Last week, it seemed that the situation in the cryptocurrency market was close to final stabilization. Bitcoin stabilized in a narrow range of $29k–$31k, and gradually restored investment attractiveness. The growth of open interest in Bitcoin provoked a decrease in correlation with the stock market, and it seemed that the local bottom of the market was passed. However, the cryptocurrency has proved that despite the growing demand from all categories of investors, the influence of fundamental factors cannot be underestimated.

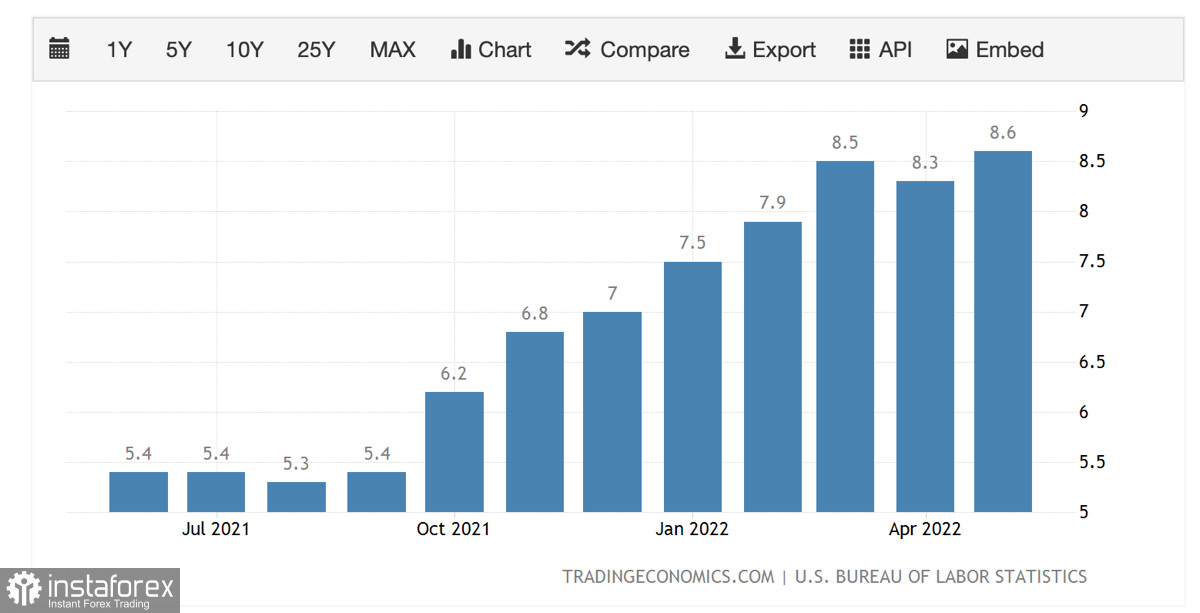

On Friday, the crypto market experienced one of the biggest drops in recent months. It was provoked by the publication of reports on the growth of consumer prices in the United States. The inflation index was a record 8.6%, despite the increase in the Fed's key rate and the start of the liquidity withdrawal program. The current inflation rate is the largest in the last 40 years, and without exaggeration, this is a huge blow to the stock and cryptocurrency markets.

It is for this reason that Bitcoin collapsed to $27k, and made a breakdown of the $29k–$31k range. On Friday, long positions worth more than $540 million were liquidated, and transactions of more than 180,000 traders were forcibly completed. Over the weekend, the fall in the price of the main cryptocurrency and the entire market continued. As a result, Bitcoin updated the local low at around $24.6k, and for the first time since 2020, it fell below $25k, where a local bottom was formed

The falling correlation with stock indices has again recovered to a maximum. This suggests that during fundamental crises, Bitcoin is perceived as a high-risk asset that will be sold first. Also, the restoration of the correlation indicates a likely continuation of the downward movement in conjunction with the stock market. The breakdown of $25k suggests that a new local cryptocurrency bottom may be set in the current bear market.

The main contributor to the further downward movement of Bitcoin will be the policy of the Fed and the correlation with stock indices. There is no doubt that after inflation at 8.6%, the Fed will significantly tighten all measures designed to calm it down. The market understands this and reinsures itself by withdrawing funds from high-risk assets. In the near future, we should expect even more aggressive monetary policy and an acceleration in the pace of liquidity reduction. The main victim of the Fed's policy will be the stock market, which again increases the correlation with BTC. With this in mind, $20k–$25k should be considered the new Bitcoin local bottom zone.

As for the current situation, the buyers stepped up when the $25k level was broken. A large number of pending orders to buy at the stated price have been triggered. The $24k–$26k zone has been a priority for investors in the current bear market. As of this writing, Bitcoin is consolidating around the previous low, at $25.2k. Technical indicators have collapsed in the oversold zone, but the stochastic oscillator has already formed a bullish crossover, which may mean a local recovery period to the $27k level. But in the future, there is every reason to believe that BTC/USD will continue to decline, as the market is once again shrouded in a fog of fear and uncertainty.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română