At the auction on June 6-10, the US dollar strengthened against all its main competitors. In this regard, the Swiss franc was no exception, which suffered significant losses at the auctions of the past five days. And this is although last week the Swiss National Bank (SNB) signaled a possible increase in interest rates, although not right now, that is, not in the short term. But the already strong US dollar received additional support when it became known last Friday that consumer prices in the United States of America rose more than economists' forecasts. As you know, the consumer price index is the most important inflationary indicator, and its current growth leaves the US Federal Reserve System (FRS) no choice but to further tighten its monetary policy by raising the main interest rate. So let's see what decision the Open Market Committee (FOMC) will make this Wednesday, and what will be the rhetoric of Fed Chairman Jerome Powell's speech during the traditional press conference. There is little doubt that the tone of the main American banker will be "hawkish", but we will learn about the degree of its rigidity already during the speech of the head of the Federal Reserve. Naturally, the Fed's decision on rates and Powell's press conference will be the most important event of this week. Let me remind you that the forecasts boil down to the fact that at the upcoming meeting the Fed will raise the federal funds rate by another 50 basis points, bringing it to 1.5%. Since such a step has already been taken into account in the price of the US dollar, much will depend on what the head of the US Central Bank will say regarding the further actions of the regulator.

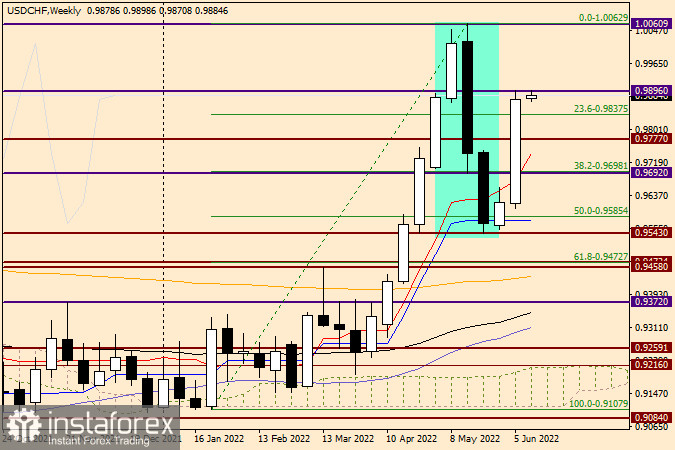

Weekly

The huge bullish candle that appeared on the weekly chart following the results of the previous trades fully confirmed the previously made assumptions regarding the further growth of the pair. Moreover, even the immediate goal, which was determined by the strong historical and technical level of 0.9900, was practically achieved. The USD/CHF pair last week showed maximum values at the level of 0.9896. Well, if the decision and the tone of the Fed are to the liking of market participants, the dollar/franc may soar to the recent highs that were shown at 1.0063, and once again test this resistance level for a breakdown. In case of unfavorable developments for the US dollar, USD/CHF will roll back to a strong technical zone of 0.9760-0.9750. Judging by the grid of the Fibonacci tool, stretched to the growth of 0.9090-1.0063, the pair gave a classic pullback to the middle of this movement, after which it turned up to resume the upward dynamics. But its continuation can be judged only after a true breakdown of the sellers' resistance at 1.0063 and consolidation above this level.

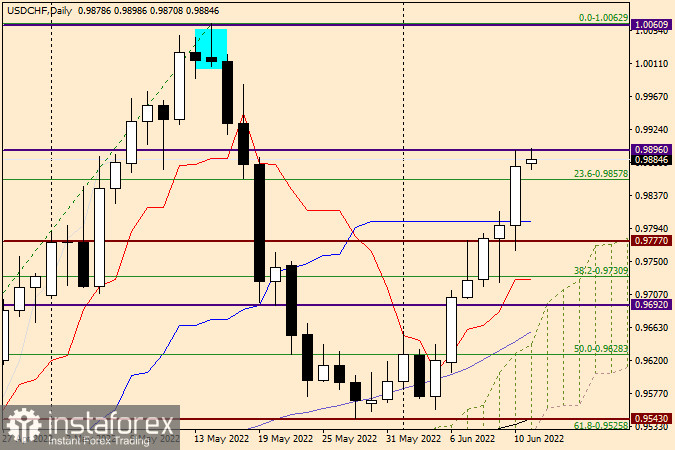

Daily

On the daily chart, the technical picture has an even more pronounced and beautiful correct look. After the appearance on May 16 of the reversal model of candle analysis, called "Tombstone", the pair really began to decline, which in the end turned out to be most likely corrective, but at the same time quite significant. Only at the level of 0.9543 USD/CHF did bulls come to their senses, and began to urgently correct the situation. If we go back to the last trading day of last week, then last Friday the main achievement of the players to increase the exchange rate was a confident breakdown of the blue line of the Kijun Ichimoku indicator. Now this line, which was previously resisted, can appear as strong support. In short, according to trading recommendations, given the pair's presence near 0.9900, it is impossible to rule out a pullback from this strong mark, after which we proceed to consider options for buying USD/CHF, the nearest of which I advise you to look after a decline into a strong technical area of 0.9860-0.9835. That's all for now.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română