The outcome of the Fed's monetary policy meeting always plays a significant role in the dynamics of global financial markets. However, many already expected that rates will be raised by 0.75% to 1.75%, so nothing much happened yesterday. In addition, Fed Chairman Jerome Powell said this kind of increase is a one-time thing, stressing that the next moves will depend on the situation with inflation and the state of the country's economy.

The decision was also not surprising given the technical oversold situation that is now on the markets.

Today, the Bank of England is also releasing its decision on interest rates, which many assume to be an increase of 0.25% to 1.25%. But this is unlikely to support pound as the difference in interest rates is not in favor of the currency. This means that if there are no surprises, GBP/USD will again be under pressure.

Looking at all this, it is clear that the Fed does not want to drive the US economy into a deep recession by actively raising rates, but it will do so if necessary. It is ready to stop at any time if inflationary pressure eases. On this wave, a "bottom" may begin to form in the stock markets, and dollar's growth will gradually slow.

Forecasts for today:

EUR/USD

The pair is consolidating above 1.0400. A dip below will prompt a further decrease to 1.0350.

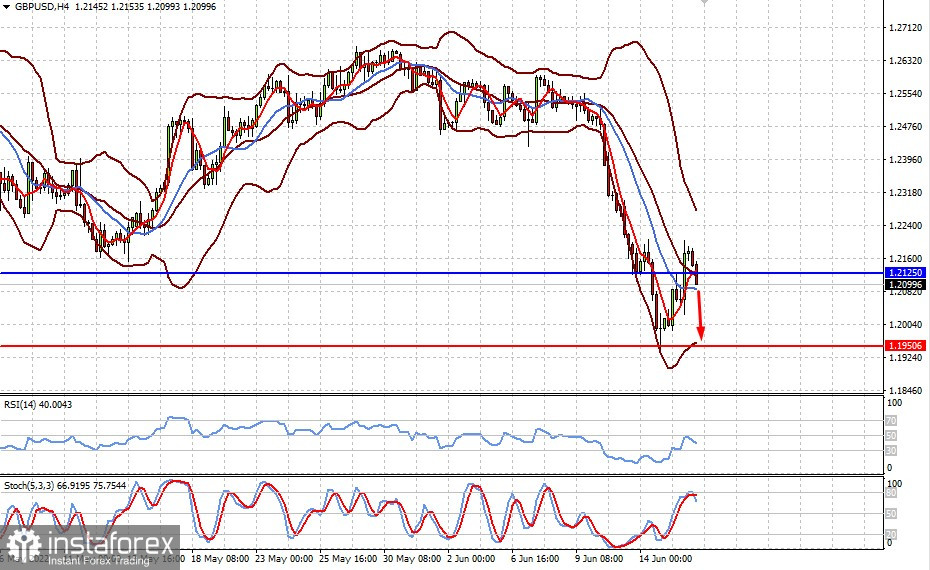

GBP/USD

The pair is declining ahead of the Bank of England's decision on rates. It is now below 1.2125, and may dip further to 1.1950 depending on the outcome of the policy meeting.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română