Bitcoin reached $23k for the first time in two years and continued to decline, updating the local bottom. Buying activity continues to remain low due to the panic situation in the market and fundamental negativity. As a result, the cryptocurrency managed to stabilize around $22.5k. A similar situation occurred on the chart of the market capitalization of the crypto market, where the decline stopped at around $930 billion.

Mainly, the decline of the cryptocurrency and the entire market stopped due to mass purchases by retail investors. The institutional audience has been accumulating Bitcoins for a long time, and after the collapse, it is only gaining momentum in accumulation. However, it is important to note that an uncertain "Doji" candle has formed on the BTC and market charts. This suggests that even despite the massive buy-off and the activation of buyers, the downward trend dominates. However, a local breakdown in the uninterrupted fall has been achieved, which means that an upward correction should be expected in the near future. The likely target for an upward spurt will be the $24.4k level.

On the daily timeframe of Bitcoin, we have a powerful spill, as a result of which the main technical metrics have reached the oversold zone. The RSI dropped below the 30 mark and left the bullish zone, but subsequently stabilized and began a sideways movement. This indicates the achievement of a local bottom in the current downward momentum, and the beginning of a massive price buy-off. The stochastic oscillator also left the bullish zone and reached the overbought area around 20. Stochastic also began to turn in the upward direction, and even formed a bullish intersection, which indicates the emergence of a local upward momentum. With this in mind, we should expect a price rebound and a short-term upward correction in the near future.

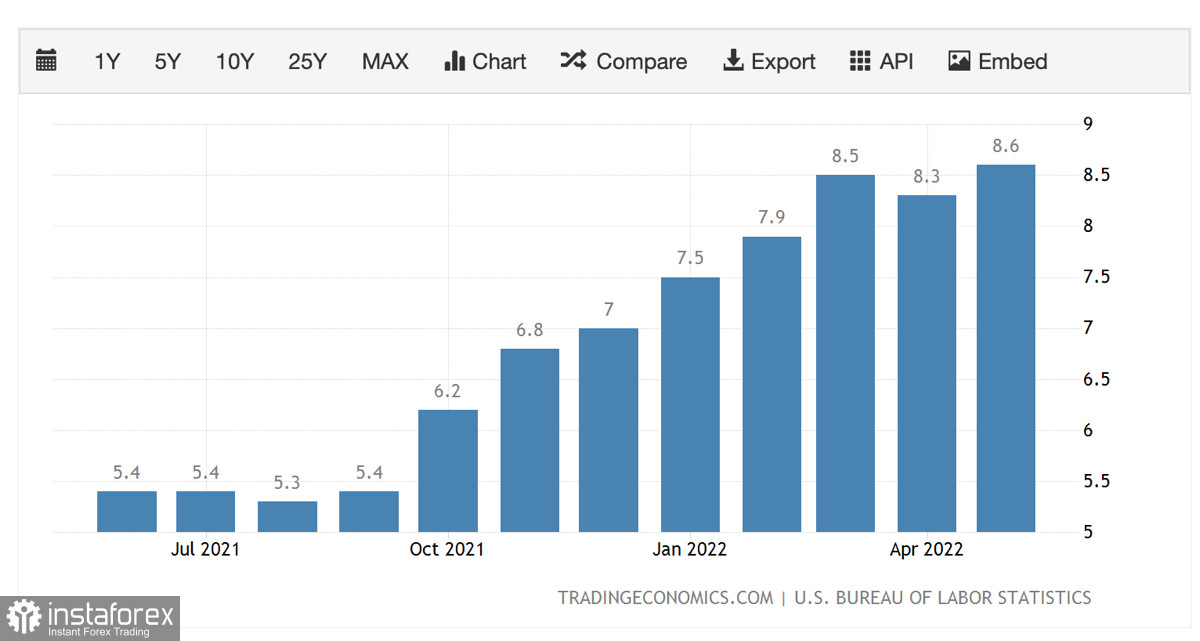

Bitcoin and the cryptocurrency market have completed one of the most painful corrective movements, but it is still too early to talk about the formation of a local bottom and a full price reversal. In the near future, the market will test its nerves for strength during the next increase in the key rate. On Wednesday, the Fed will hold a scheduled meeting, where it is planned to raise the key rate by 0.5.

However, taking into account record inflation, the department can make a knight's move and increase the figure by 75 basis points at once. In this case, the markets are waiting for another massive collapse, as the current quotes include a rate increase of 0.5. It is also important to note that in addition to the US, banks in Japan and the UK will also hold a meeting on the key rate.

With this in mind, the cryptocurrency market may expect another collapse. If this happens, we can expect new serious shocks in the market, such as the collapse of the UST. Yesterday, June 14, the stablecoin USDD lost its peg to the US dollar, which caused another wave of capital outflow.

The situation with the investments of the largest Bitcoin holders is even more alarming. MicroStrategy is getting close to a $21k margin call. If the company fails to fulfill its obligations to Silvergate Bank, another outflow of capital from the crypto market may cause a chain reaction.

Many decentralized companies will start selling off their digital coins in order to keep the remaining capital in fiat. This directly affects the prices of major cryptocurrencies. With this in mind, it is still too early to talk about the final bottom of Bitcoin and the cryptocurrency market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română