Today, we expect a very important event of the day and the whole week. In the evening, the FOMC will announce its decision on interest rates and publish its economic forecast. Half an hour later, the press conference with Jerome Powell will take place. He will explain the decision of the FOMC, review the current state of the global economy, and outline further plans of his department. Market participants widely expected the US regulator to raise the federal funds rate by 50 basis points, that is, to 1.5%. Most probably, these expectations have already been priced in by the USD market. That is why the greenback has been actively growing across the board recently. If this assumption is true, the US currency may follow the scenario that happened to it after the two previous rate hikes that also came in line with the forecast. Before the announcement, traders were buying the dollar but after the actual increase of the rate, they began to sell it.

This is exactly what happened after the two previous rate hikes. Even the hawkish stance of Fed Chair Jerome Powell could not save the dollar from falling. It is highly likely that the same will happen today given that the US dollar has considerably advanced against other majors. Therefore, it may decline after the Fed announces a 50-basis-point increase. The only condition that will maintain and even boost the uptrend in the US dollar is the decision of the Fed to lift the rate by 75 basis points instead of 50. However, the central bank is unlikely to do such a move. As I see it, the US Federal Reserve has already outlined the plan of its tightening cycle and has no reason to rush. It is true that inflation is high but too rapid monetary tightening can do more harm than good. First, the US regulator needs to analyze the effectiveness of the previous rate hikes of 25 and then 50 basis points. This is quite logical and professional when conducting monetary policy. In the economic calendar today, we can see other macroeconomic reports such as retail sales in the US and industrial production in the euro area. However, the Fed will be in the spotlight today.

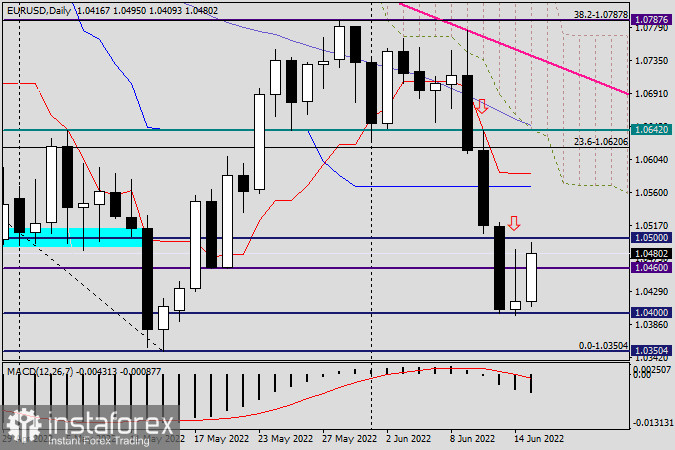

Daily chart

I am glad to note that my trading recommendations from yesterday turned out to be relevant. The most popular currency pair on Forex indeed went lower to the key level of 1.0400. After facing support, it pulled back to the strong broken price zone of 1.0460-1.0500. A long upper shadow that appeared in this zone confirmed my recommendation to sell the pair on a pullback to 1.0460-1.0500. The only thing is that the targets were located too close. This is quite natural as the market is cautious ahead of Jerome Powell's statement. Everybody is waiting for the FOMC meeting to get a clue about the future plans of the regulator. At the moment of writing, the euro/dollar pair was moving upwards to trade near the level of 1.0464.

If we count on the technical factors, a retest of yesterday's highs at 1.0485 will most likely send the pair towards the psychological level of 1.0500. However, the technical factor may not be prevailing today. I think that the FOMC meeting will have the biggest effect on the pair's trajectory. Therefore, I believe that it won't be right to give any specific recommendations for today's session. As for my assumptions based on years of experience and trading observations, the pair may rise following the two previous scenarios as I mentioned above. Let's discuss the technical picture and the further direction of EUR/USD tomorrow when the news is already out. For those who have any open positions or want to open some, I recommend trading very carefully amid the Fed's statement as the market may be highly volatile today and all Stop Losses may be triggered.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română