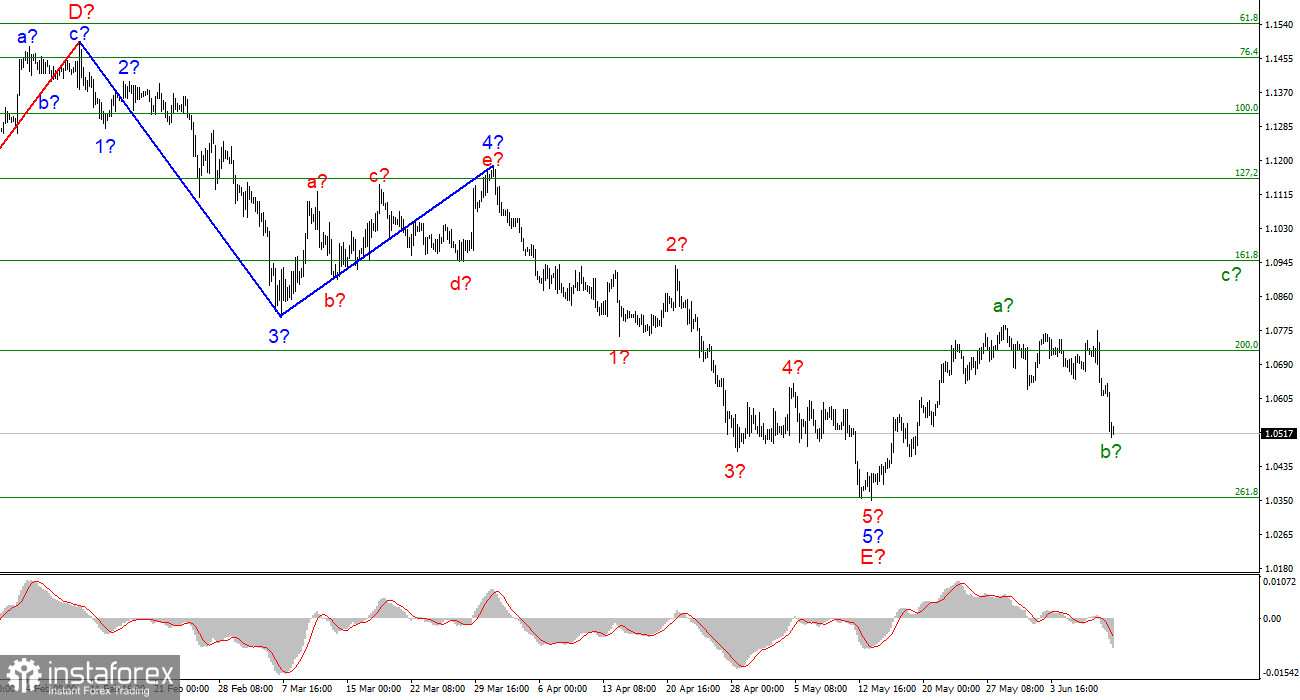

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing and does not require adjustments. The instrument has completed the construction of the descending wave 5-E, which is the last in the structure of the descending trend section. If this is true, then at this time the construction of a new upward section of the trend has begun. It can turn out to be three-wave, or it can be pulsed. At the moment, two waves of a new section of the trend are visible. Wave a is completed, and wave b takes a three-wave form, as I expected, and the decline in the quotes of the instrument has resumed and is currently even stronger than I expected. Wave b is already taking on a rather deep look, but the wave marking is not broken - the instrument can decline even to the low of the downward trend section, which is recognized as completed. The only option in which the decline of the euro can resume for a long time is the rapid completion of the correction section of the trend and the construction of a new downward impulse. However, to identify this option, you need at least the completion of the ascending wave c, the targets of which are located about 9-10 figures.

The euro currency failed to cope with market pressure.

The euro/dollar instrument fell by 105 basis points on Friday. The report on US inflation, which showed a new acceleration in price growth, led to an increase in demand for the US dollar, which had been high before after the ECB meeting and Christine Lagarde's speech. Let me remind you that although the ECB promised to raise rates in the summer and autumn, the market was not satisfied with this approach and expected the regulator to take a tougher stance. It was difficult to say whether it was right or not. I think that after a long downtime, the ECB began to tighten its rhetoric, and this is already good, this change should have had a favorable effect on the euro currency. But the market decided otherwise, and the report on American inflation completely unsettled it. As I have already said, the correction section of the trend is continuing its construction, and wave b may turn out to be quite deep, its goals are located up to the level of 261.8% Fibonacci. However, I still believe that this wave will complete its construction at the beginning of next week. The question is, how long will the overall increase in quotes continue? If the news background is interpreted by the market in the same way as last week, then the entire wave marking will change very quickly, and the construction of the downward trend section will resume. This option is especially likely if the Fed raises the interest rate next week, as expected, by 50 basis points. Therefore, it will be doubly difficult for the euro currency next week. If such a market reaction followed the generally good results of the ECB meeting, then what will happen when the Fed raises the rate by 50 points at once? The tool is walking on the razor's edge again and can fall at any moment.

General conclusions.

Based on the analysis, I conclude that the construction of the downward trend section is completed. If so, then now you can buy a tool with targets located near the estimated mark of 1.0947, which equates to 161.8% Fibonacci, for each MACD signal "up". It is best to first wait for the completion of the construction of wave c-b.

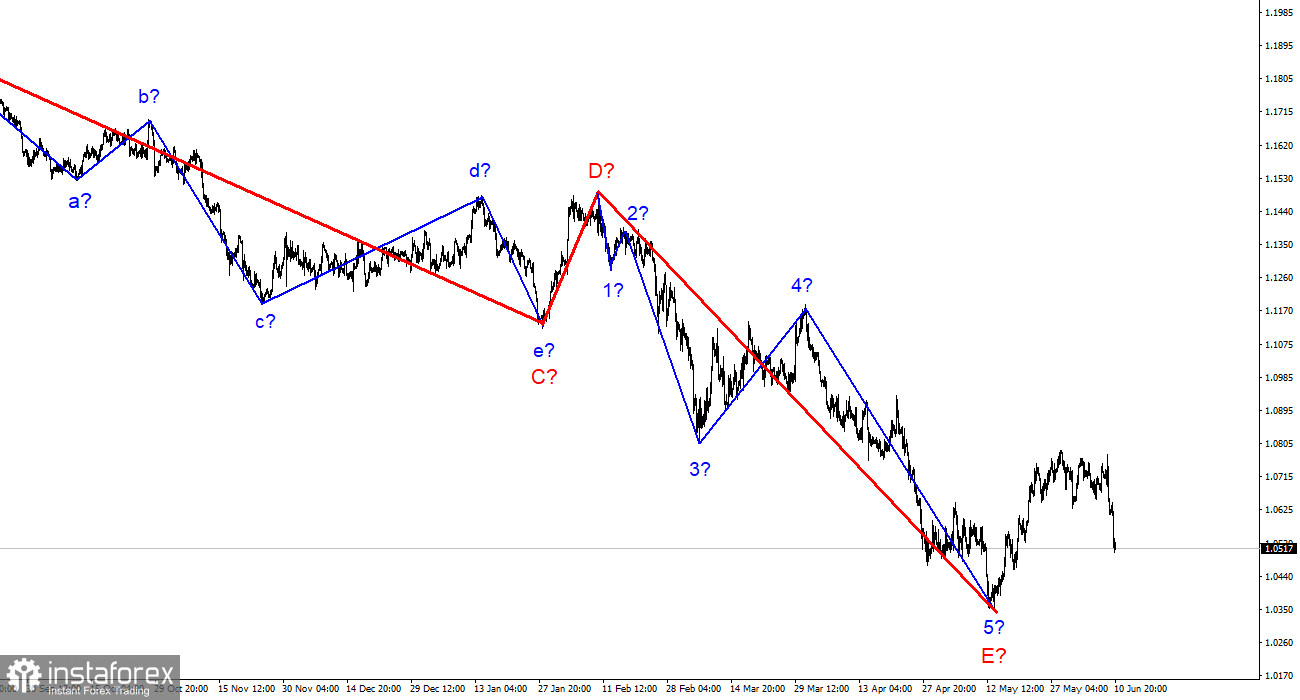

On a larger scale, it can be seen that the construction of the proposed wave E has been completed. Thus, the entire downward trend has acquired a complete look. If this is indeed the case, then in the future for several months the instrument will rise with targets located near the peak of wave D, that is, to the 15th figure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română