EUR/USD

Higher timeframes

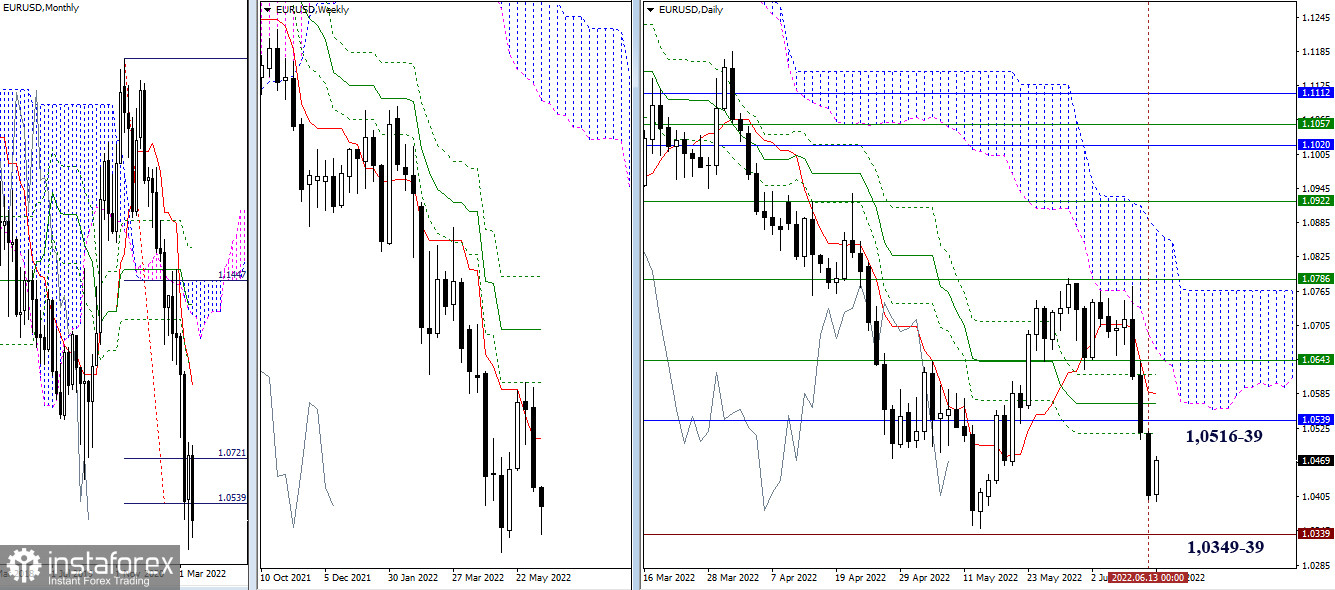

Bears dominated the market throughout yesterday's trading. Their benchmarks are now the local lows of May 2022 (1.0349) and January 2017 (1.0339). Consolidation below will restore the downward trend on the higher timeframes, after which new prospects will open for the bears. The resistances that will oppose the bulls, in case they recover their lost positions, have not changed their location today and can be noted at 1.0516 – 1.0568-85 – 1.0620 (daily Ichimoku cross) and 1.0539 (monthly level) – 1.0642 (weekly short-term trend).

H4 – H1

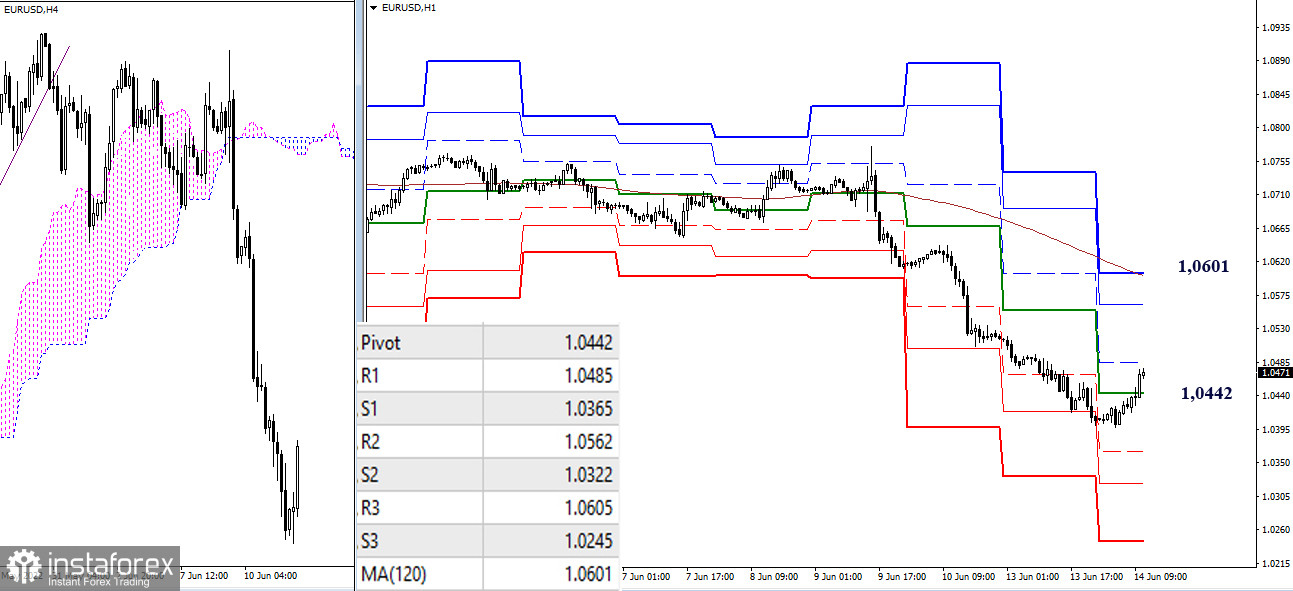

The main advantage on the lower timeframes belongs to the bears. Nevertheless, the pair is now in the upward correction zone. The main corrective reference point is the resistance of the weekly long-term trend (1.0601), on the way to this reference point, additional resistances of 1.0485 and 1.0562 (classic pivot points) can be noted. If the correction is completed and the bears manage to restore the downward trend (1.0397), then the relevance will return to the support of the classic pivot points, so the targets for intraday decline today can be noted at 1.0365 – 1.0322 – 1.0245.

***

GBP/USD

Higher timeframes

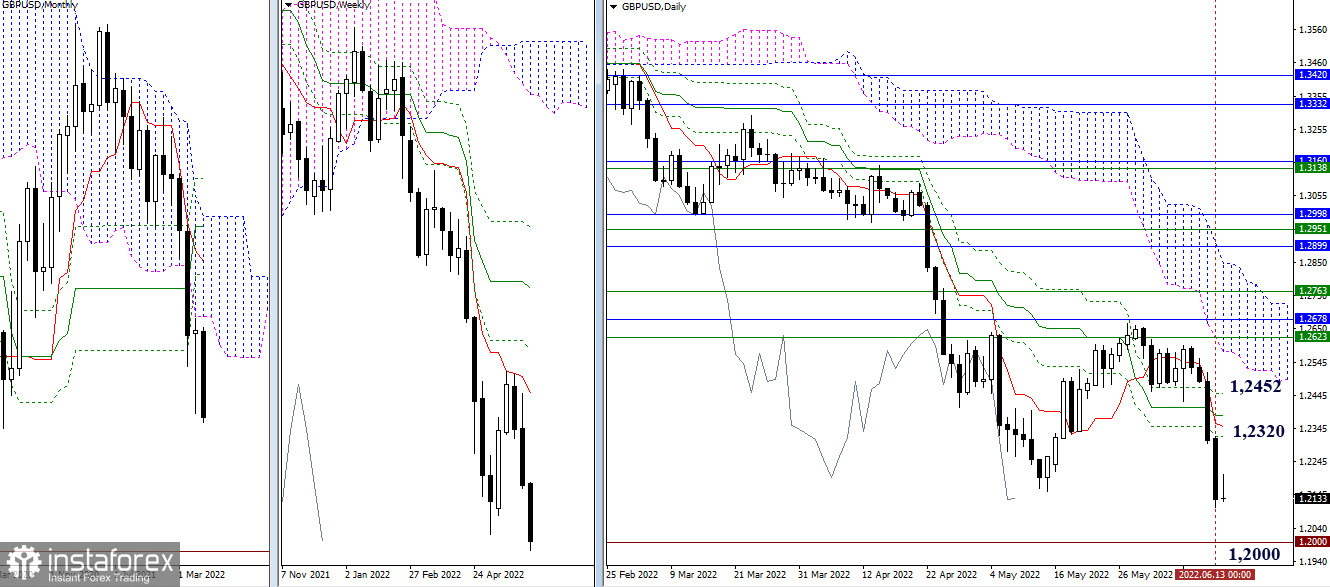

Sellers yesterday made a good bid to restore the downward trend, closing the working day below the local low of May (1.2155). Confirmation of the result and continued decline will reinforce bearish sentiment and opportunities. The nearest reference point for the decline may be the psychological level of 1.2000. The previously passed levels of the daily Ichimoku cross have now been turned into resistance, which, in case of the emergence of a new upward correction, will meet bulls at the levels of 1.2320 – 1.2352 – 1.2386 – 1.2452.

H4 – H1

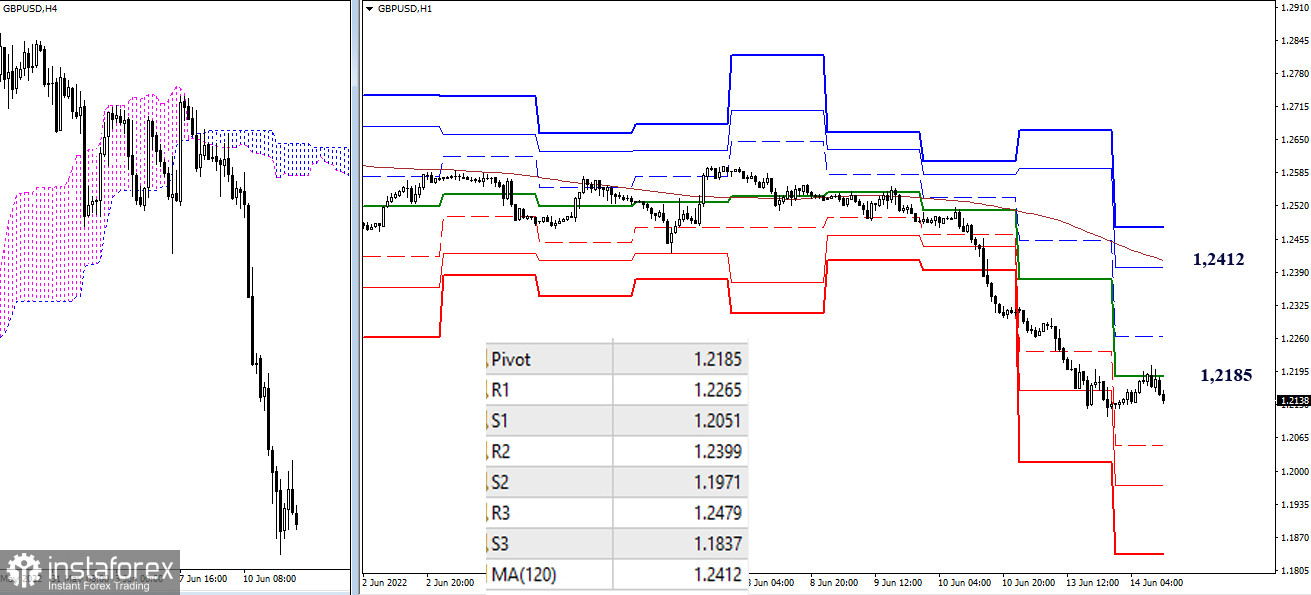

At the moment, the main advantage on the lower timeframes belongs to the bears. Their intraday reference points are the support of the classic pivot points, which today are located at 1.2051 – 1.1971 – 1.1837. The current resistance, which is now holding back the development of an upward correction, is the central pivot point of the day (1.2185), and the key resistance for the development of a correction, which is responsible for the current balance of forces, can be noted at 1.2412 (weekly long-term trend), intermediate resistance on this path can be provided by R1 (1.2265).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română