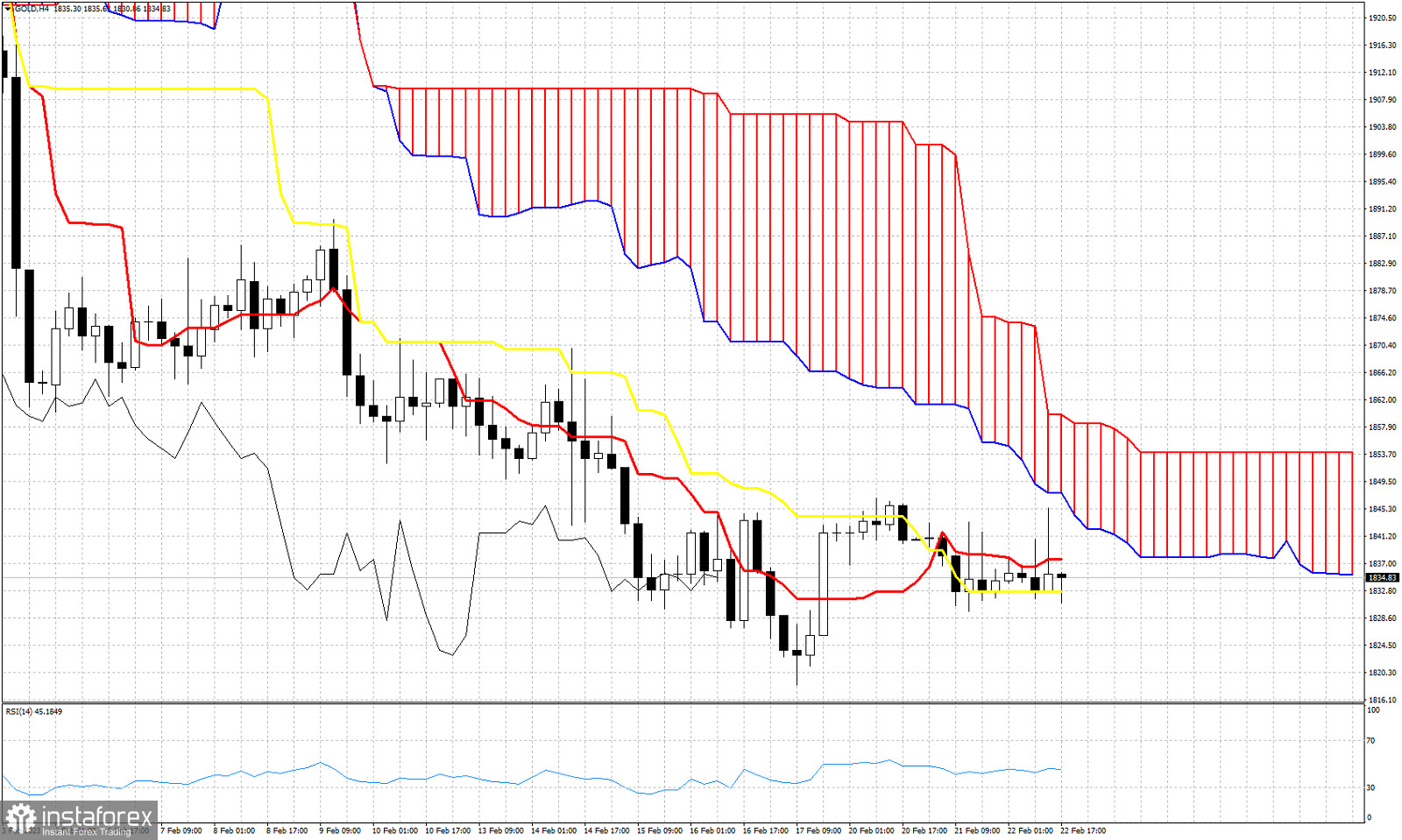

According to the Ichimoku cloud indicator Gold price remains in a bearish trend as price is still below the 4 hour Kumo. At the beginning of February we got our last important signal in Gold when price broke below the Kumo at $1,922. Since then trend is bearish. The tenkan-sen (red line indicator) and the kijun-sen (yellow line indicator) provide near term support and resistance. Support by the kijun-sen is at $1,832 and resistance by the tenkan-sen at $1,837. The lower cloud boundary is key resistance at $1,847. It can be tested again if bulls push price above $1,837. The Chikou span (black line indicator) is still bellow the candlestick pattern (bearish). Over the next couple of sessions by the end of the week I expect to see an increase in volatility. Inability to break above $1,837 will lead to rejection and a push towards $1,820. Recapturing $1,837 will lead to a push towards the Kumo.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română