Markets experienced another wave of shocking sell-offs on Monday, primarily due to the growing threat of recession in the United States. The sharp fall in US stocks prompted the negative wave in the European stock market, which, of course, had an impact on trading this morning in the Asia-Pacific region. But dollar, on the contrary, grew significantly, rising above the local highs of January 2017 and February 2020. It is supported by another increase in treasury yields, which is manifested in the next convergence of yields of interest-sensitive 2-year notes and a benchmark of 10-year bonds. The main reason is the increase in consumer inflation in the US, which removed all hopes that the Fed will pause raising interest rates. At the time of writing, the ICE dollar index is correcting slightly down to 104.80 points, losing 0.16%. Traders are obviously turning to safe assets in the face of impending recession.

If inflationary pressure continues, demand for dollar will grow further. Even rate hikes in the EU, UK and other economically developed countries will not be able to stop it. Dollar will also receive support due to a strong gap in real interest rates. It will only be stopped by a slowdown in inflationary pressure in the US and, in connection with this, an increase in expectations of a pause in the cycle of rising interest rates by the Fed.

Forecasts for today:

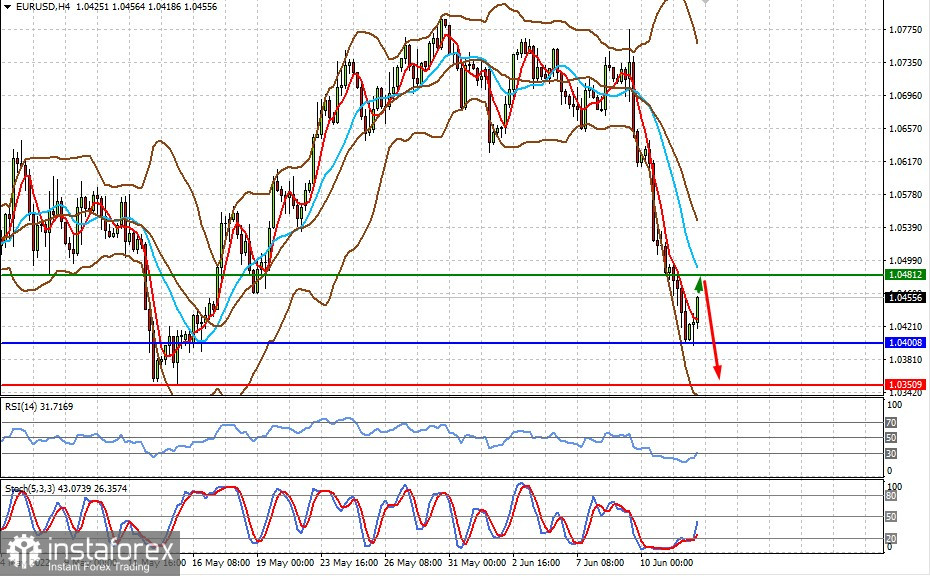

EUR/USD

The pair found support at 1.0400 and is recovering, thanks to a rebound in the European stock market. It will most likely head to 1.0480, but then turn around and return to 1.0350.

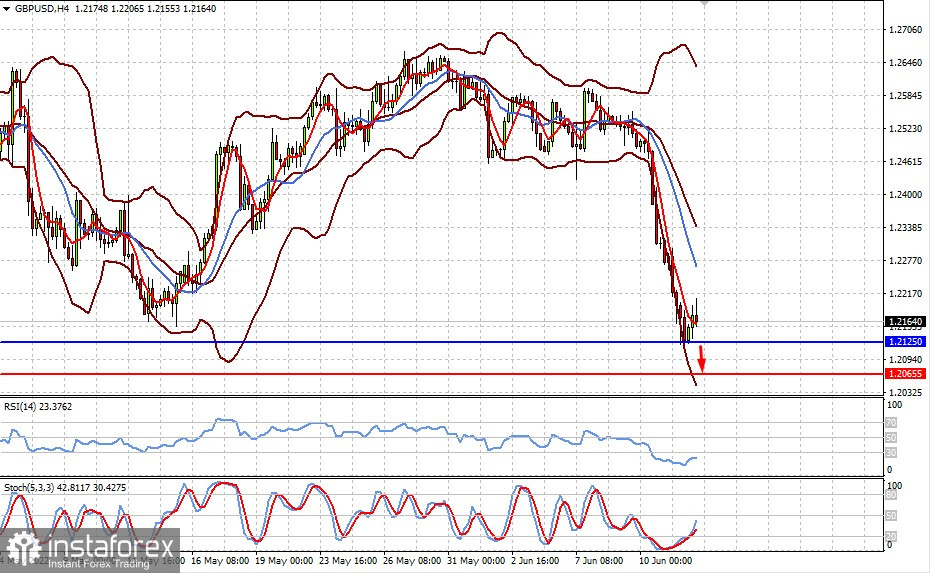

GBP/USD

Although the pair is currently trading above 1.2125, there is a high chance that it will decline to 1.2125, and then head to 1.2065.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română