Pound fell to yearly lows, once again proving the very precarious position of the Bank of England. Much has now fallen on the shoulders of the government, which, despite the recent victory of Boris Johnson, is still having a difficult time coping with responsibilities. In fact, its recent £15bn package to support the population will definitely not last long.

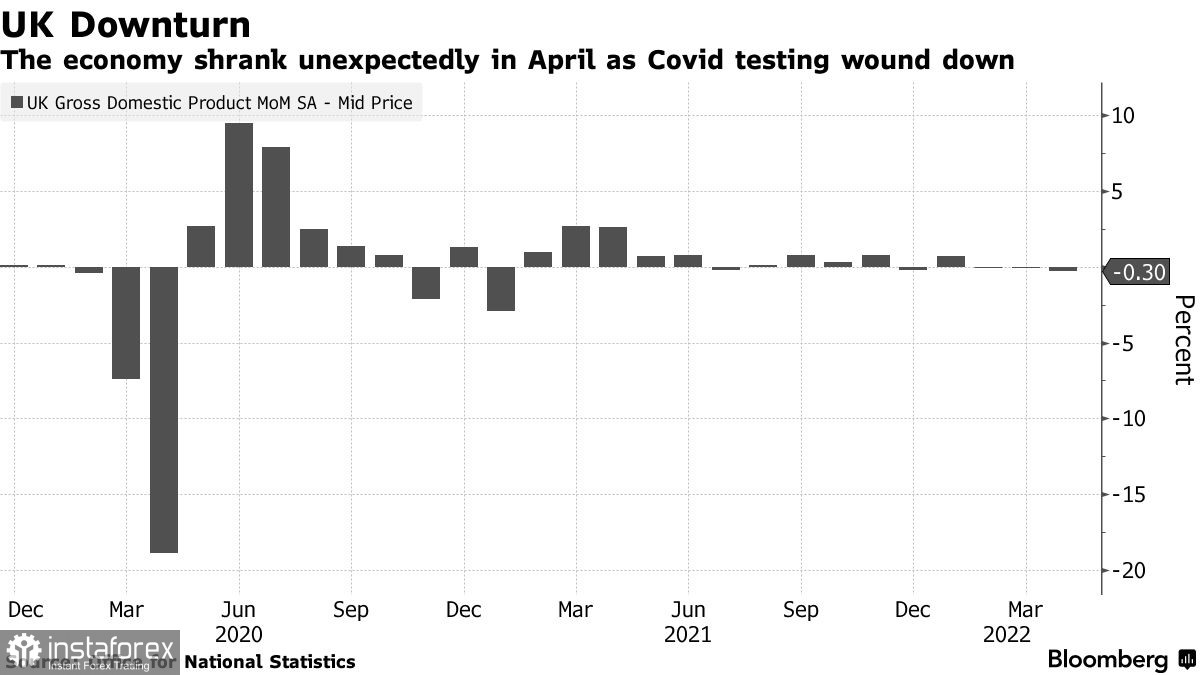

According to the Office for National Statistics, UK GDP fell 0.3% in April, while output fell 0.1%. The primary reason was the termination of the Covid testing program, which affected services. Reports say the sector declined due to a 5.6% decrease in healthcare costs, with testing and tracing activity falling nearly 70% in April. The ONS noted that if GDP is measured without including this indicator, the economy would still grow by only 0.1% per month.

The figures highlight the bleak outlook for the UK economy, especially since production has declined, while services and construction are far from ideal. But this is not the reason for the pound to collapse strongly as the numbers may still convince the Bank of England to act more cautiously in its fight against inflation. It is expected that at the meeting to be held this Thursday, the central bank will raise rates by a quarter of a point, but the further actions are still uncertain. Nevertheless, even a slight hint that the bank will pause the increase of rates will surely cause a sell-off in GBP.

A number of economists agree that the economy will remain subdued in the coming months, with industrial output down another 0.4% in the second quarter. But considering that inflation remains high and the labor market shows no signs of weakening, this will not be enough to prevent the Bank of England from raising rates. However, if the bank does not increase the rate by 50 basis points this week, the pressure on GBP/USD will continue, especially since it is expected that rates will rise to 2% only by November.

On the bright side, UK households continue to show signs of resilience despite the contraction in GDP. But looking at it more closely, it is clear that households are reducing consumption of basic necessities in response to a decrease in the cost of living.

In other data, the UK trade deficit narrowed to £20.6bn in April. Exports grew by 7.4%, significantly outpacing imports by 0.7%.

The report on retail sales will be released this week, where a reduction will further increase the pressure on pound. Even the housing market, which did not succumb to the economic downturn during the pandemic, is showing signs of cooling.

Talking about GBP/USD, bulls have defended the yearly lows around 1.2160 and now they will probably count on going beyond 1.2220, which will strengthen the correction of the pair. A break of 1.2220 will lead to an immediate push to 1.2270, where buyers will face more difficulties. The targets will be 1.2320 and 1.2370. But if the bears break below 1.2160, pound will go straight to 1.2120. Going beyond this range will lead to another downward movement to lows 1.2070 and 1.2030.

As for EUR/USD, it is obvious that the bearish trend is gaining strength, and the immediate support is now visible at 1.0420. The only goal of sellers now is this level. If buyers do not show themselves on the market, pressure in the pair will most likely increase. Dropping below 1.0420 will lead to a further fall to 1.0390, and then to 1.0350 and 1.0306. A correction will take place after an obvious return to 1.0500. That will open the prospects for recovery to 1.0540 and 1.0565.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română