The GBP/USD currency pair was trading quite actively on Monday, but the movements of the last few days are more and more like a "swing". On Monday, the pair showed good growth after it fell quite heavily on Friday. The fall did not raise any questions, as it was provoked by strong Non-Farm in the United States. But the growth on Monday raises questions since there were simply no macroeconomic events on that day. One could assume that the "foundation" helped the British pound, but there was also no important news that did not concern the economy and supported the pound. Thus, everything is now going to the fact that the British currency will continue to adjust with difficulty, after which the upward trend can be resumed. How strong it will turn out, is impossible to say now. This whole trend itself can be a correction against the global downward trend, which has been going on for more than a year and a half.

In general, the situation is not quite standard. After all, the euro and the pound are still under the influence of complex geopolitics in Eastern Europe. Now, we can say, there is some lull, since no serious decisions on a global scale are being taken, and the public has already come to terms with the fighting in Ukraine a little. Nevertheless, this conflict may be protracted and may flare up with renewed vigor, since Ukraine will not give up its territories, as it has publicly stated more than once. And with NATO weapons, it will have something to go on a counteroffensive, which has already begun in some areas. Russia, too, will not give up the occupied territories, because otherwise why would they need to be captured? Thus, the conflict will persist for a long time and will have devastating consequences not only for its participants but also for those "who live next door." And this is the UK too, which recently remembered that it has its unresolved conflict with the European Union. Moreover, Boris Johnson may resign tomorrow.

The Conservatives have organized a procedure for passing a vote of no confidence in the Prime Minister.

The most high-profile news of the past weekend was the collection of the necessary number of votes by British MPs to begin the procedure for passing a vote of no confidence in Boris Johnson. Recall that this whole story began with the fact that the British Prime Minister had a lot of fun during the pandemic and "lockdowns" while the British were forbidden to even go outside for some periods. At first, Johnson tried his best to disavow the accusations. He said that he did not know about any parties, did not know that they were forbidden to hold at all, then there was a version that he appeared at one of them for only 30 minutes, and a little later that they were not parties at all, but working meetings at 10 Downing Street. Nevertheless, the British police and an internal group of the Parliament conducted an investigation that clearly showed that there were parties, and alcohol was present at them as well as Boris Johnson himself. After that, the Prime Minister began to apologize, but his ratings had already begun to fall.

The British were very upset because they could not even go to visit relatives for the holidays, and at this time British deputies were taking out alcohol from the nearest stores with crates to have a nice time at Johnson's residence. Boris himself tried to distract the public's attention from this scandal (far from the first with his participation). The conflict in Ukraine started very successfully at that time and everyone forgot about the "coronavirus parties" for a while. Johnson himself regularly spoke in public, making it clear that the government opposes the Russian Federation and will support Ukraine with everything it needs. Johnson's position was very beneficial since public opinion in Europe is on the side of Ukraine, otherwise, no one would have taken unprecedented sanctions against the Russian Federation. After all, it's all about the electorate. If the Germans do not care what is happening in Ukraine, and the prices of heating, gasoline, and food are rising every day, then it is reasonable to assume that they simply will not vote for the current government in the next election. In general, a vote will be held in the UK Parliament on June 8. For Johnson to resign, at least 180 conservatives must support the vote.

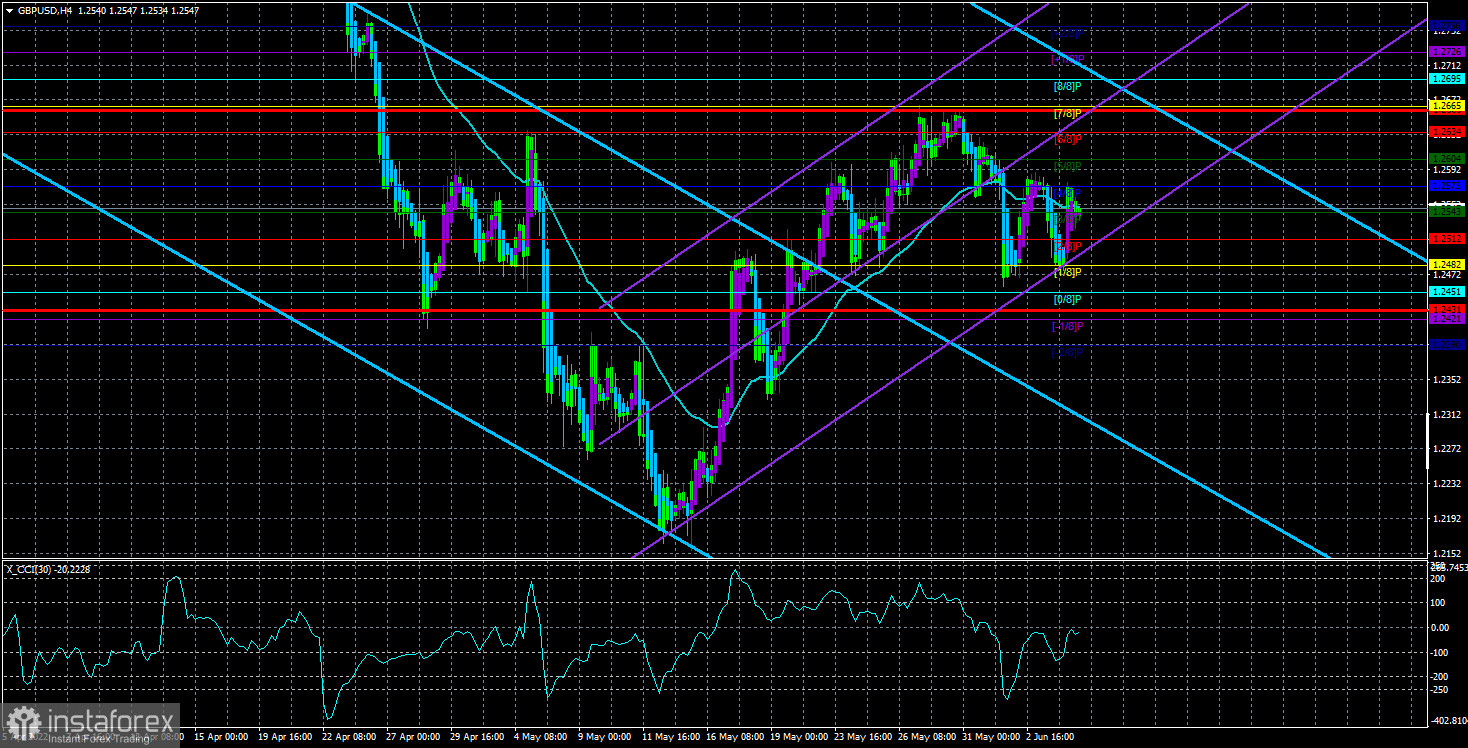

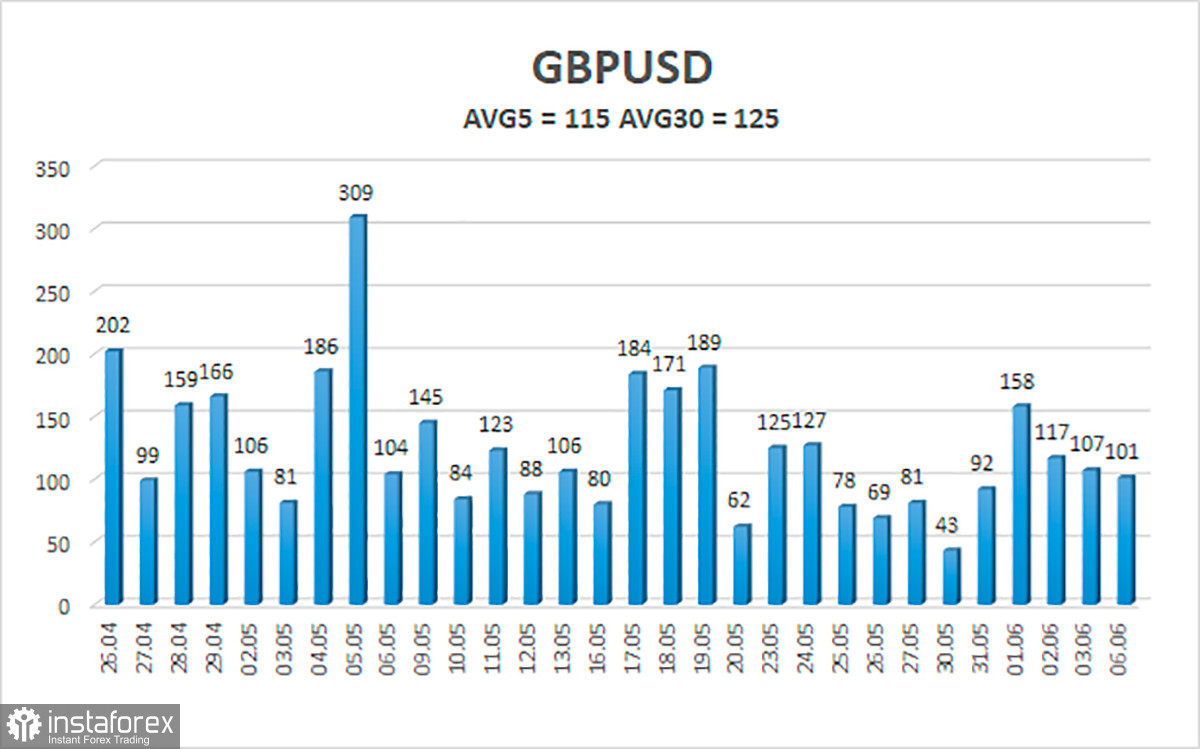

The average volatility of the GBP/USD pair over the last 5 trading days is 115 points. For the pound/dollar pair, this value is "high". On Tuesday, June 7, thus, we expect movement inside the channel, limited by the levels of 1.2431 and 1.2661. The reversal of the Heiken Ashi indicator downwards signals an attempt to resume the downward movement.

Nearest support levels:

S1 – 1.2512

S2 – 1.2482

S3 – 1.2451

Nearest resistance levels:

R1 – 1.2543

R2 – 1.2573

R3 – 1.2604

Trading recommendations:

The GBP/USD pair continues to be located below the moving average line on the 4-hour timeframe. Thus, at this time, new sell orders should be opened with targets of 1.2482 and 1.2451 in the event of a price rebound from the moving average. It will be possible to consider long positions again if the price is fixed above the moving average line with targets of 1.2604 and 1.2661.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română