From the very beginning of the current trading week, another major and very interesting currency pair dollar/franc has escaped our attention. Well, let's fill this gap and conduct a technical analysis of this trading instrument.

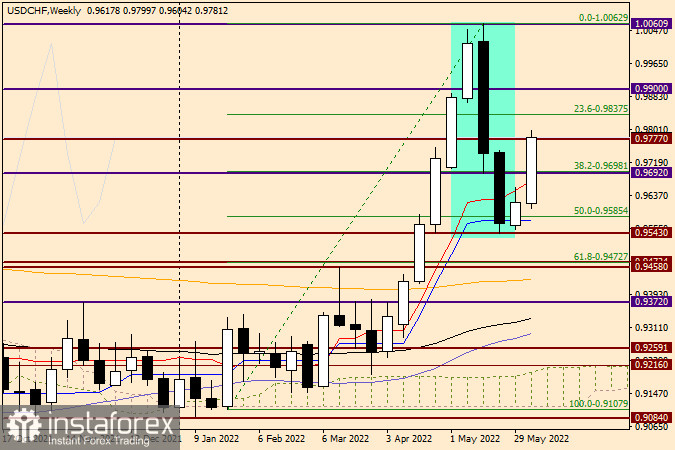

Weekly

Looking at the weekly timeframe, it becomes clear why USD/CHF is one of the author's favorite currency pairs. This means a very decent technique for this trading instrument. Look at what a clear and classic pullback was given to the growth of 0.9108-1.0063. Almost exactly to the middle of this movement. At the same time, the corrective pullback was of such force and pressure that it could easily mislead traders that a trend change is taking place for the dollar/franc. However, everything is still far from being so unambiguously clear and understandable. The option of changing the bullish trend to a bearish one at the moment still cannot be completely written off. We will receive the final confirmation of the continuation of the upward trend only after the true breakdown of the resistance level of 1.0063. USD/CHF bulls themselves have set the bar so high that now they have to make a lot of efforts to regain full control over the dollar/franc pair and return the quote above parity (1.0000).

I note that at the moment of writing, the pair is trading near 0.9775, and up to 1.0063. And looking at the previous very strong two-week decline, the question remains - is it a rollback? As a rule, the rollback movement is smoother and less aggressive. It is also worth noting that there are several very important and strong technical levels at the top, it will not be easy for USD/CHF bulls to return above them. For example, the level of 0.9900 can be safely attributed to such marks. Another important technical component is the fact that, after falling below the red Tenkan line and the blue Kijun line of the Ichimoku indicator, USD/CHF bulls seem to have risen from the ashes, and right now the rate is already above Tenkan. However, there is still time for the current technical picture to change before the end of the weekly trading.

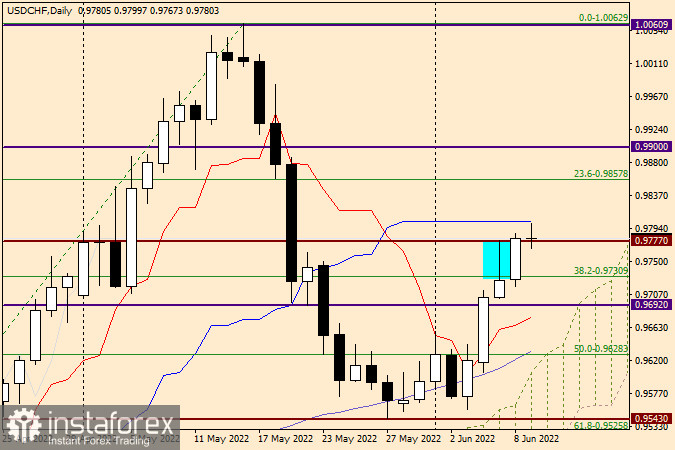

Daily

On the daily timeframe, you can also observe a fairly good technique, which is demonstrated by the dollar/franc. After the appearance of a bullish candle for June 7 with a very long upper shadow, which is highlighted on this chart, the next day, realizing that this could lead to negative consequences, the bulls caught themselves and closed trading on June 8 above the maximum values of the previous day. But the absorption of growth has reached a thin one, and whether this is enough to continue the upward dynamics, perhaps, remains the main question. I believe that it is not for nothing that the current daily candle does not yet have a body, which indicates the thoughts of market participants. I do not exclude that today's events related to the ECB will bring activity to the course of trading for this pair as well. It's not for nothing that the euro and the franc have been walking in unison against the US dollar for a very long time.

And the last thing I would like to draw your attention to today is the daily blue Kijun line of the Ichimoku indicator, which is located exactly near another very decent technical level of 0.9800. I assume that the passage of this mark will open the way to 0.9900, which means that bulls for USD/CHF at all costs need to close trading above 0.9800, of course, with subsequent consolidation. The task is not easy, but doable. If this happens, on a rollback to the 0.9800-0.9777 area, it will think about opening purchases. If a bearish reversal pattern of candle analysis appears under 0.9777 or 0.9800, we will get a signal about the opening of sales. That's all for now.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română