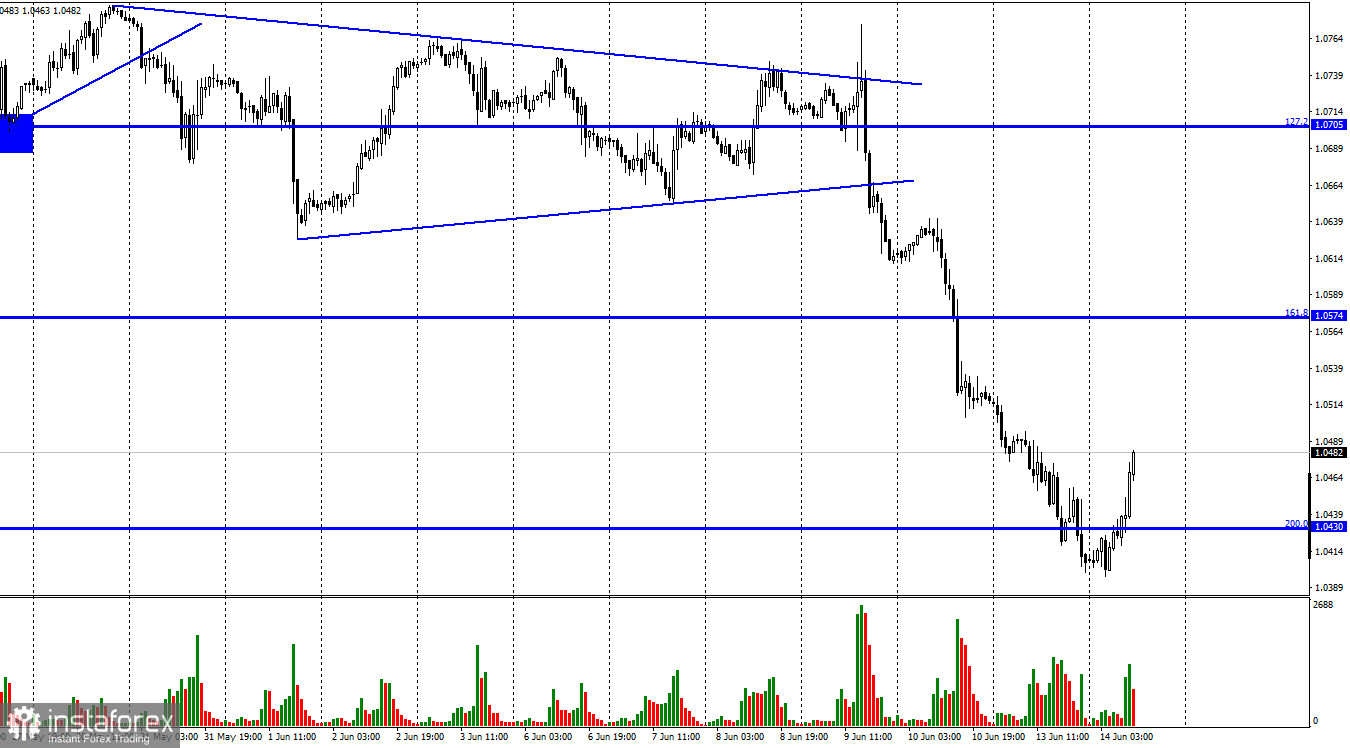

Hello, dear traders! The EUR/USD pair kept falling on Monday and consolidated below the 200.0% correction level at 1.0430. Overall, the pair has been declining for three days. Therefore, today the pair has reversed and started the upward pullback consolidating above the nearby level of 200.0%. The pair may continue rising towards the 161.8% Fibonacci level at 1.0574. However, the decline of the past three days (especially on Monday) is extremely significant. At the end of last week, the ECB meeting's outcome was published in the EU. On Friday, the US inflation report was released. Its results were unexpected for many traders. Traders' reaction is controversial, however, they had reasons to trade actively. Moreover, though there was no news background on Monday, the euro continued to decline. I think this means that bear traders took the initiative again.

Tomorrow evening, the Fed meeting's outcomes will be released. Besides, they will most likely not be favorable for the euro. Today, the pair may perform an upward pullback to drop more dramatically tomorrow. Notably, traders are almost confident that the regulator will raise the interest rate by 0.50%. Moreover, some analysts believe that the Fed may raise the rate by 0.75%. Nevertheless, both options will support the US dollar. Besides, the Fed has to accelerate the pace of monetary policy tightening. Inflation is further rising in the US, the EU, and the UK. Central banks are becoming willing to raise rates and cut stimulus programs. However, these moves are ineffective. Rates should be raised much higher, and each central bank's capacity for such changes is determined by the state of its economy. Therefore, different central banks may raise the interest rates by different amounts. Moreover, the EUR/USD and GBP/USD pairs are significantly determined by this aspect.

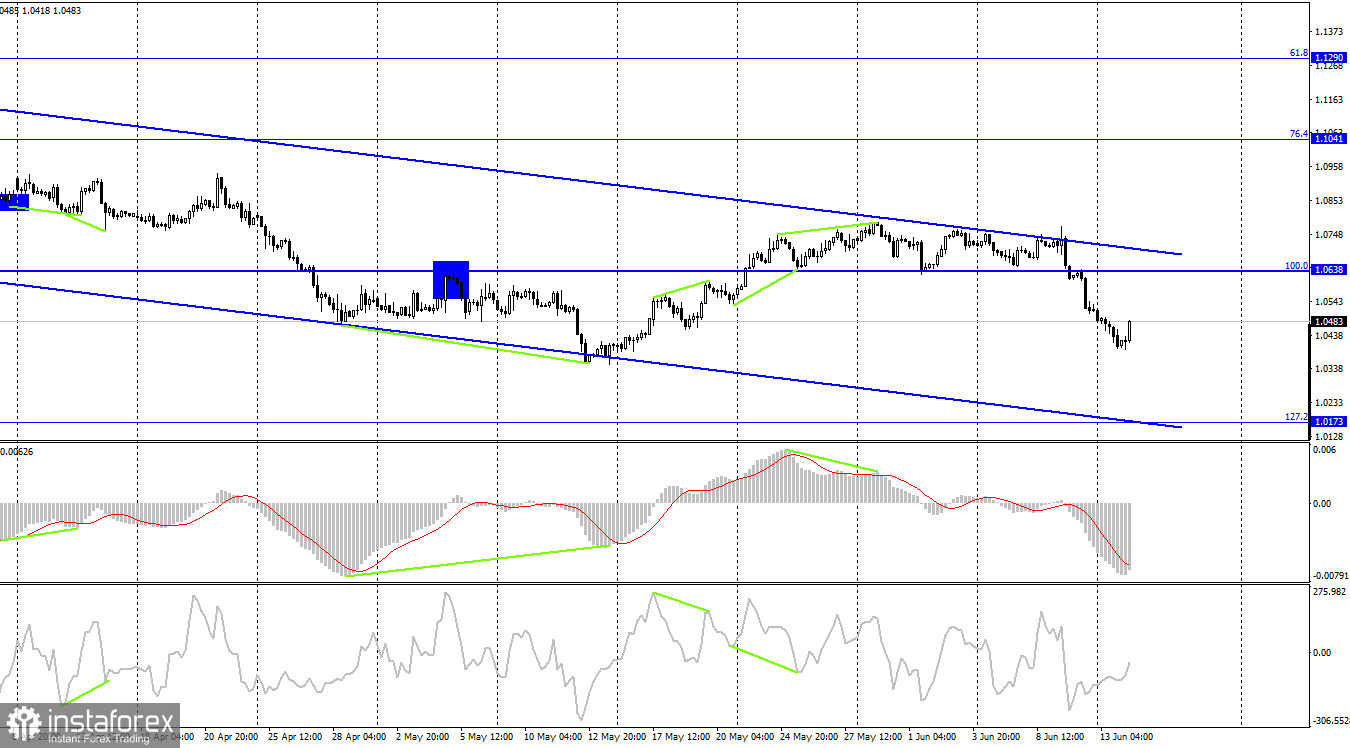

On the H4 chart, the pair rebounded from the upper line of the downtrend channel around which it has been moving for the past two weeks. The pair also closed below 100.0% correction level of 1.0638. Therefore, the pair will likely further fall towards the 127.2% correction level at 1.0173. If the pair consolidates above the descending channel, it will favor the euro and will resume its growth towards the 76.4% Fibonacci level at 1.1041.

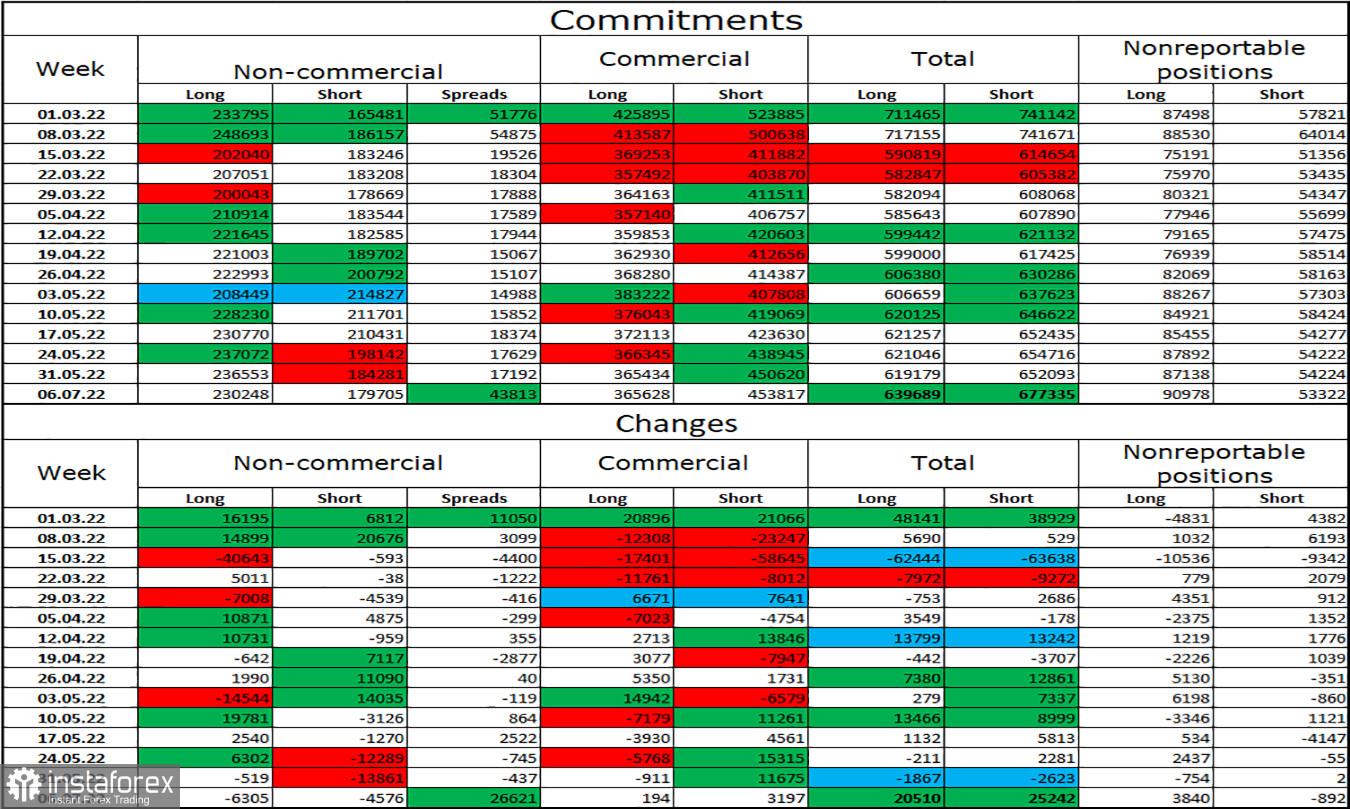

COT report:

Speculators closed 6,305 long contracts and 4,576 short contracts during the past reporting week. This means that the bullish sentiment of major players has slightly weakened. The total number of long contracts held by them is now 230,000, while the number of short contracts totals 179,000. As seen, the difference between these figures is not significant. Moreover, this fact does not favor the bears. Therefore, it is hard to believe that the euro has been constantly declining for the past few months. As for the euro, the sentiment of "non-commercial" traders remained bullish during this period. The prospects for the euro's growth have been rising slightly for the past few weeks. However, the last two days of the past week have exacerbated the situation. No positive news is expected for the euro this week. Therefore, the currency may continue falling, while speculators may further buy the euro.

US and the EU economic news calendar:

On June 14, the US and EU economic calendars do not have any entry. Therefore, news background will not affect traders' sentiment today.

EUR/USD outlook and recommendations for traders:

I recommended selling the pair when it closes below the level of 1.0638 on the H4 chart with the targets of 1.0574 and 1.0430. Both targets have been worked out. I recommend buying the euro in case it consolidates above the channel on the H4 chart with the target of 1.1041.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română