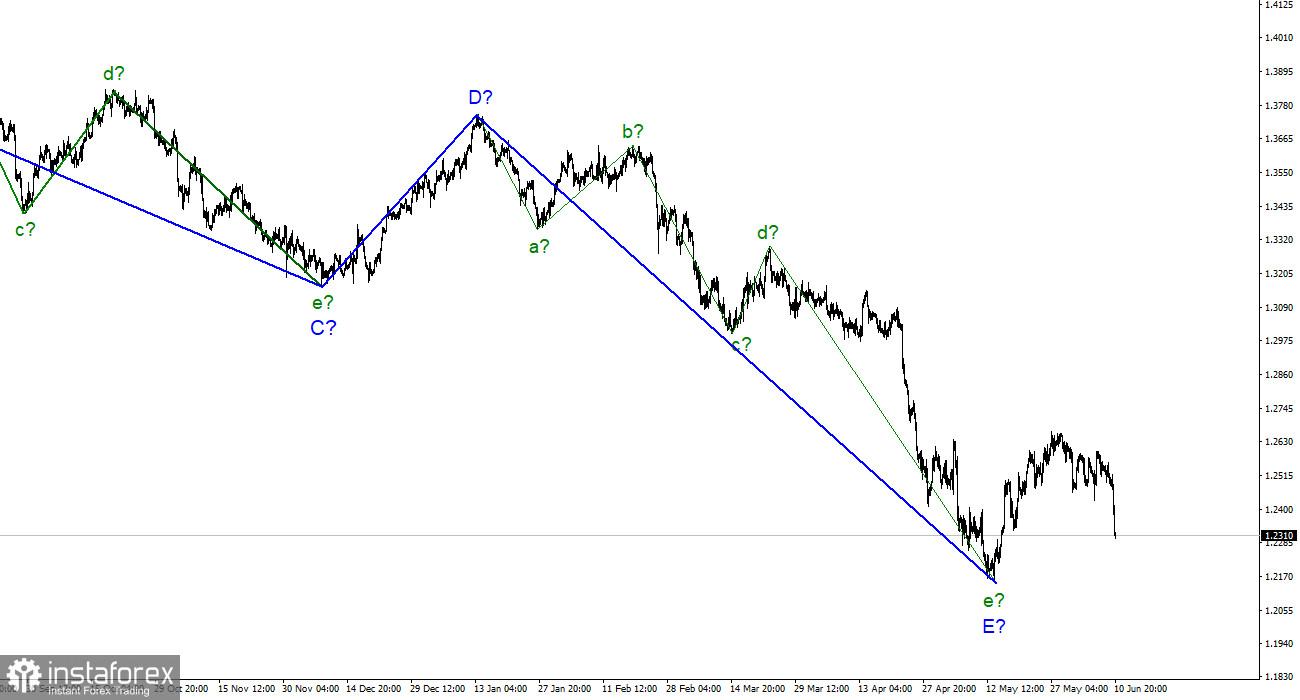

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require adjustments. The downward section of the trend is completed, and the wave e-E, although it has taken a rather complex form, however, is also a five-wave in the structure of the five-wave downward section of the trend, as well as for the euro/dollar instrument. Thus, both instruments presumably completed the construction of downward trend sections. According to the British, the construction of an upward section of the trend has begun, which I currently interpret as a corrective one. I believe that it will turn out to be three-wave, but there is also a second option, in which it will take a pulsed, five-wave form. The construction of the corrective wave b is presumably continuing, within which five waves are already visible. Thus, in the near future, the construction of wave c with targets located around 30 figures may begin. I will note once again that the wave markings of the euro and the pound are very similar now, so we can expect that both currencies will move approximately the same in the next few weeks. If the news background remains the same negative for the British, it is possible to complicate the downward section of the trend.

The pound falls down

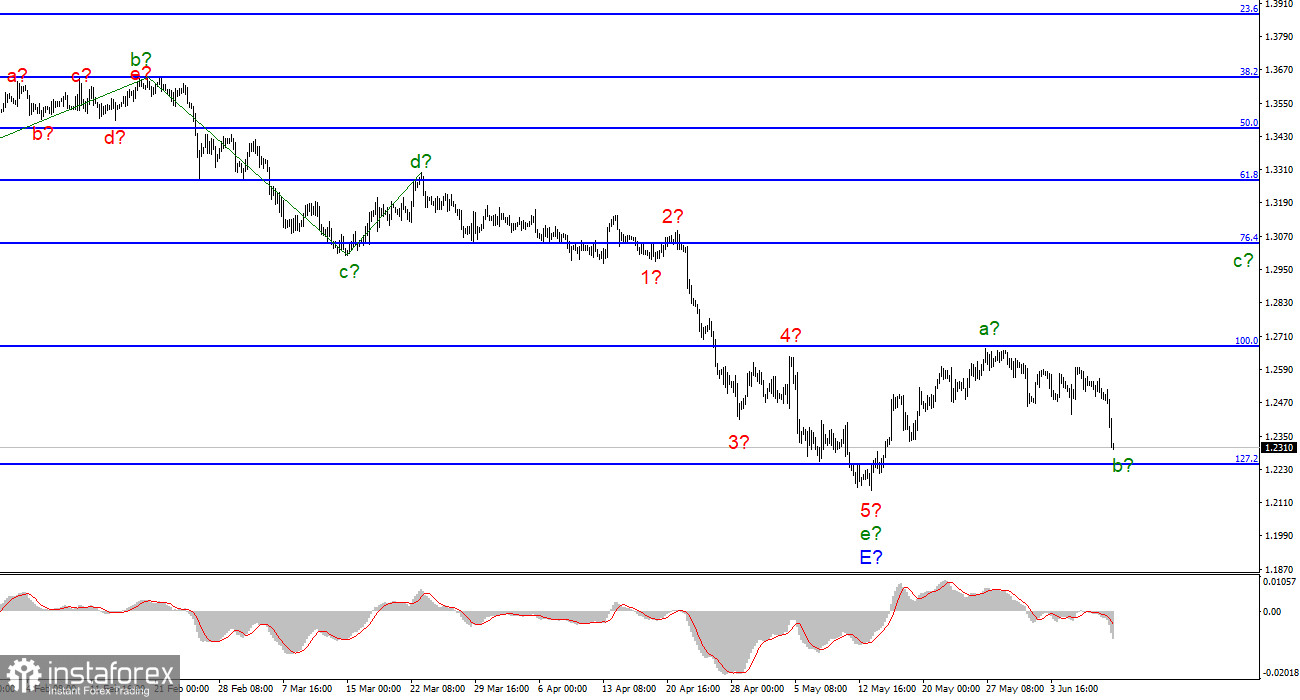

The exchange rate of the pound/dollar instrument decreased by 185 basis points on June 10. If we take into account the report on American inflation, which deservedly caused an increase in demand for the dollar, then everything looks quite expected. However, it should also be noted that the decline of the instrument began in the morning and at the time of the release of the inflation report, the pound had already dropped by 50 points. Wave b has almost dropped to the low of the entire downward trend segment. It can end at the lowest point of this section. An unsuccessful attempt to break through the 1.2246 mark will indicate that the market is not ready for stronger sales. But I also think that the market reaction to the inflation report was excessively strong. 180 points of losses due to one report that showed nothing unexpected. Almost everyone expected a new acceleration of inflation, so where did such a reaction come from?

We can only talk about one thing – the market is not ready for sales, but for purchases of the pound. So far, I don't want to believe this, because if this version is correct, then the wave markup will undergo certain changes, and the downward trend section looks quite complete and convincing and I would not like to change it. Thus, I can only hope that next week, when the Fed raises the interest rate by 50 basis points, the market will no longer increase demand for the dollar. The probability of such a scenario is low, but there is nothing more to hope for. The market has long been aware of the FOMC's plans, so it can sell it instead of buying the dollar. In general, the whole hope of the British lies in the Fibonacci level of 127.2%.

General conclusions.

The wave pattern of the pound/dollar instrument still assumes the completion of the construction of wave E and the entire downward trend segment. Thus, I now advise buying the British for each MACD signal "up" with targets located above the peak of wave a, not lower than the estimated mark of 1.3042, which corresponds to 76.4% Fibonacci. Under certain circumstances, wave marking can become much more complicated, but now there are no signals for such an option.

On the larger scale, the entire downward trend section looks fully equipped. Therefore, the continuation of the decline of the instrument below the 22nd figure is postponed indefinitely for the time being. Wave E has taken a five-wave form and looks quite complete. The construction of at least three waves ascending trend sections has begun.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română