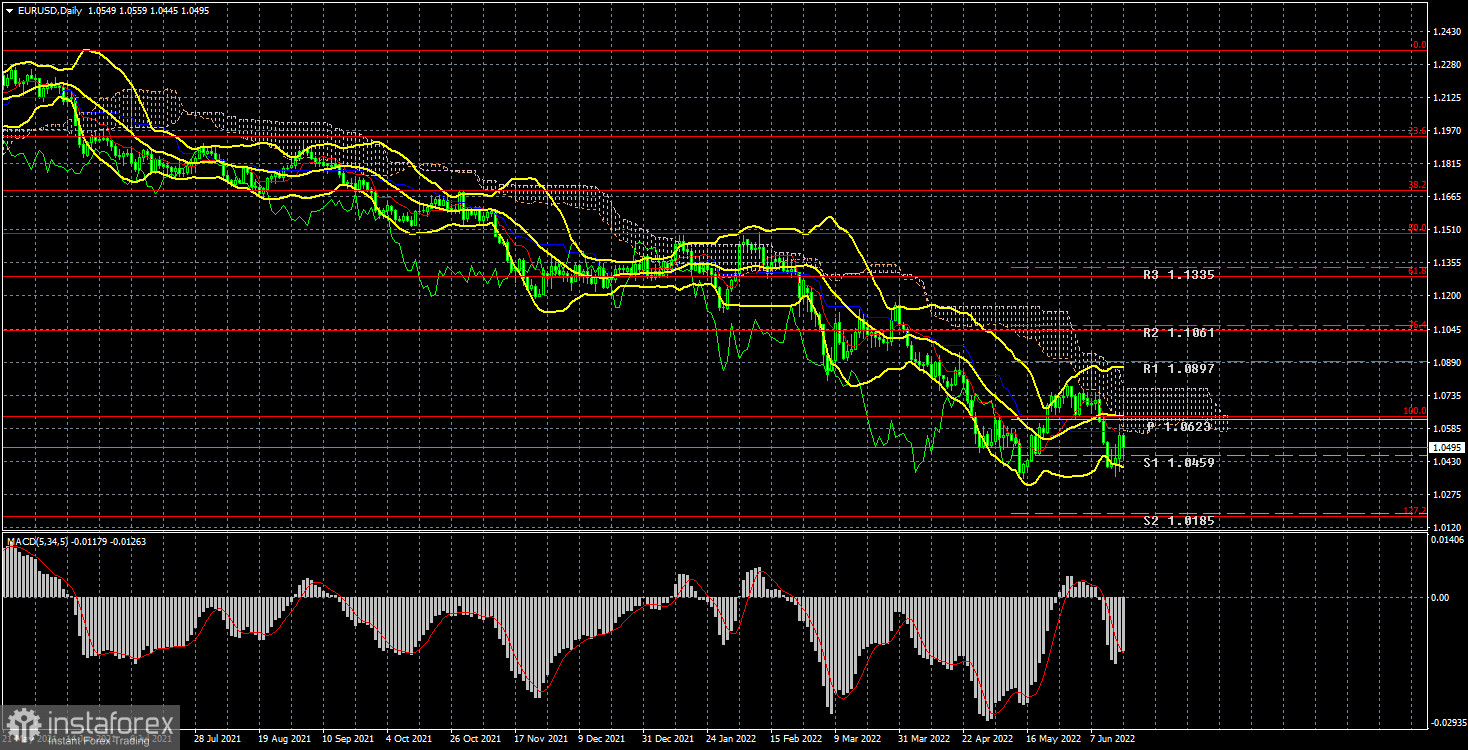

1) On the 24-hour timeframe, the pair stopped just a step away from the minimum for the last 20 years – 1.0340 and has already rushed to it again. Almost all factors still speak in favor of the long-term growth of the US dollar. Traders failed to overcome the Ichimoku cloud, so the upward movement and purchases of the euro currency are still not relevant. You need to wait, at least, to overcome the Senkou Span B line, and only after that consider buying the euro currency.

2) As for the sales of the euro/dollar pair, they are still more relevant now. The price has fixed back below the critical line, so we have a new sales signal at our disposal with a target of 1.0172 (127.2% Fibonacci), which is already below 20-year lows.

Explanations of the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts - the net position size of each category of traders.

Indicator 2 on the COT charts - the net position size for the "Non-commercial" group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română