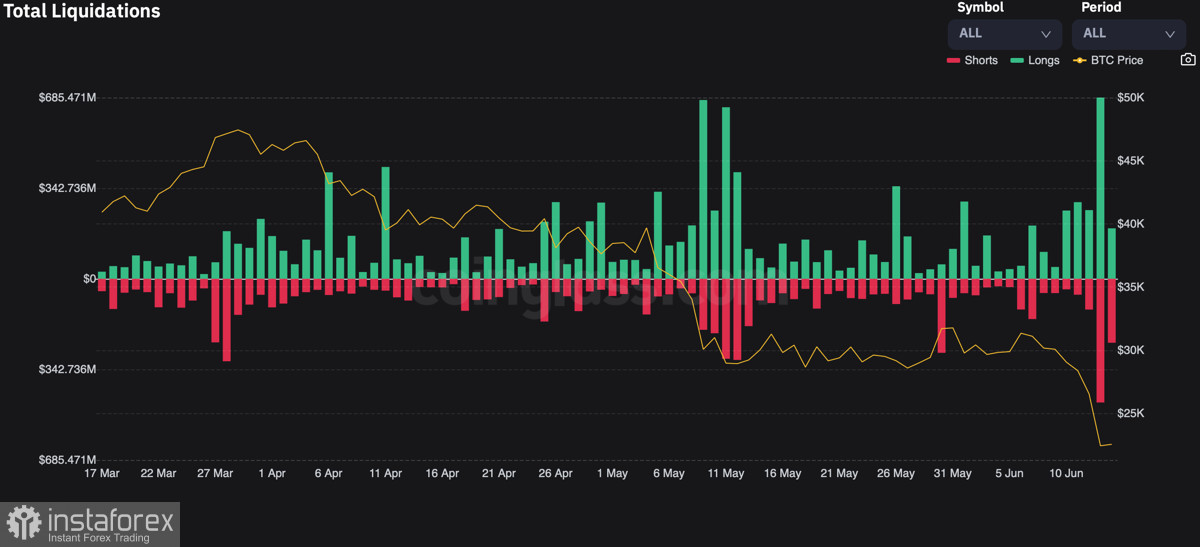

The new week began for the cryptocurrency market and Bitcoin with a real apocalypse. The main digital asset declined to $20.9k, after which it began to stabilize due to increased buying volumes. However, despite this, the total losses of traders over the past day reached $1 billion. According to The Block Research, the percentage of all purchased BTC coins that are in profit has decreased from 92% to 72%.

At the moment, the cryptocurrency dropped below $21k, followed by a massive buyout. As of June 14, the asset continues to consolidate around $22.2k. Sellers continue to dominate the market, despite the significant activation of buyers.

According to CryptoQuant, there have been two huge outflows of BTC coins from crypto exchanges over the past few days. At the same time, there is a massive sale of assets of liquidity pools, miners who have not received profits, as well as retail investors.

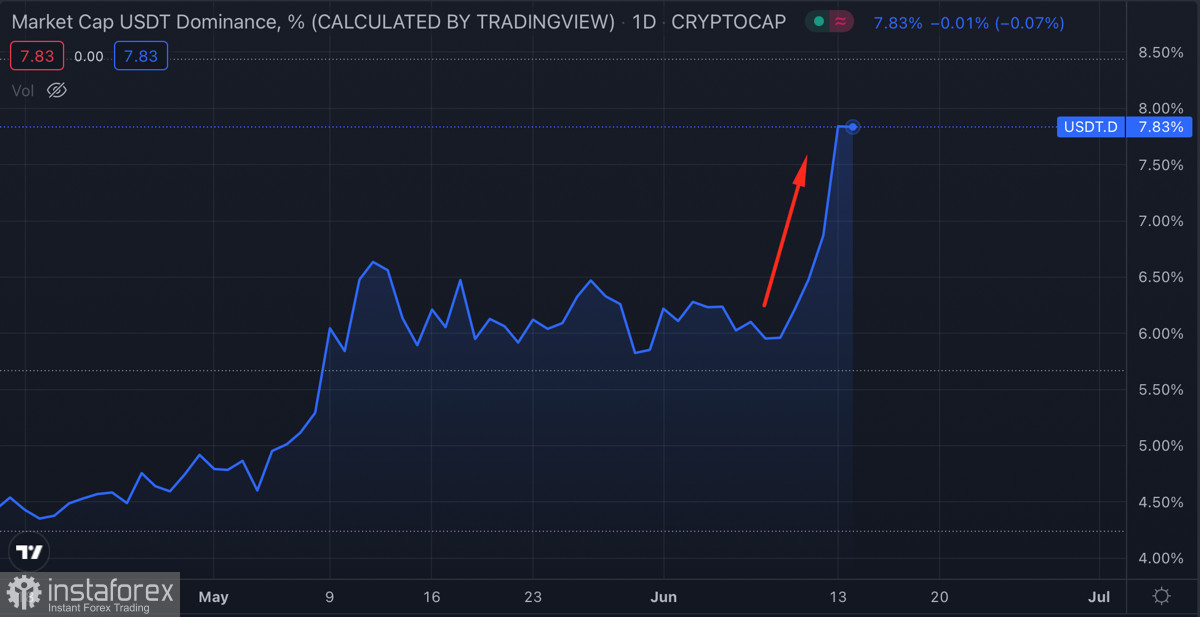

All this puts additional pressure on Bitcoin quotes. Despite this, there is every reason to believe that the market believed in reaching the local bottom of the cryptocurrency. This is evidenced by the growing volumes of long positions on a number of cryptocurrency exchanges. Another important signal indicating an increase in the pace of purchases is the growth in the volume of stablecoins on the market. During the collapse on June 13, the market capitalization of the USDT label increased significantly. The same goes for the USDC stablecoin.

A large influx of stablecoins to crypto exchanges during the collapse indicates the preparation of large capital for mass purchases. However, we are yet to see the realization of stablecoin stocks. According to TradingView data, the USDT and USDC accumulation period is over, the daily coin capitalization chart has turned sideways. This indicates the completion of the stage of accumulation of stablecoins. The next step will be the gradual purchase of cryptocurrency.

"Whales" are in no hurry to absorb free volumes, which may mean an even deeper drop in Bitcoin. As we have already noted above, the number of long positions is growing on some exchanges. More than 100,000 BTC are opened in long, which is a historical record. At the same time, only 3000 BTC is in short. So much attention to long positions can cause a backlash to purchase at even more favorable prices.

On Wednesday, the Fed, the central banks of the UK, Japan, and China will hold a meeting, and it can be assumed that another collapse may occur on this day. The key rate is expected to increase by at least 50 basis points. This can be a very convenient moment for another collapse, followed by a massive accumulation from large capital.

Bitcoin volatility has again reached a local high, which also increases the likelihood of impulsive price changes. With this in mind, there is every reason to believe that the local bottom of the main digital asset has not yet been established. Excessive market positivity can lead to a retest of the $20k level, which can lead to a cascade of negative consequences due to the MicroStrategy margin call and the next phase of a decrease in liquidity volumes.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română