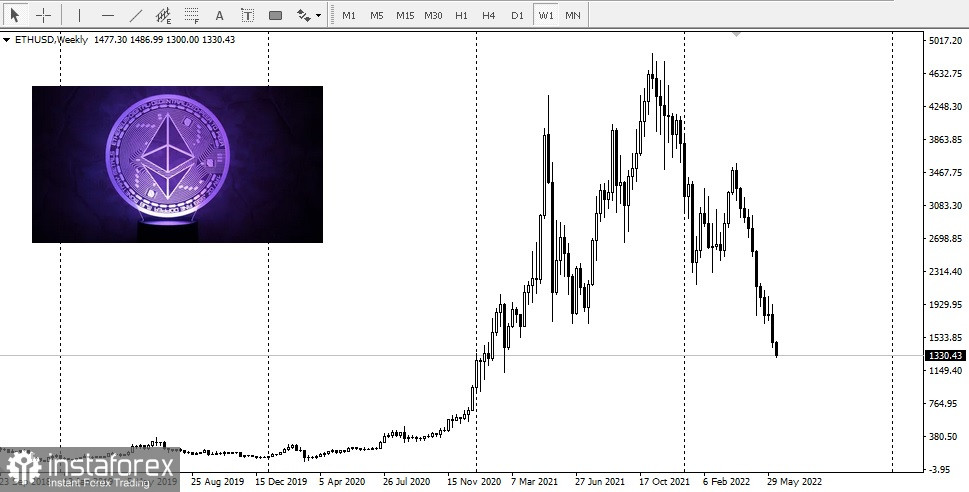

Over the weekend, the crypto space suffered another sudden collapse, undermining the outlook for future prices. The main macroeconomic driver damaging the crypto space, which is largely traded as a risky asset, was another hot inflation report. On an annualised basis, US inflation stood at 8.6% in May, a new 40-year high. It was expected to reach 8.3%.Following the release of inflation data, Mohamed El-Erian, chief economic advisor at Allianz, told CNBC that the Federal Reserve will have to be even more aggressive about raising rates. He added that inflation had not yet peaked.The reasons for Ethereum's decline were so significant because, in addition to the macro environment that exerted pressure, there is the problem of switching to a more energy-efficient proof-of-stake protocol from the proof-of-work protocol that Bitcoin also uses.

The delay in merging is due to the difficulty bomb, a code in Ethereum designed to increase the computational complexity of mining. It aims to gradually disconnect miners from the blockchain.

The delay in merging is due to the difficulty bomb, a code in Ethereum designed to increase the computational complexity of mining. It aims to gradually disconnect miners from the blockchain.

After implementation and completion, there will be a merge for the proof-of-stake system.With the proof-of-stake protocol, there will no longer be a need for miners. Instead, people will put their coins to verify new transactions and add them to the blockchain. This potentially consumes 99% less energy.The fact that developers delayed the release date of the difficulty bomb in order to fix some bugs that arose during the merger at Ropsten, one of the oldest test networks for Ethereum, has had an impact on the price of Ethereum."If there are no problems, then the merge will happen in August," Ethereum co-founder Vitalik Buterin said. However, a delay in the difficulty bomb might mean a longer wait for the merge.Bitcoin outlook.The latest sell-off has pushed prices below the $26,000 level.Poor performance in the stock market is also putting pressure on Bitcoin. There is now a risk of a drop to $19,000.

The week before last, Treasury Secretary Janet Yellen ignited a debate about whether bitcoin should be part of anyone's retirement scheme.

The week before last, Treasury Secretary Janet Yellen ignited a debate about whether bitcoin should be part of anyone's retirement scheme.

Yellen said it was possible that Congress could potentially start regulating which assets could be part of a retirement plan.This comes after Fidelity announced it would allow bitcoin as an option in its retirement plans.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română