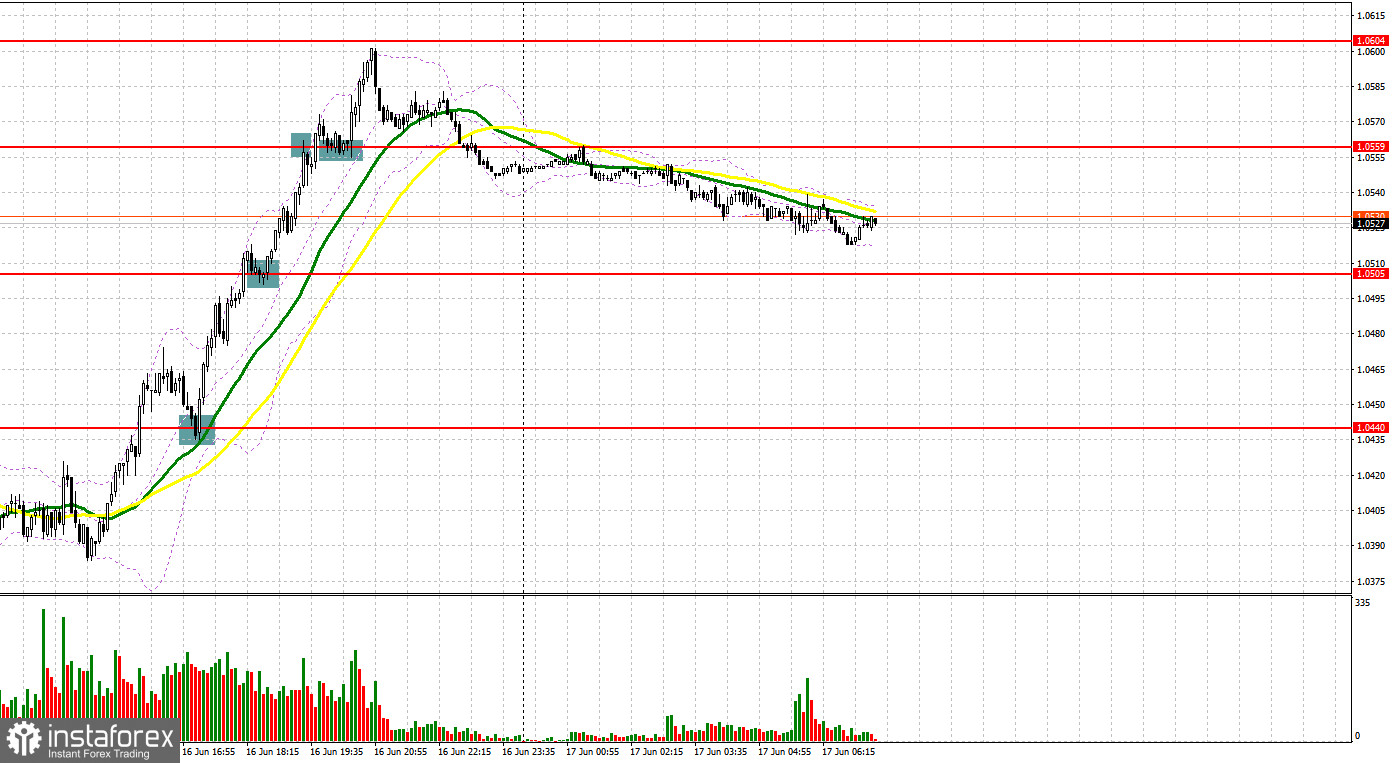

The euro rose against the US dollar on the hope that the European Central Bank will also take the side of a more aggressive monetary policy in the future, following the Federal Reserve's example. Yesterday, a lot of good market entry signals were formed. Let's look at the 5 minute chart and see what happened there. Data on the euro area did not particularly help the euro, although they coincided with economists' forecasts. A breakthrough of 1.0409 occurred along with a reverse test from the bottom up of this level, which formed a very obvious sell signal, counting on the continuation of the bearish trend, which had a slight pause yesterday. However, I did not see a major downward movement. The bulls managed to take control of 1.0440 in the afternoon, and a reverse test from the top to the bottom of this range resulted in forming an excellent buy signal, as a result of which the pair rose by more than 60 points. A little later there was a similar consolidation above 1.0505 and a signal to open long positions. As a result, EUR/USD rose another 50 points. An attempt at a false breakout at 1.0559 led to consolidating losses, after which the bulls took this level as well, forming another buy signal there - another plus 40 points.

When to go long on EUR/USD:

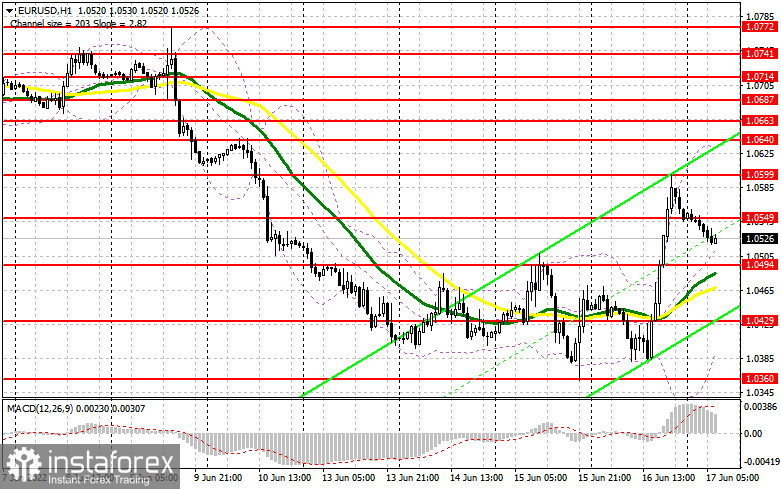

The euro managed to get above 1.0494, which indicates quite good prospects for further recovery of the pair. Inflation data in the eurozone for May of this year will be released today. According to economists' forecasts, the CPI index should not exceed 8.1%, but if this doesn't turn out to be the case and inflation continues to grow, all this will pull the euro up as well. The ECB will have no choice but to follow the same pattern as other central banks, raising rates more aggressively in order to contain inflationary pressures that are destroying the economy and leading to lower household living standards. In case the euro falls after the data is released, the key task is to protect the nearest level of 1.0494, just below which there are moving averages, playing on the bulls' side. Forming a false breakout there creates a signal to open long positions, counting on an attempt to regain the intermediate resistance of 1.0549, built on the basis of yesterday. A breakthrough and test from the top down of this range, similar to what I discussed above, will hit the sell stops, which will give a signal to enter long positions with the possibility of a larger upward correction to yesterday's high of 1.0599. A more distant target will be the area of 1.0640, where I recommend taking profits.

If the EUR/USD falls and there are no bulls at 1.0494, the pair may return back to the horizontal channel, which will mean new problems for bulls. In this case, I advise you not to rush to enter the market: the best option for opening long positions would be a false breakout in the support area of 1.0429. I advise you to buy EUR/USD immediately on a rebound only from the level of 1.0360, or even lower - in the region of 1.0306 with the goal of an upward correction of 30-35 points within the day.

When to go short on EUR/USD:

The bears failed to protect the upper border of the horizontal channel at 1.0494 and lost control of the market. It is obvious that the current downward correction observed in today's Asian session will not last long - exactly until the release of data on inflation in the eurozone, since there is nothing more for traders to rely on in the morning. In case EUR/USD grows in the first half of the day after a sharp jump in inflation in the eurozone in May this year, forming a false breakout at the intermediate resistance level of 1.0549 creates a signal to open short positions with the prospect of returning to the support of 1.0494 formed on the basis of yesterday. As I said, a lot depends on this level. A breakdown and consolidation below this range along with weak data from the eurozone, as well as a reverse test from the bottom up - all this will lead to a sell signal with the removal of bulls' stops and a larger movement of the pair down to the 1.0429 area. However, be very careful with selling today, as the bulls can take advantage of the moment of correction and increase long positions. It is obvious that the euro is heavily oversold and at current levels there are clearly fewer people willing to build up short positions than before. A breakthrough and consolidation below 1.0429 is a direct road to 1.0360, where I recommend completely leaving short positions.

In case EUR/USD increases during the European session, as well as the absence of bears at 1.0549, I advise you to postpone short positions to a more attractive level of 1.0599. Forming a false breakout there will be a new starting point for a downward correction of the pair. You can sell EUR/USD immediately on a rebound from the high of 1.0640, or even higher - in the area of 1.0663 with the goal of a downward correction of 30-35 points.

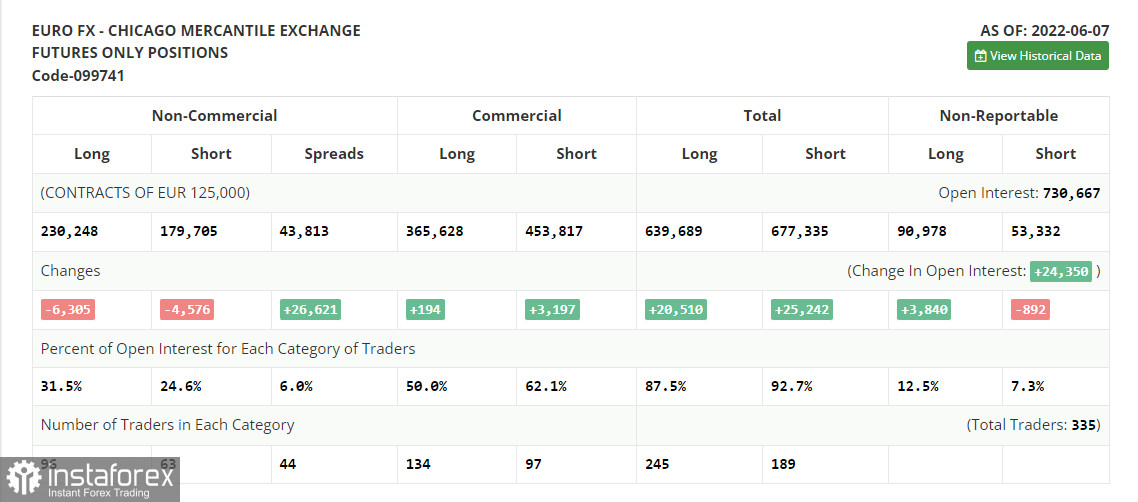

COT report:

According to the Commitment of Traders (COT) report from June 7, the number of both long and short positions slumped. The fact is that most traders were very cautious expecting the ECB meeting. That is why market activity was very low. The time showed that it was a perfect idea to avoid trading. Last week, the ECB's representatives said that the regulator would raise the benchmark rate at the following meeting. However, even this announcement failed to prop up the euro. The US inflation data published on Friday caused a decline in risk assets, including the euro. A further trend of the euro/dollar pair depends on the Fed's decision on monetary policy and forecasts for the next few years. If the regulator's stance remains aggressive, the euro is likely to slide deeper to new yearly lows.

The COT report unveiled that the number of long non-commercial positions declined by 6,305 to 230,248, while the number of short non-commercial positions dropped by 4,576 to 179,705. Although the euro is rather cheap, traders are not very interested in it. According to the week's results, the total non-commercial net position decreased to 50,543 against 52,272 a week earlier. The weekly closing price dropped to 1.0710 compared to 1.0742.

Indicator signals:

Moving averages

Trading is above the 30 and 50-day moving averages, which indicates the euro's succeeding growth.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a decline, the lower border of the indicator around 1.0390 will act as support. In case of growth, the upper border of the indicator in the area of 1.0640 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română