The GBP/USD currency pair was trading more or less calmly on Thursday, but on Friday it fell by 200 points. At the same time, the fall began much earlier than the publication of the report on American inflation, which showed that you can not count on a pause in raising rates this fall. Inflation in the US continues to rise, even ignoring the attempts of the Fed to stop this process. Thus, this week the Fed is guaranteed to raise the rate by 0.5%, and maybe by 0.75%? We would not completely rule out such an option. After all, the inflation report is already known, and the members of the monetary committee have enough time to "digest" it and make a more balanced decision. However, more on this a little later. So far, it should be said that the euro/dollar and pound/dollar pairs continue to trade almost the same with minimal differences. The downward trend in the pound is also likely to be resumed, and the British currency itself is likely to update its 2-year lows. The pound is already quite close to them, so it is unlikely that its fall will end in the next few days. Especially if the Fed raises the key rate.

Of the other factors affecting the movement of the pound/dollar pair, there is not much to highlight right now. Simply because they all remain the same as they were before. Traders continue to stubbornly ignore the rate hike by the Bank of England and it seems that it is the potentially high Fed rates, together with the geopolitical conflict in Ukraine and its consequences for Europe, that are the main reasons for the fall of European currencies. As you can see, the pound failed to adjust normally against the global downward trend. And if so, it means only one thing - the bulls did not even enter the fight and did not try to seize the initiative. It was the bears who recorded part of the profit on short positions, which led to a pullback.

There will be a lot of macroeconomic statistics, will it help the pound?

In the new week, there will be plenty of important reports and events both overseas and in the UK. Already on Monday, early in the morning, reports on GDP for April, trade balance, and industrial production will be published in Britain. To be honest, these are still not the most important reports, but on Monday morning they may affect the movement of the pound/dollar pair. On Tuesday in Britain - the unemployment rate and wages. Also reports of medium significance, but can also have a restrained effect on the movement of the pair. Thursday is the meeting of the Bank of England and unexpectedly most experts are inclined to believe that the British regulator will raise the rate for the fifth time in a row and bring it to 1.25%. Here is a chance for the British pound. However, in reality, it may be the opposite, since the previous four promotions did not help too much.

There will also be interesting events in the States. On Wednesday, there will be a report of medium significance on retail sales and a meeting of the Fed, at which a decision will be made almost unequivocally to raise the rate to 1.5%. It will also be interesting to listen to the speech of Jerome Powell, who probably will not be able to ignore the topic of inflation. On Friday - a report on industrial production. Thus, two important meetings of central banks will be held this week, at which important decisions will be made with the highest probability. This means that this week's volatility may be very high. Perhaps, as in the course of past meetings, the market will not trade the pair in one direction. On the days of meetings, a scenario in which there will be a surge of emotions with strong movements in different directions is more likely. But then, when the market has fully assimilated all the information, there will be an adequate elaboration of these events.

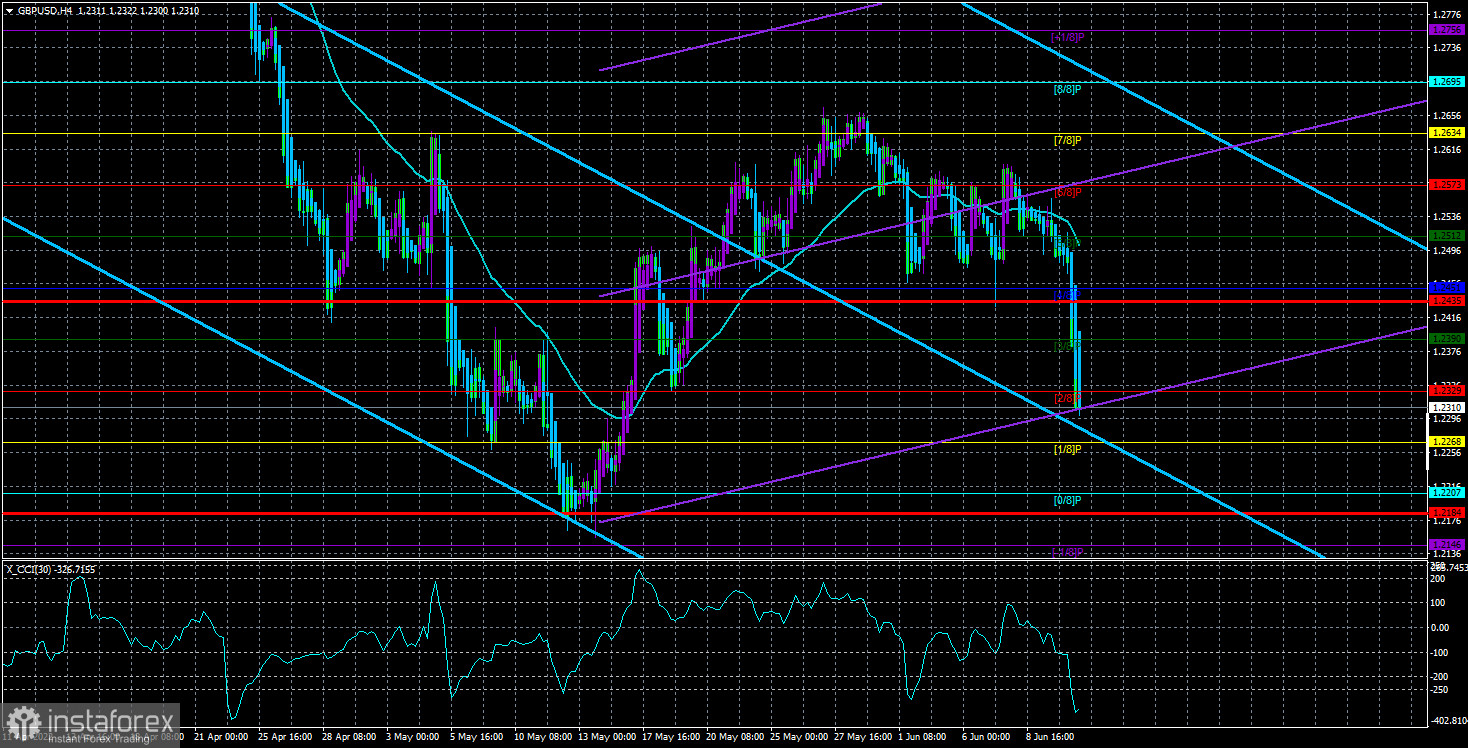

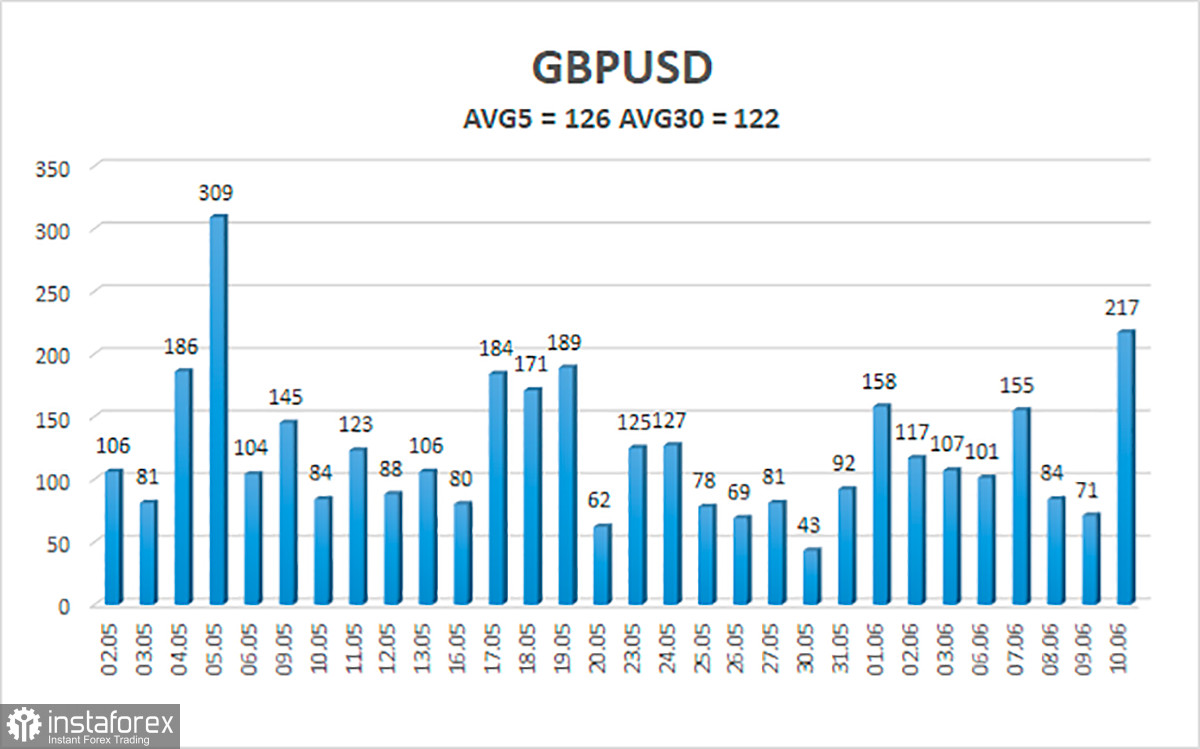

The average volatility of the GBP/USD pair over the last 5 trading days is 126 points. For the pound/dollar pair, this value is "high". On Monday, June 13, therefore, we expect movement inside the channel, limited by the levels of 1.2184 and 1.2435. The upward reversal of the Heiken Ashi indicator signals a round of corrective movement.

Nearest support levels:

S1 – 1.2268

S2 – 1.2207

S3 – 1.2146

Nearest resistance levels:

R1 – 1.2329

R2 – 1.2390

R3 – 1.2451

Trading recommendations:

The GBP/USD pair continues a strong downward movement in the 4-hour timeframe. Thus, at this time, you should stay in sell orders with targets of 1.2268 and 1.2207 until the Heiken Ashi indicator turns up. It will be possible to consider long positions again if the price is fixed above the moving average with targets of 1.2573 and 1.2634.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română