The composite index of the largest companies in the region Stoxx Europe 600 by 12:33 GMT + 3 fell by 0.05% and amounted to 464.09 points.

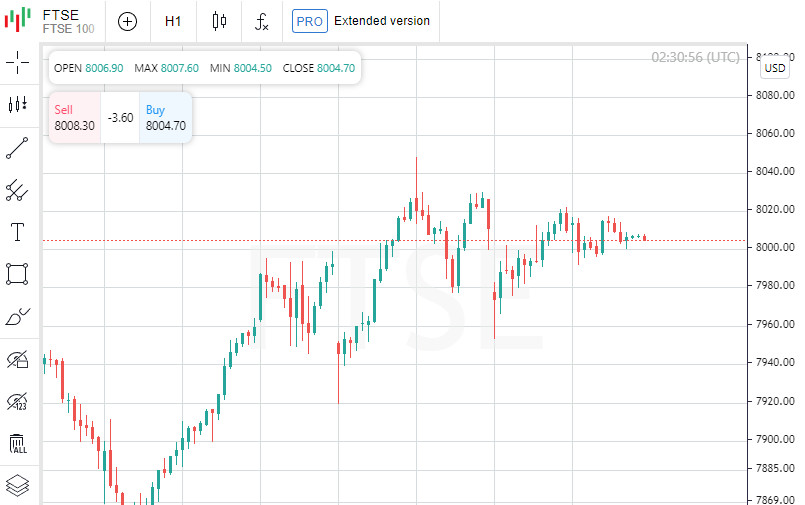

The British stock index FTSE 100 fell by less than 0.1%, the German DAX - by 0.24%, the French CAC 40 - by 0.31%. The Italian FTSE MIB and the Spanish IBEX 35 lost 0.1% and 0.3% respectively.

Trading activity in world markets is expected to be lower than usual on Monday due to the celebration of Presidents Day in the US.

Stocks in Shanghai and Hong Kong rose sharply on Monday on news that the People's Bank of China kept its one-year Loan Prime Rate at 3.65% and the five-year lending rate at 4.3%. per annum.

People's Bank of China has not changed rates for six meetings in a row. At the same time, many economists believe that in the coming months the rate may be lowered to stimulate economic growth, writes Bloomberg.

On Wednesday evening, the minutes of the last Fed meeting will be made public, at which the key interest rate was raised by 25 basis points.

Investors are particularly looking forward to the minutes as several Fed officials, including the heads of the Federal Reserve Banks of Cleveland and St. Louis, said last week that they were calling for a sharper rate hike.

Shares of Pernod Ricard SA rose 0.1%. One of the world's largest producers of alcoholic beverages announced the start of a new stage of the share buyback program. The purchase of securities in the amount of up to 300 million euros will take place before April 6 and will be carried out as part of a total program of 750 million euros.

Stellantis and Pirelli are up 2%, leading gains on the Milan bourse, while Telecom Italia shares are down 2.9%.

Capitalization of the British retailer Frasers Group rose by 3.5% after the company announced a share buyback worth up to 80 million pounds ($96.26 million).

Quotes of Commerzbank AG fall by 2.7%. As reported, the shares of Germany's second-largest bank will be included in the calculation of the main German stock index DAX 40 from February 27 instead of the papers of the chemical company Linde, according to a report by Deutsche Boerse AG, operator of the Frankfurt stock exchange.

French supermarket chain Carrefour jumped 8% in market value to lead growth in the Stoxx Europe 600 index. The retailer reported annual revenue of more than 90 billion euros and recorded an 11% increase in like-for-like sales in the fourth quarter of last year.

The decline leader in the Stoxx Europe 600 is Raiffeisen Bank International, shedding 7.6%, while the gainer was led by French medical equipment maker Orpea S.A., which jumped 17.7%.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română