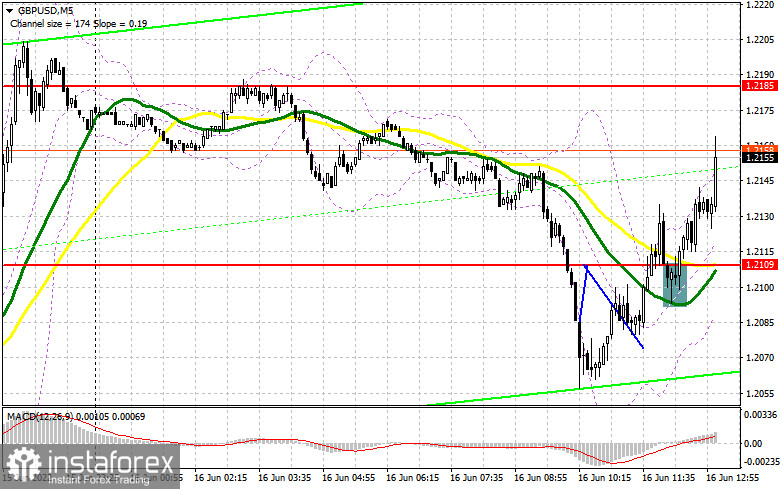

The pair showed several entry points in the first half of the day. Let's have a look at the 5-minute chart and analyze what happened. In my morning forecast, I drew your attention to the level of 1.2109 and recommended entering the market from it. Unfortunately, a breakthrough of this level happened without a bottom/top test, which prevented traders from opening short positions from that level. After bulls regained control over 1.2109, there was a reverse top/bottom test of 1.2109, which resulted in a false breakout and a buy signal, counting on the continuation of yesterday's bullish scenario. At the time of writing, the pair increased by more than 50 pips. The technical picture has changed slightly.

Long positions on GBP/USD:

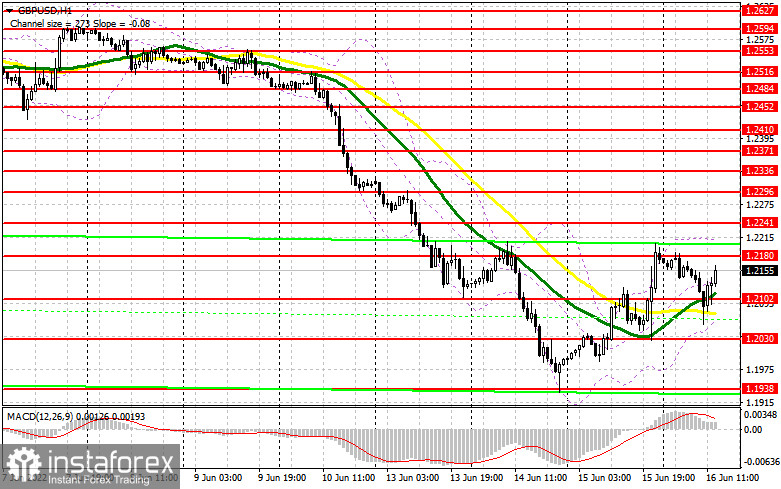

The Bank of England's decision is likely to play a major role today, but if its policy remains unchanged, we can expect the pound's rally to the new resistance at 1.2180. It would also be important to keep the control over the new support at 1.2102, to which the pair may fall after the Bank of England's report and comments. In case the pair rushes to the upside, only a breakthrough and a retest of 1.2180 from above are likely to trigger some Stop Loss orders and cancel the short-term bearish market and return the price to 1.2241. The next target is located in the area of 1.2296. Once the pair reaches this area, it will be possible to talk about a new uptrend. If the British pound declines after the decision of the Bank of England and strong US data release, bulls will have to do their best to protect the support of 1.2102, formed in the first half of the day. Only a false breakout at this level may create a signal for the opening of long positions while expecting a bullish correction to continue. If bulls show weak activity at 1.2102, the pressure on the pair is likely to considerably increase again. This may quickly drag the pair to 1.2030. For this reason, it is better not to rush buying the pair. It would be better to enter the market after a false breakout at this level. It is not recommended to buy the GBP/USD pair from a rebound. Only a false breakout near 1.1938 may allow expecting an intraday rebound by 30-35 pips.

Short positions on GBP/USD:

Bears were active in the market but then they slowed down a bit. Many traders are afraid of more aggressive statements after the meeting, similar to what we heard from the Federal Reserve yesterday. As long as the trading is carried out below 1.2180, the upward correction will be seriously limited. A false breakout of this level after the Bank of England's statement may form a signal to open short positions according to the trend with the ain at the support of 1.2102, where the moving averages are passing, which are favorable for bulls. If bears manage to break through this level, bulls' Stop Loss orders may be triggered and the pair is likely to slide down to 1.2030, which is the last hope for bulls. A reversal test bottom/top of 1.2030 may form an additional sell signal and allow the pair to plummet to the area of 1.1938, where traders may lock in profits. The next target is located in the area of 1.1876, but that is a scenario with the most negative economic assessment by the Bank of England committee. If the GBP/USD pair rises and we see a lack of activity at 1.2180 there might be an upside surge amidst the triggering of the bulls' stop-losses. In this case, it is better to postpone opening short positions with a target of 1.2241. You may sell the pound there only after a false breakout is formed. It is possible to open short positions on a rebound from 1.2296 or even higher from 1.2336, allowing an intraday rebound by 30-35 points to the downside.

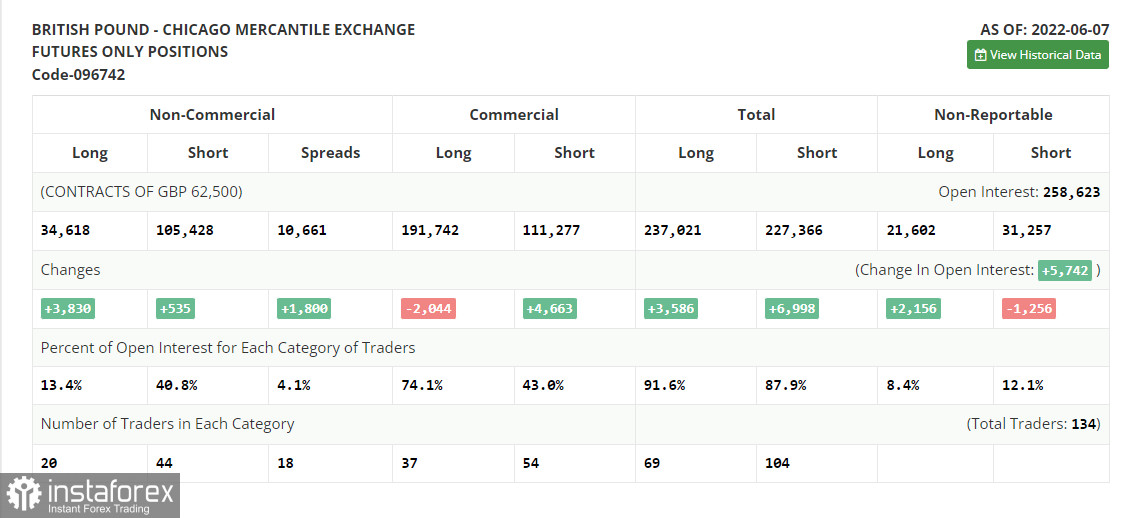

The COT report for June 7 logged a large increase in long positions and only a small increase in short ones. However, at the moment, the picture is quite different: the last three trading days turned the market upside down. The further direction of the pair, which is nearing the yearly lows, depends on the Federal Reserve meeting and its decisions. A more aggressive policy is likely to push the GBP/USD pair down, as the UK economy, as the latest data shows, is gradually contracting, which does not add confidence to investors. The meeting of the Bank of England is unlikely to help the pound as the regulator may not give up its policy of raising rates. I very much doubt its further aggressive actions aimed at fighting inflation by sacrificing the growth rate of the economy. While Governor Andrew Bailey continues to say that the regulator is not yet going to give up on raising interest rates, there are no hints of a more aggressive approach to the monetary policy either. The COT report indicated that long non-commercial positions rose by 3,830 to 34,618, while short non-commercial positions increased by 535 to 105,428. This led to a decrease in the negative nonprofit net position to -70,810 from -74,105. The weekly closing price rose to 1.2511 from 1.2481.

Indicator signals:

Moving averages

The pair is trading near the 30- and 50-day moving averages, indicating some uncertainty ahead of important statistics.

Note: Period and prices of moving averages are considered by the author on hourly chart H1 and differ from the common definition of classic daily moving averages on daily chart D1.

Bollinger Bands

If the pair grows, the middle boundary of the indicator at 1.2200 will act as resistance.

Indicators description

- Moving average defines the current trend by smoothing out volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average defines the current trend by smoothing out volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence) indicator Fast EMA of period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands. Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions, which use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română