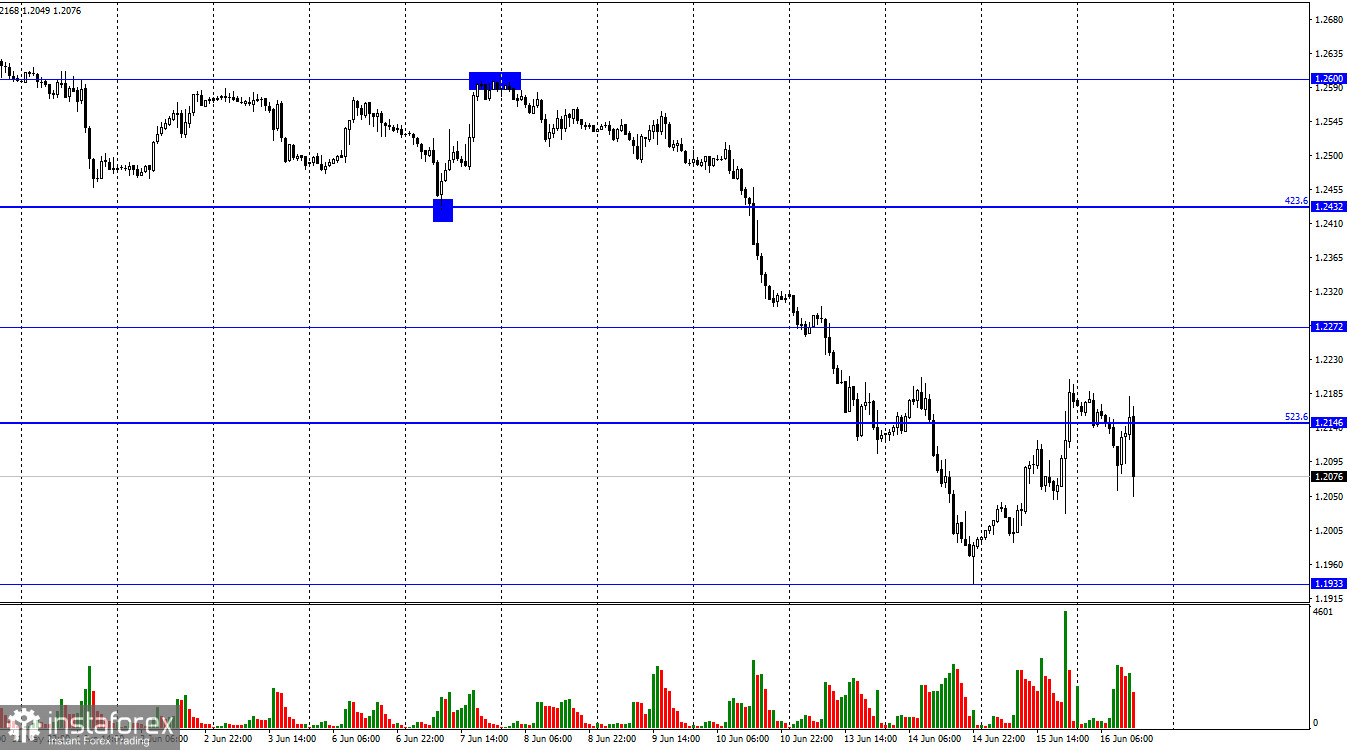

According to the hourly chart, the GBP/USD pair performed a reversal in favor of the British on Wednesday and rose above the corrective level of 523.6% (1.2146). However, this morning, even before the announcement of the results of the Bank of England meeting, a reversal was made in favor of the US currency and a drop of 100 points. At the hour when the results of the meeting became known, the British quotes managed to fall by 100 points, and then also grow by 100 points. Therefore, I cannot say that traders were pleased with the 0.25% increase in the interest rate. If we analyze both meetings, it is generally very difficult to draw any conclusions that would help determine the further dynamics of the pair. Last night, the Fed raised the rate by 0.75%, which has not happened in the last 28 years. However, this morning the pair was at the levels that were just before the announcement of the results. The pound sterling an hour after the announcement of the results of its central bank is about the same as before this event.

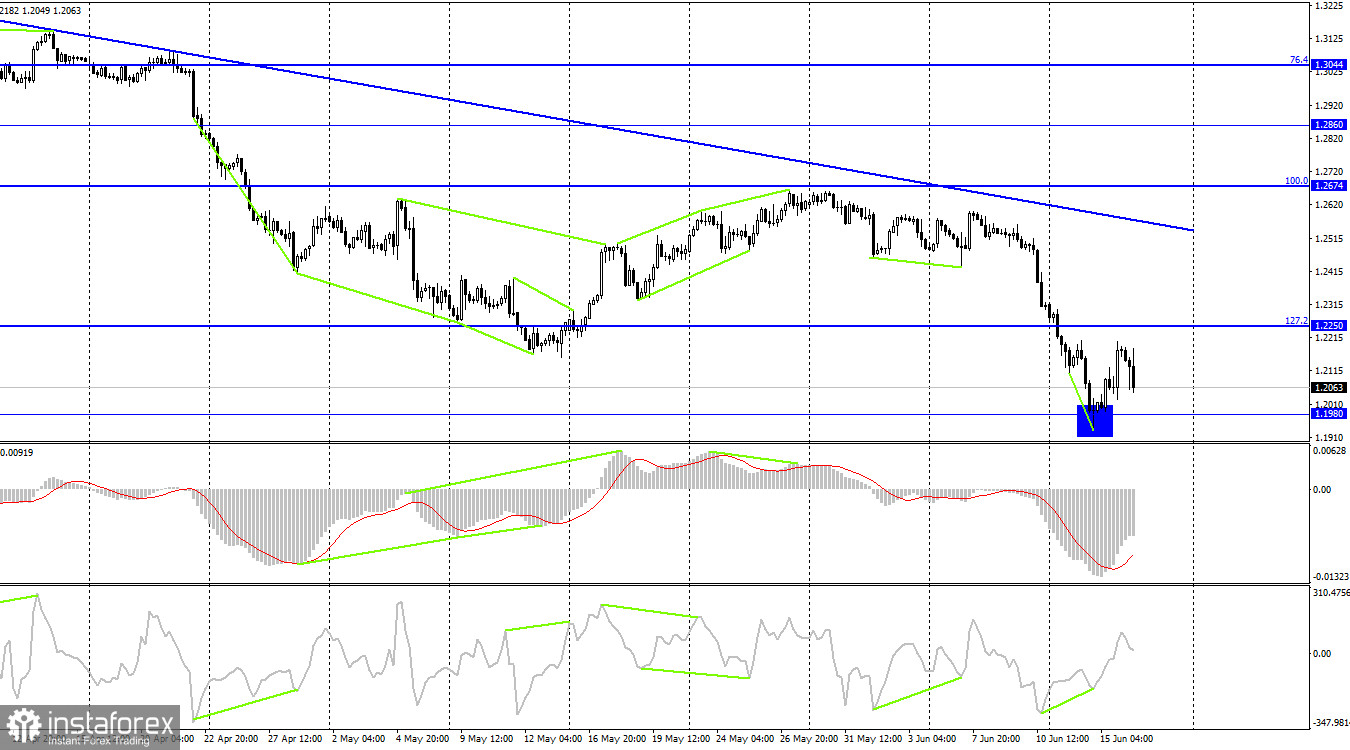

Of course, the British dollar will have some growth potential today, but why did the dollar show such weak growth yesterday? I believe that traders are now overwhelmed with important information and have not yet been able to fully formulate a trading strategy for the next few days or weeks. According to all the canons of fundamental analysis, the dollar should have grown noticeably yesterday, but this did not happen. I think that in the next few days we should pay more attention to the graphic picture. Fixing the pair's rate above the Fibo level of 523.6% will allow traders to count on further growth in the direction of the 1.2272 level. To determine further dynamics, it is better to refer to the 4-hour chart. And it clearly shows that the mood of traders remains clearly "bearish" and now there is not a single prerequisite for it to change.

On the 4-hour chart, the pair performed a fall to the level of 1.1980, a rebound from it, and a reversal in favor of the British. A "bullish" divergence was also formed at the CCI indicator. Thus, the growth process may last for some time in the direction of the Fibo level of 127.2% (1.2250). The rebound of quotes from this level will work in favor of resuming the fall of the pair. Fixing the pair above the level of 127.2% will increase the chances of continued growth in the direction of the downward trend line, which characterizes the mood of traders as "bearish".

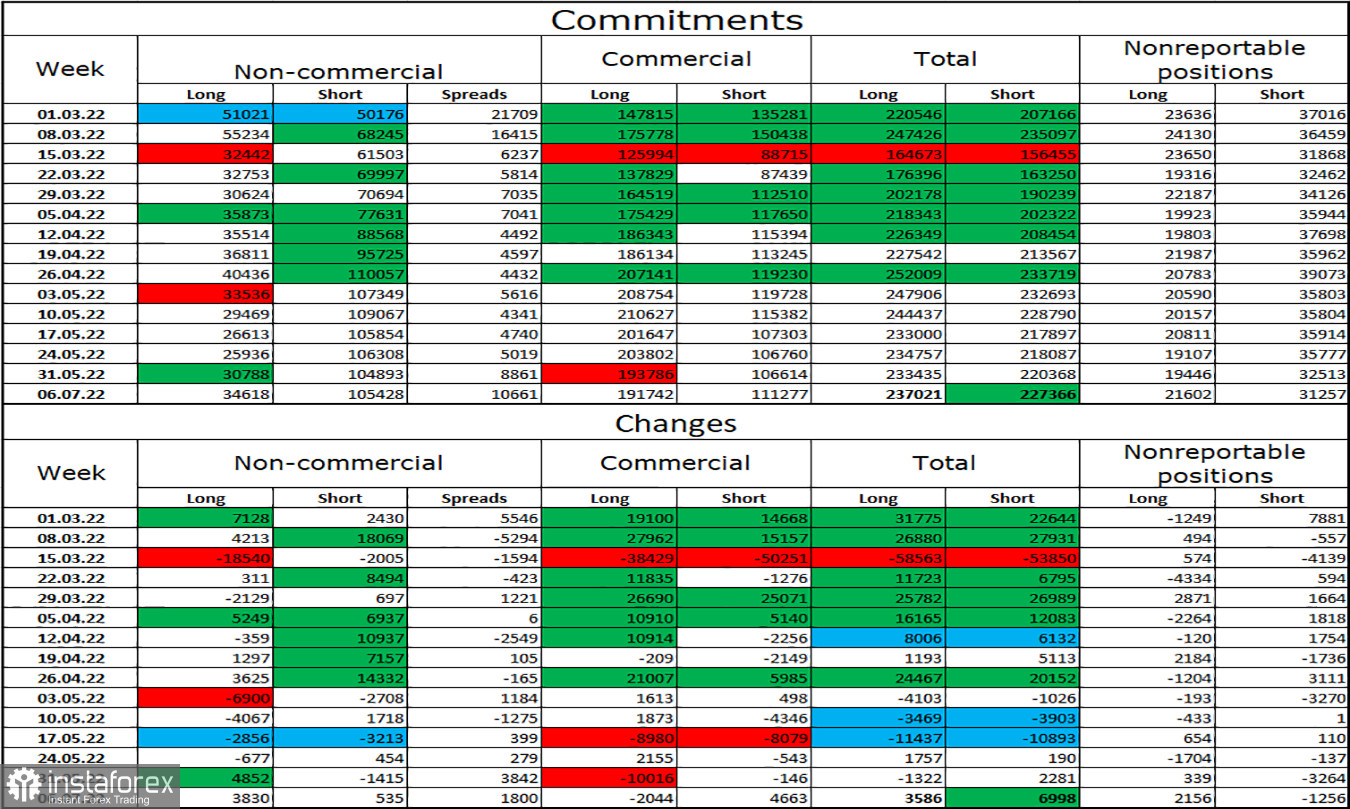

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has become a little more "bullish" over the past week. The number of long contracts in the hands of speculators increased by 3,830 units, and the number of shorts - by 535. Thus, the general mood of the major players remained the same - "bearish", and the number of long contracts exceeds the number of short contracts very much. Major players continue to get rid of the pound for the most part and their mood has not changed much lately. So I think the pound could continue its decline over the next few weeks. A strong discrepancy between the numbers of long and short contracts may indicate a trend reversal, but the information background is more important for major players now. So far, in any case, it makes no sense to deny that speculators sell more than they buy.

News calendar for the USA and the UK:

UK - Bank of England's interest rate decision (11:00 UTC).

UK - minutes of the monetary policy committee meeting (11:00 UTC).

On Thursday in the UK, the main and most important event of the day has already passed. In the USA today, not the most important reports on the issued construction permits or the production activity of the Philadelphia Federal Reserve will be released. But I believe that these reports will not affect the mood of traders in any way. The results of the Bank of England meeting will influence the mood for the rest of the day.

GBP/USD forecast and recommendations to traders:

I recommended selling the British at the close under the level of 423.6% (1.2432) on the hourly chart with targets of 1.2272 and 1.2146. Both goals have been fulfilled. I recommend buying the British when the pair's rate is fixed above the level of 1.2146 on the hourly chart with a target of 1.2272.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română