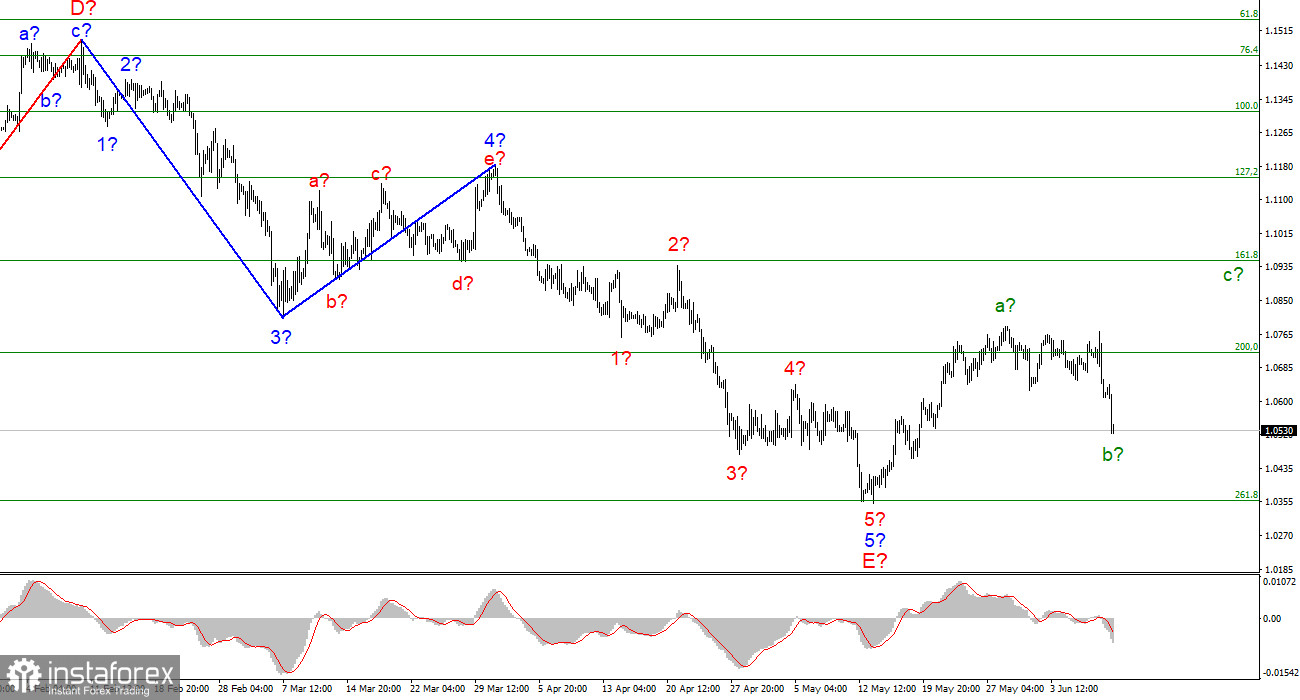

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing and does not require adjustments. The instrument has completed the construction of the descending wave 5-E, which is the last in the structure of the descending trend section. If this is true, then at this time the construction of a new upward section of the trend has begun. It can turn out to be three-wave, or it can be pulsed. At the moment, two waves of a new section of the trend are visible. Wave a is completed, and wave b takes a three-wave form, as I expected, and the decline in the quotes of the instrument has resumed and is currently even stronger than I expected. Wave b is already taking on a rather deep look, but the wave marking is not broken - the instrument can decline even to the low of the downward trend section, which is recognized as completed. The only option now in which the decline of the euro can resume for a long period is the rapid completion of the correction section of the trend and the construction of a new downward impulse. However, to identify this option, you need at least the completion of the ascending wave c, the targets of which are located about 9-10 figures.

The US inflation report shocked the market

The euro/dollar instrument declined by 100 basis points on Thursday, and today - by another 100. Thus, in a little more than a day, the euro currency fell in price by 200 points. Let me remind you that yesterday the results of the ECB meeting became known, and although, in my opinion, they were not bad for the euro, the market decided otherwise and started new sales. From the point of view of wave marking, such a move was expected, since wave b had to take a three-wave form. However, the decline of the instrument continued this morning, when there was no news. Thus, you need to be prepared for the fact that the wave marking will become more complicated, and the downward section of the trend will take a more complex and extended form. I don't believe in this option yet, since the wave pattern has not raised any questions in recent months and does not require adjustments, but this is the market - anything can happen here.

Today, the US released an inflation report for May. The consumer price index has grown once again and has already amounted to 8.6% y/y. Core inflation, on the contrary, decreased and amounted to 6% y/y However, the market did not pay any attention to the base value and decided this: if inflation continues to rise, even despite the Fed's interest rate increase to 1%, then the regulator will raise the rate further and even more, and will not even think about taking a break in the cycle of tightening monetary policy. Thus, US inflation has significantly increased the likelihood that the Fed will act tougher and more aggressive than previously planned. In recent weeks, FOMC members have hinted several times at a possible break in the rate hike this fall, but if inflation continues to rise, there will be no break. The demand for the dollar is growing and this is already going against the current wave markup, which implies an increase in the instrument.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section is completed. If so, then now you can buy a tool with targets located near the estimated mark of 1.0947, which equates to 161.8% Fibonacci, for each MACD signal "up". It is best to first wait for the completion of the construction of wave c-b.

On a larger scale, it can be seen that the construction of the proposed wave E has been completed. Thus, the entire downward trend has acquired a complete look. If this is indeed the case, then in the future for several months the instrument will rise with targets located near the peak of wave D, that is, to the 15th figure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română