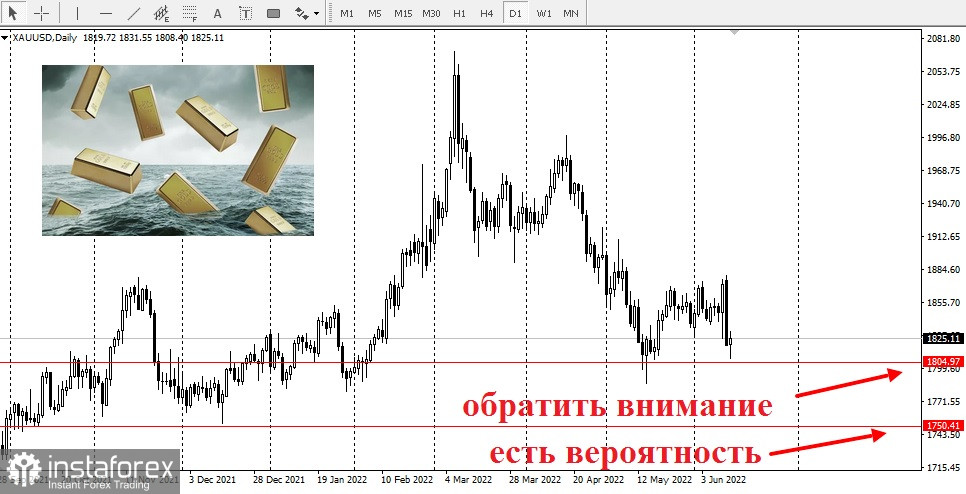

Gold experienced a sharp sell-off in response to rising bond yields. They strengthened the dollar, dropping by $50 in one day.The precious metal faces challenges as investors are still digesting Friday's inflation data and renewed fears of another deceleration of growth in China due to the latest COVID outbreak.The situation regarding COVID-19 in China could lead to a longer period of supply chain problems, which would fuel inflationary fears.Furthermore, expectations of aggressive rate hikes by the Federal Reserve, which are now seen as insufficient to control inflation, are rather inflated.It had been expected that the Fed would be able to slow down rate hikes by September or October. However, the tactics have now changed.Analysts are guessing how aggressive they will be and how long they will last. Aggressive tightening could continue until the end of the year.Consequently, gold remains at risk of a more significant sell-off.Support at $1,800 an ounce may not be held, and the gold market could fall to $1,750 an ounce.

According to strategists at TD Securities, a plunge below $1810 an ounce could cause significant selling pressure.

According to strategists at TD Securities, a plunge below $1810 an ounce could cause significant selling pressure.

The financial market collapse continues after last week's shocking CPI. All financial markets continue to react to last week's CPI inflation report. The CPI rose by 1% in May, pushing annual inflation up by 8.6%, the highest level since December 1981. The main drivers of inflation continue to be food, energy and housing.Last week's consumer price index report will certainly have a strong impact on the Fed meeting. It starts today in the US session and ends tomorrow with interest rate results. Some economists anticipate an interest rate hike of 75 basis points. However, the majority expect a 50 basis point increase now, at the July meeting and probably in August and September.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română