The global sell-off intensified after an unexpected rise in US inflation, which will put pressure on the Federal Reserve to tighten monetary policy. Treasury bond yields traded at multi-year highs.

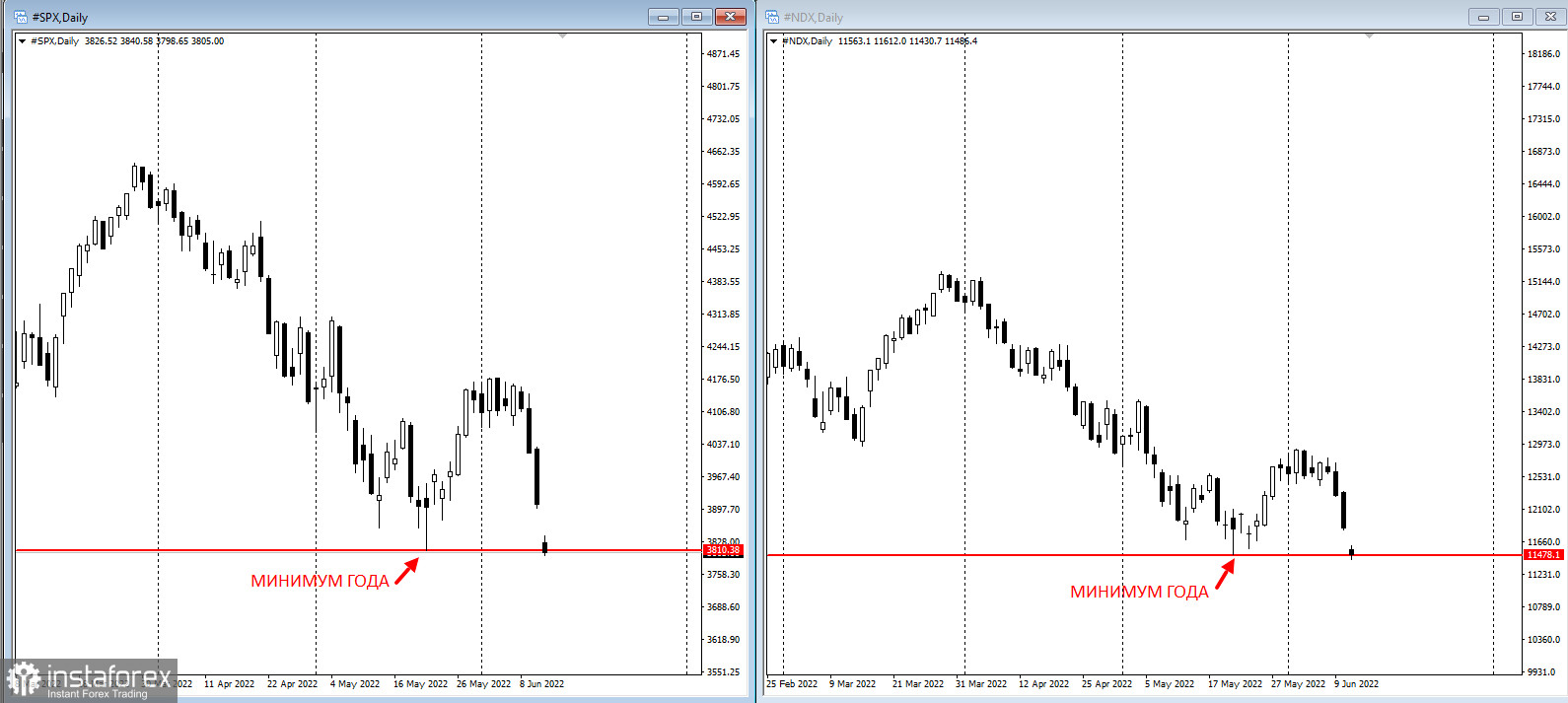

S&P 500 futures dropped by more than 10%, while Nasdaq 100 contracts fell even further. Indices plunged after Friday's consumer price shock report triggered a sell-off of more than $1 trillion. Today they reached new annual lows.

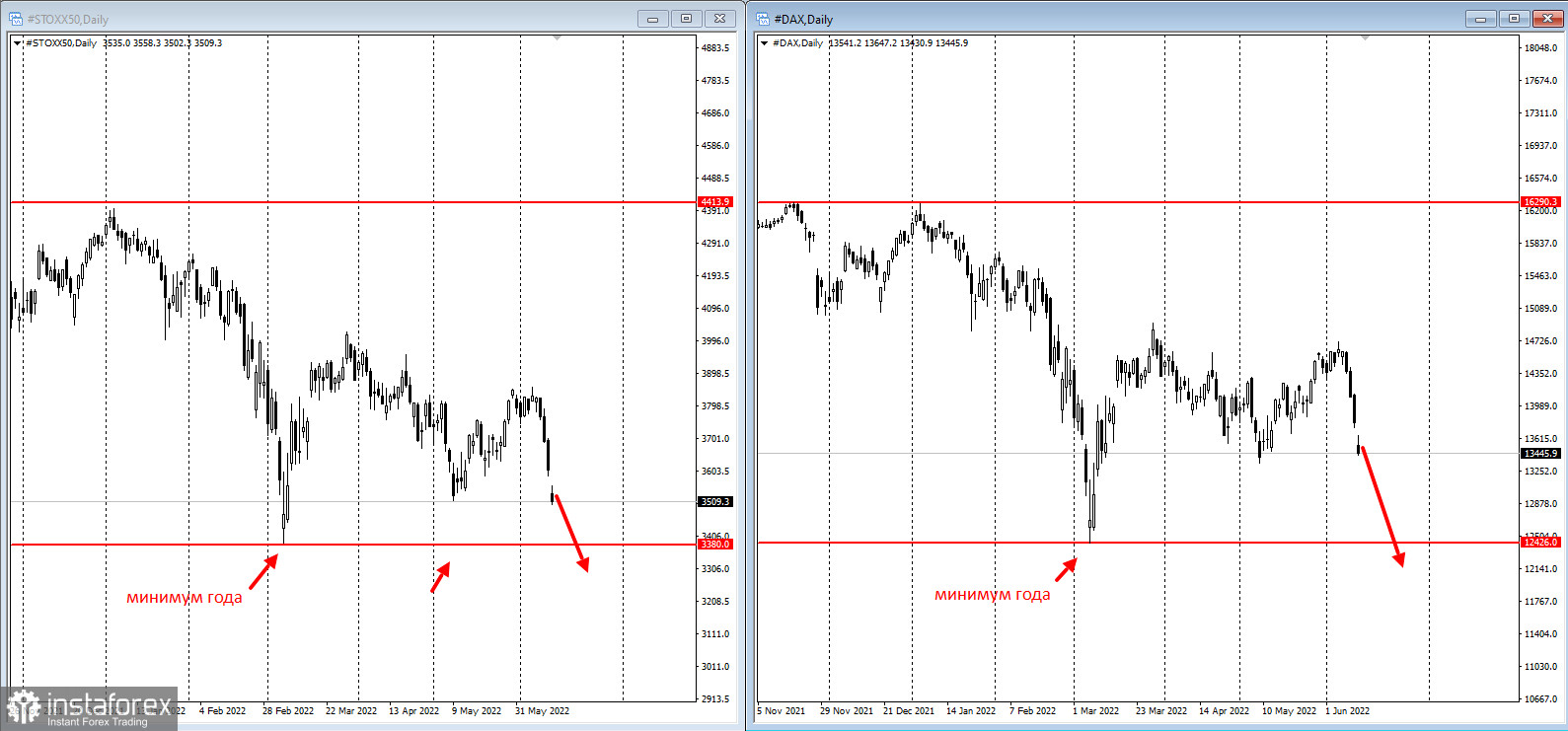

The Stoxx50 traded at its lowest level since early March. It seems set to hit the year's low:.

Traders are wagering on 175 basis points of tightening from the BOE by its September decision. This includes two half-points and one 75-basis-point increase. If that comes to pass, it would be the first time since 1994 the Fed resorted to such a draconian measure.

Meanwhile, European Central Bank Governing Council member Peter Kazimir said that he clearly saw the need for a 50-basis-point rate hike in September

What to watch this week:

US PPI, Tuesday.

- FOMC rate decision, Chair Jerome Powell briefing, US business inventories, empire manufacturing, retail sales, Wednesday.

- ECB President Christine Lagarde due to speak, Wednesday.

- Bank of England rate decision, Thursday.

- US housing starts, initial jobless claims, Thursday.

- Eurozone CPI, Friday.

- Industrial production, Friday

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română